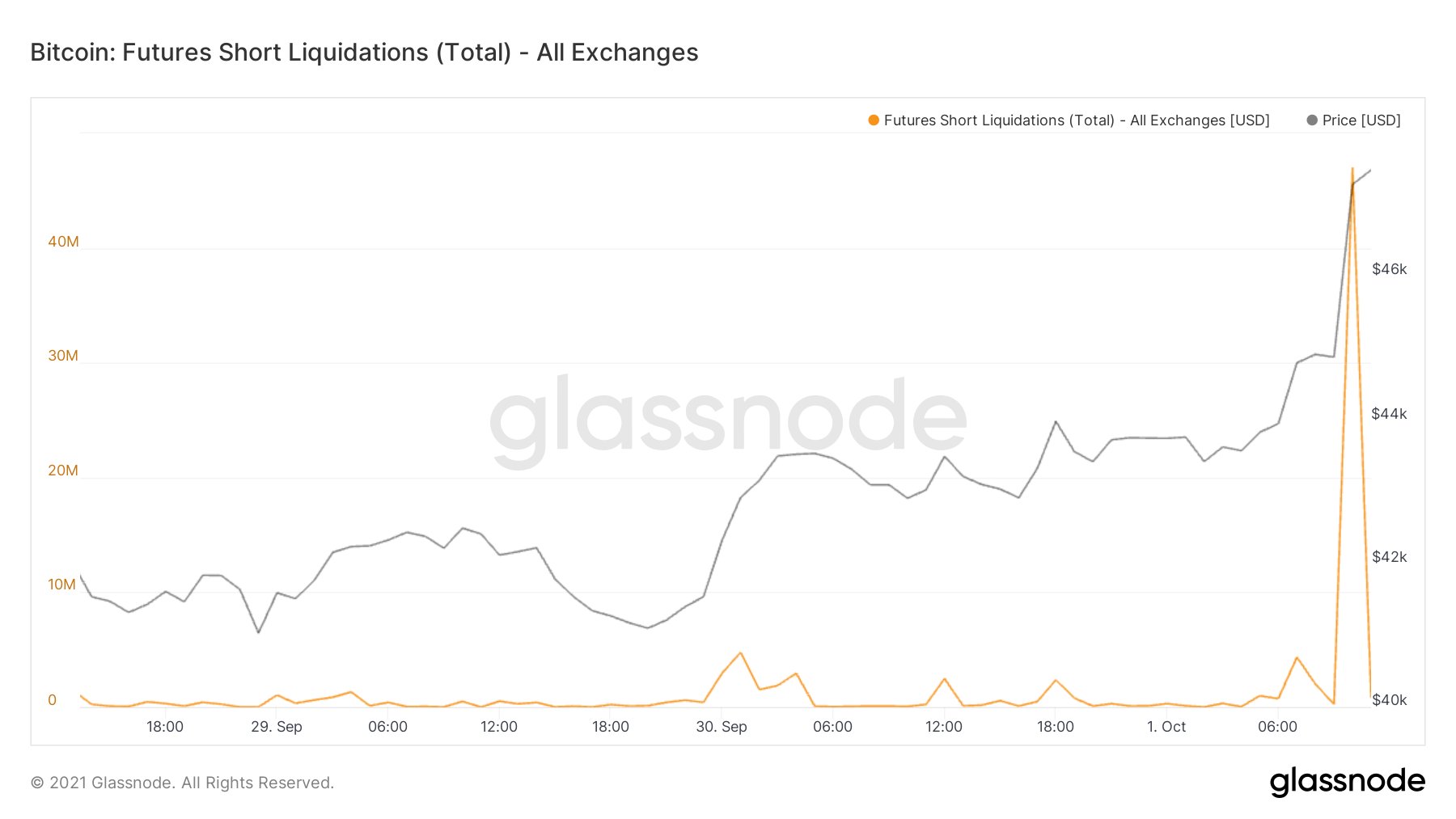

$47,000,000 In Bitcoin Shorts Liquidate In An Hour As BTC Climbs To $47.5k

After today’s incredible Bitcoin move where the price climbed to $47.5k, shorts worth around $47 million liquidated within an hour. $47,000,000 In Bitcoin Futures Shorts Liquidate Within Just An Hour As pointed out by an analyst on Twitter, around $47 million in Bitcoin futures shorts have liquidated within an hour today. If you don’t know […]

Related News

The entire market capitalization of all 10,800 cryptocurrencies in existence is down 2.8% on Monday as bitcoin has lost over 2.4% during the last 24 hours. Meanwhile, bitcoin shorts are rising again after bitcoin shorts tapped a two-year high on the derivatives exchange Bitfinex on June 25. Bitcoin Shorts Climb Higher Bitcoin (BTC) and digital markets, in general, have seen better days as BTC tapped an all-time high above the $64K handle three months ago but is still down 48.66% since then. Roughly 17 days ago, on Bitfinex, the number of BTC/USD short positions skyrocketed to levels not....

‘We can liquidate it any day of the week, any hour of the day,’ said Michael Saylor. Michael Saylor has said that all $400 million of business intelligence firm MicroStrategy’s Bitcoin reserve holdings could be liquidated at any time.In a Sept. 22 interview, Saylor told Bloomberg that although “volatility isn’t really a reason to sell,” he would not hesitate to dump MicroStrategy’s 38,250 Bitcoin (BTC) at a moment’s notice if an alternative asset’s yields were to jump.Selling such a large amount of the crypto asset could easily cause a significant price drop, as happened in June when....

A quant has explained how the Bitcoin funding rate (72 hour) may be able to correctly signal tops and bottoms in the price of the crypto. Bitcoin Funding Rate May Be Able To Indicate Tops And Bottoms In The Market As explained by an analyst in a CryptoQuant post, the 72-hour version of the funding rate looks to have been effective at pointing out tops and bottoms in the BTC market. The “funding rate” is the periodic payment that Bitcoin futures traders (either long or short) have to make between each other. When the value of this metric is negative, it means shorts are paying a....

After exploding onto the scene during the first quarter of 2014, the Blackcoin price has declined consistently. However, on September 10 the Blackcoin price increased by as much as 18% at its peak (although it declined briefly by the end of the day). Nevertheless, Blackcoin sustained a price increase of more than 10% over the course of 24 hours. CCN examines the 24-hour Blackcoin price increase so investors can decide whether or not it is the beginning of a longer trend. Blackcoin Price Climbs Out of the Red. 24-hour price Blackcoin price chart from CoinGecko. When it first burst onto the....

Bitcoin has recently fallen below a $32,000 critical hold point and in response, retail investors have taken this as an opportunity to make money from the falling bitcoin price. So far, retail investors have started loading up on shorts, an incredibly bearish metric for the market. Retail investors load up on shorts | Source: Twitter […]