Bizarre Correlation Between Bitcoin Dominance And The Dollar Discovered

Bitcoin just rocketed above $11,000 following the recent Square news, and DeFi tokens everywhere had a significant bounce. As well as Bitcoin has done, altcoins have outperformed the top crypto asset prompting another intraday fall in dominance. Interestingly, a deeper review of the DXY dollar currency index’s relationship with altcoins has uncovered a bizarre correlation […]

Related News

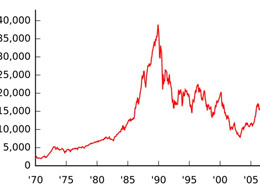

In the late 1980s, a prolific trader - and now billionaire - Paul Tudor Jones predicted the 1987 stock market crash by comparing two ten-year charts - one from the 1920s and one from the early 80s (to be accurate and give credit where it's due it was actually his assistant that first discovered correlation, but for simplicity's sake let's use Paul). Since then, many traders have tried to emulate this method of prediction and, while many have failed, some have had a reasonable amount of success. The field of technical analysis suggests that historic price action is relevant, after all. How....

Kraken has identified a decreasing correlation between Bitcoin and the legacy financial markets. A report published by major U.S.-based crypto exchange Kraken has identified signs the correlation between Bitcoin (BTC), the greenback, and legacy markets, is continuin to weaken.Kraken’s September volatility report found Bitcoin (BTC) largely maintaining a negative correlation with the U.S. Dollar Index (DXY) since May, despite a brief coalescence between the two markets in early September. Bitcoin's 30-day rolling correlation with U.S Dollar Index: KrakenThe report attributes BTC’s dollar....

Bitcoin price is nearly trading at its former all-time high, and at a price point that feels unreachable for many to own a full coin, interest has again turned toward altcoins. BTC dominance has sunk as a result, and at the same time, the dollar is breaking down from support. The scenario in the past […]

Bitcoin decoupled with the stock market and saw its correlation with gold rise to a level not seen since last year. Bitcoin (BTC) and gold are no longer investors’ primary choices as inflation hedges amid the strengthening United States dollars. The current turmoil in financial markets added to the geopolitical tensions has run havoc on the majority of the assets that investors prefer to invest in during times of financial crisis.Bitcoin has lost nearly 70% of its market cap since the market top last year while gold, which strengthened its position in the first quarter of the year despite....

Investors should keep an eye on the tight inverse correlation between the strength of the U.S. dollar and Bitcoin. A widespread debate among investors is the correlation of Bitcoin (BTC) with other markets. A high degree of correlation between the equity markets and Bitcoin has existed, particularly in the last few months. In other periods, gold and Bitcoin appear to move in tandem.However, the correlation that should be watched the most is the dollar since the global economy is based on the strength or weakness of our world reserve currency, the United States dollar.Weaker USD drove up....