Grayscale Discount Hints At Spot Bitcoin ETF Denial

Grayscale had filed for a Bitcoin Spot ETF after the SEC had greenlighted three Bitcoin ETF Futures for trading last week. Expectations were high that the regulatory body would also approve this ETF which would prove to be a better trading option for investors in comparison to the futures ETFs. The investment firm filed to […]

Related News

In a seismic shift for the Bitcoin industry, the DC Circuit court has ruled in favor of Grayscale Investments yesterday, effectively vacating the US Securities and Exchange Commission’s (SEC) previous denial of Grayscale’s Bitcoin spot ETF proposal. The decision has set the stage for a new chapter in the long-standing saga of Bitcoin spot ETFs, […]

Will GBTC get to become the first US-based spot bitcoin ETF? The euphoria from six months ago turned into Grayscale hinting that it might sue the SEC if its request is denied. Currently, the climate dictates that the answer will probably be negative, but the company is not giving up. According to CNBC, Grayscale “met privately with the Securities and Exchange Commission last week in an effort to persuade the regulator to approve the conversion of its flagship fund into an ETF.” Related Reading | Grayscale Removes Bancor (BNT) And Universal Market Access (UMA) From Its DeFi Fund The....

In response to the U.S. Securities and Exchange Commission’s denial of a request to convert its Bitcoin trust into an exchange-traded fund, Grayscale Investments, the largest manager of digital currency assets globally, has filed a lawsuit against the SEC. Michael Sonnenshein, CEO at Grayscale Investments, tweeted on June 29 : Grayscale Investments Initiates Lawsuit Against […]

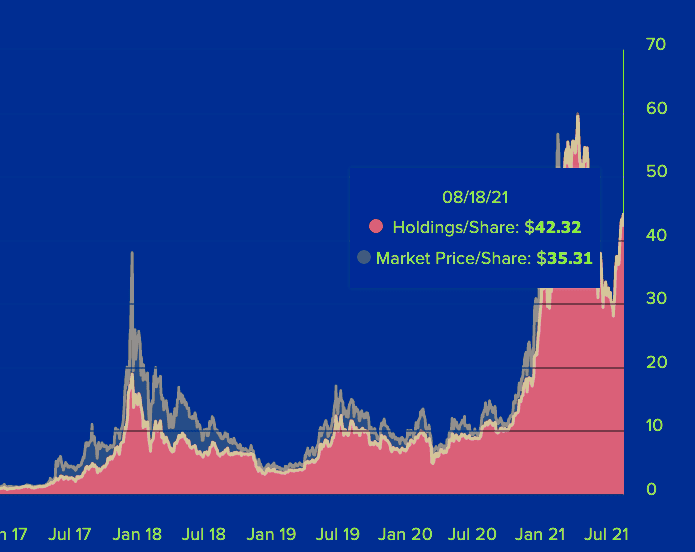

Digital Currency Group’s Flagship Grayscale Bitcoin Trust Is Trading At About 16.52% Below The Bitcoin Spot Price, Marking The Largest Discount Since Bitcoin’s May Price Decline.

It's a polarizing world in institutional Bitcoin offerings this week as Grayscale's CEO remains convinced demand will return. Bitcoin (BTC) descending to $24,000 has cost its largest institutional investment vehicle more than the average hodler.According to data from on-chain monitoring resource Coinglass on May 13, the Grayscale Bitcoin Trust (GBTC) is now trading at a nearly 31% discount.Grayscale CEO: Investors are "waiting for things to settle down"Amid ongoing market volatility this week, GBTC has seen its fledgling recovery fall flat on its face — for the time being.The so-called....