Bitcoin On-Chain Data: Selling From Whales Holding 1k+ BTC Behind Crash

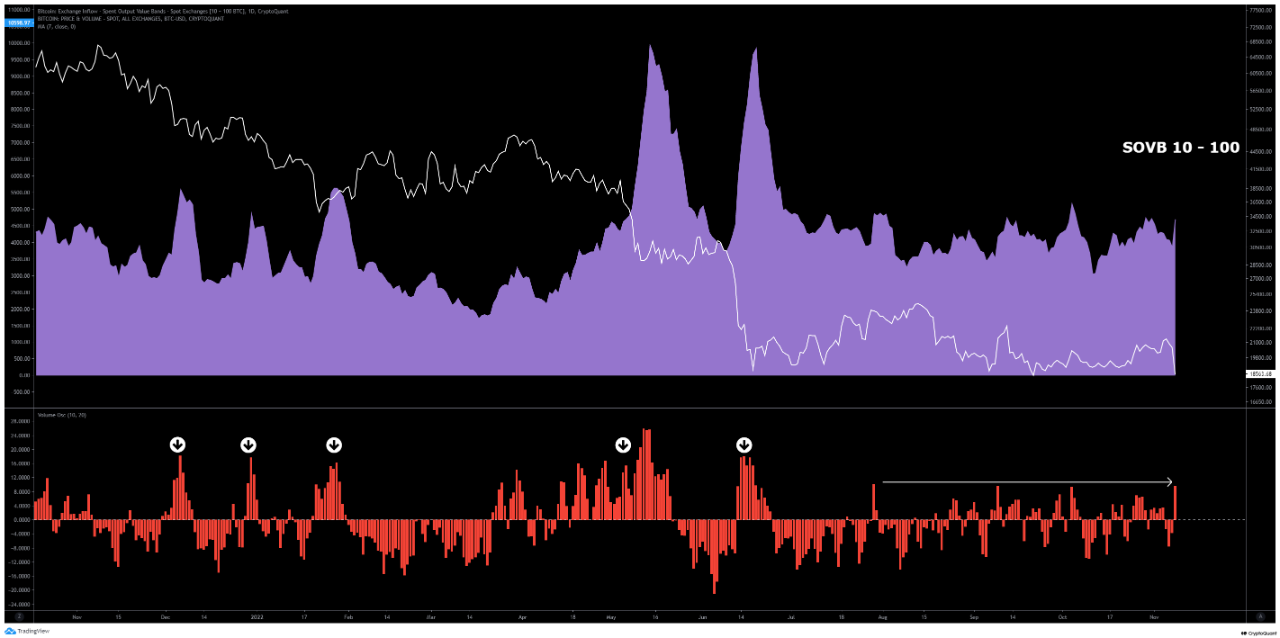

On-chain data shows Bitcoin whales with more than 1k BTC were the main sellers in the latest crash, as other cohorts displayed muted activity. Bitcoin Spent Output Value Bands Shows Spike From 1k-10k Group As pointed out by an analyst in a CryptoQuant post, unlike in the previous declines, the 10-100 BTC and 100-1k BTC cohorts didn’t show any spikes in activity during the latest crash. The relevant indicator here is the “Spent Output Value Bands” (SOVB). which displays the number of coins being moved by each value band in the Bitcoin market. These “value....

Related News

Shiba Inu is reeling from a sharp price crash, with on-chain data pointing to massive selling by large holders (whales) as the culprit. Over the past week, SHIB’s market value has dropped significantly alongside the rest of the industry, erasing recent gains and testing key support levels. The exodus of Shiba Inu whales has not […]

On-chain data shows the Bitcoin sharks and whales have continued to hold strong despite the asset’s price surge. Bitcoin Sharks & Whales Have Been Increasing Their Holdings Recently According to data from the on-chain analytics firm Santiment, the BTC sharks and whales have been participating in accumulation during the past month. The indicator of relevance […]

On-chain data shows the number of Bitcoin holders with 10k+ BTC have grown recently, a sign of accumulation from whales. Number Of Bitcoin Whales Holding 10k Or More BTC Has Gone Up Recently As pointed out by an analyst in a CryptoQuant post, both the 1k+ and 10k+ BTC holders have observed some growth in recent weeks. Holders with 1k or more BTC are considered whales, and movement from them can have noticeable impacts on the Bitcoin market. The relevant indicator here looks at all wallets on the network to see how many own between 1k and 10k BTC and how many are holding more than 10k BTC.....

On-chain data shows that XRP whales are currently offloading their coins, which paints a bearish outlook for the altcoin. This comes as XRP struggles to stay above the psychological $3 level and risks dropping to new lows. XRP Whales Offload $480 Million Coins In Two Weeks Santiment data shows that XRP whales have dumped 160 million coins ($480 million) since around September 4, when their holdings peaked at around 6.95 billion. Since then, their XRP holdings have dropped from 6.95 billion to around 6.77 billion. These whales hold between 1 million and 10 million tokens. Related Reading:....

Various on-chain data shows that Bitcoin whales are holding onto their funds and have little interest in selling in the short term. The price of Bitcoin (BTC) is experiencing a volatile time. After achieving $14,100 for the first time since 2017, a sharp pullback followed. Yet, key on-chain data and whale clusters show that high-net-worth individual investors are holding onto their positions.This trend shows that whales are not expecting a major pullback in the near term. A low level of activity from whales is a positive metric following a large uptrend. It shows that whales are not....