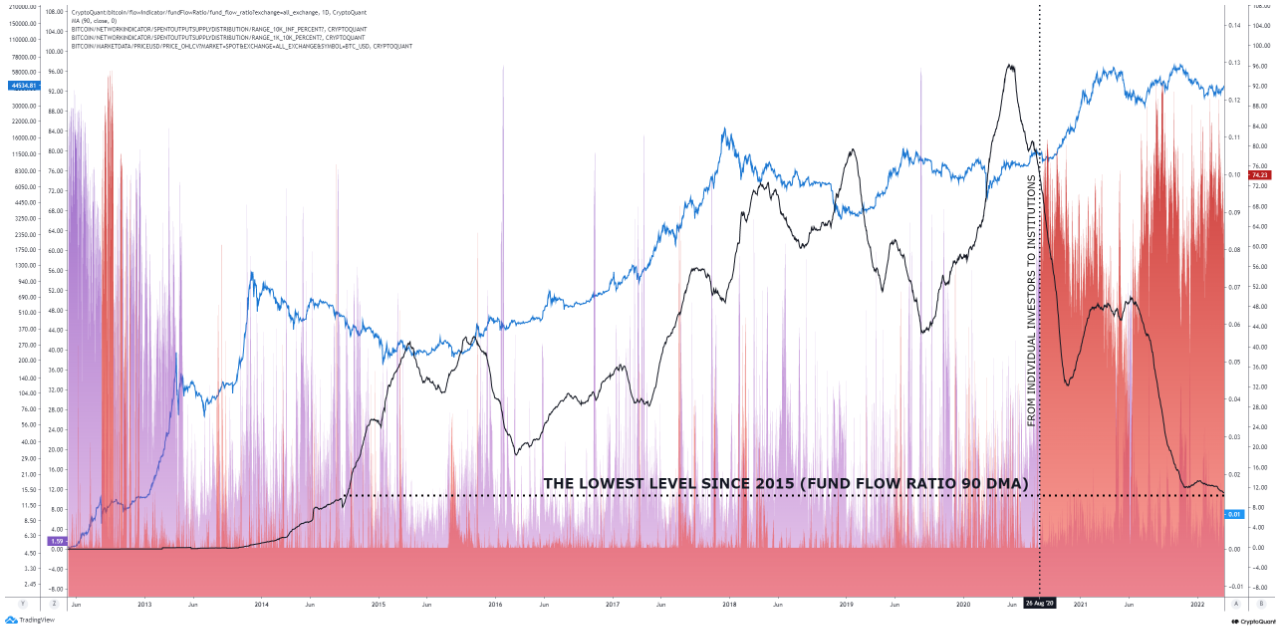

Data: Bitcoin Whales Are Increasingly Preferring OTC Deals Over Exchanges

Data shows the Bitcoin fund flow ratio has been going down in the last couple of years, suggesting that whales have started to prefer selling through OTC deals over centralized exchanges. Bitcoin Fund Flow Ratio Reaches Lowest Level Since 2015 As explained by an analyst in a CryptoQuant post, BTC whales seem to have increasingly […]

Related News

Bitcoin deposits into exchanges have become a popular on-chain data point, but some say this metric can be misleading. Traders are increasingly checking on-chain data to "predict" both the short-term and long-term price trend of Bitcoin (BTC) using such platforms as CryptoQuant, Glassnode and WhaleAlert. Particularly, data points such as Bitcoin exchange inflows and outflows and stablecoin inflows are actively used by traders to anticipate where BTC may go next. 499 #BTC (29,979,163 USD) transferred from unknown wallet to #Coinbasehttps://t.co/zkhywRQS82— Whale Alert (@whale_alert) March....

High-net-worth investors, or whales, have been buying Bitcoin more aggressively since Christmas, on-chain data show. Bitcoin (BTC) whales have been buying more since Christmas, on-chain data shows. This indicates that high-net-worth investors are continuing to eat up the supply of BTC.It is nearly impossible to segregate institutional investors from individual investors through on-chain data. However, the trend shows that investors with large capital are increasingly entering into the Bitcoin market despite its rally.Bitcoin large supply holders. Source: SantimentWhy are whales continuing....

Crypto whales all across the board have been seemingly taking more conservative positions in stablecoins since the bear market started. This has evolved into larger holdings in dollar-pegged cryptocurrencies which have very low volatility. These digital assets have since become a safe haven for investors who are looking to escape highly volatile tokens but still keep their funds in the crypto market. Crypto Whales Move To Stablecoins Usually, there has been a marked increase in the stablecoin holdings of the top Ethereum whales but this trend of moving into stablecoins seems to not be....

On-chain data shows whales are sending their Bitcoin from spot exchanges to derivatives, indicating that they are building up their positions. Bitcoin Whales Build Up Their Positions On Derivative Exchanges As pointed out by a CryptoQuant post, Bitcoin whales seem to be moving their crypto from spot exchanges to derivative exchanges. The relevant indicator here is the “all exchanges to derivative exchanges flow mean,” which shows the total amount of coins being transferred from spot exchanges to derivative exchanges. When the value of this metric shows continuous high values,....

On-chain data shows the Dogecoin whales have made a few large transactions during the last 24 hours. Here’s what they have been up to. Dogecoin Whales Have Been Making Transfers To & From Exchanges According to data from the cryptocurrency transactions tracker service Whale Alert, several large transfers have been spotted on the Dogecoin blockchain […]