MicroStrategy Issuing Up To $1B In Common Stock To Buy More Bitcoin

MicroStrategy is back at it again. Fresh off the heels of selling $500M worth of privately offered notes in a securities offering this week, the leading business analytics firm is looking for more. Stock Offering MicroStrategy is rapidly approaching 100K worth of BTC in the firm’s Bitcoin-holding subsidiary, MacroStrategy LLC. The recent common stock offering […]

Related News

Michael Saylor’s MicroStrategy plans to raise $21B for additional Bitcoin ($BTC) purchases through the At The Market (ATM) Program. Specifically, MicroStrategy will sell $21B worth of 8% Series A perpetual strike preferred stock – shares that pay an 8% dividend, have a $0.001 par value, and are convertible into MicroStrategy’s Class A common stock without […]

Microstrategy Inc. is selling up to $1 billion of its common stock, MSTR, with the aim to use some of the net proceeds to buy bitcoin. The Nasdaq-listed company also recently completed a $500 million secured notes offering and will use the proceeds to acquire bitcoins. Selling MSTR Stock to Buy Bitcoin Microstrategy Inc. has filed a registration statement with the U.S. Securities and Exchange Commission (SEC) to launch an “‘at the market’ securities offering for flexibility to sell up to $1 billion of its class A common stock over time,” the company announced....

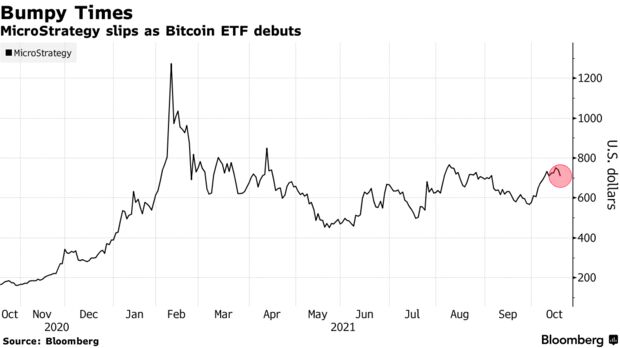

Following the launch of the first ever Bitcoin exchange-traded fund (ETF), Microstrategy’s stock took a hit. This may show that investors would prefer to get BTC exposure through the ETF rather than the tech company’s stock. Microstrategy’s Stock Drops 2% In Response To Bitcoin ETF Launch As reported by Bloomberg, the tech firm’s stock had […]

Buying the dip is essential for MicroStrategy as the company’s reserve of nearly 129,699 BTC currently suffers an aggregated value loss of over $1 billion. MicroStrategy, the largest institutional Bitcoin (BTC) buyer, entered an agreement with two agents — Cowen and Company and BTIG — to sell its aggregated class A common stock worth $500,000,000, reveals Securities and Exchange Commission (SEC) filing.MicroStrategy, co-founded by Bitcoin bull Michael Saylor, amassed approximately 129,699 BTC over several years at an aggregate purchase price of $3.977 billion. Despite market uncertainties,....

Bitcoin’s options market has flipped bearish for the short term while Citi analysts downgrade MicroStrategy's stock.