Official Remittances to Nigeria Plummet by Almost 40% in a Year When Crypto U...

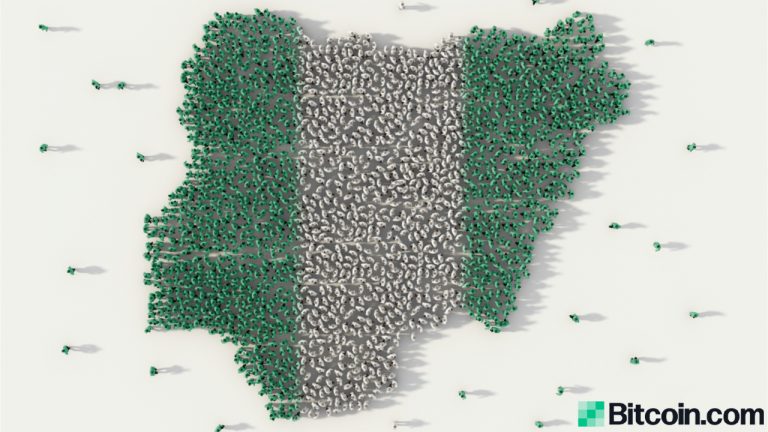

According to the latest data from the World Bank, international money transfers into Nigeria dropped by nearly 40% from $23.8 billion recorded in 2019 to $17.2 billion in the past year. Yet despite this fall, remittances, which account for 4% of the country’s GDP, still remain an important source of foreign exchange for the oil-rich country. Migrants Shunned Official Channels As shown by the data, Nigeria has only previously recorded a yearly total remittance inflow of below $20 billion just once since 2011. This occurred in 2016 when a total of $19.7 billion in official remittances....

Related News

The Central Bank of Nigeria (CBN) has announced a scheme that seeks to boost international remittances as well as to encourage the use of official corridors when retrieving funds. The CBN’s move to incentivise recipients follows the plummeting of the country’s official remittances inflows as recipients opt for non-traditional corridors such as cryptocurrencies. Declining Remittances Under the CBN’s so-called “naira for dollar scheme,” recipients of international remittances will be entitled to an extra payment equivalent to 1.2 cents (5 naira) for every one....

The uncertainty that prevails in Nigeria’s foreign exchange market is partly to blame for the plunge in cross-border remittances into the country, an official with the International Monetary Fund (IMF) has said. Covid-19 Another Contributing Factor According to a report by local news outlet Punch, the official, Abebe Selassie, said this in response to a question posed to him during a virtual press briefing. However, in his two-part response to the question, Selassie starts by acknowledging the impact the global Covid-19 pandemic has had on cross-border remittances in general. He....

Bitsika Africa, a crypto startup operating out of Ghana and Nigeria, said Monday that it processed almost $40 million in remittances in 2020, up from just under $1 million the previous year. Founder and chief executive officer Atsu Davoh said that deposits accounted for $18.87 million of the total volume, with payouts making up $17.89 million. Internal peer-to-peer transfers made up $3.19 million of total volume, he added. Davoh did not reveal how much of the total volume constituted bitcoin (BTC)-denominated remittances. The CEO had not responded to questions sent to him at Press time.....

While the CBN may be open to the idea of remittances, there is no evidence they are considering bitcoin as a potential financial source. The Central Bank of Nigeria is saying “yes” to foreign remittances. In an attempt to build the country’s international finance portfolio, the CBN is amending the Foreign Exchange Manual to allow non-native currencies and remittances to enter its money market. The document now reads: “A resident/non-resident Nigerian national and/or entities and foreign national or entity may invest in Nigeria by way of purchase of money market instruments such as....

Nigerian crypto startup Yellow Card says it processed over $165 million in volume during the first eleven months of this year. The figure represents a growth of more than 1,840% over the amount of remittances processed in the last six months of 2019. Launched in June 2019, Yellow Card enables Africans at home and abroad to buy and sell cryptocurrency using their local currency via bank transfer, cash, and mobile money. The service is being used mainly for remittances, a multi-billion-dollar industry in Africa. Yellow Card co-founder and chief executive officer Chris Maurice told....