XRP, Polygon See Month-High Volumes As Investors Show FOMO

On-chain data shows the trading volumes of XRP and Polygon have hit monthly highs as investors are displaying FOMO towards the assets. XRP, Polygon See Volume Spike Similar To Bitcoin’s Surge A Few Days Back According to data from the on-chain analytics firm Santiment, XRP & MATIC have seen high volumes recently. The “trading volume” here refers to the total amount of any cryptocurrency that’s being transacted on the different exchanges in the sector every day. When the value of this metric is high, it means that the asset in question is being moved around a lot on....

Related News

Decentralized exchange (dex) volumes have been dropping since December 2021 according to current statistics. However, last month dex trade volumes spiked 2.37% higher than the volumes recorded in February. Despite the brief spike and with only eight days left in April, metrics show this month’s dex volumes will likely be much lower than in March. Decentralized Exchange Volumes Slip Month After Month — April’s Dex Volumes Remain Lackluster In 12 months, dex platforms recorded over $1 trillion in trade volume as they have become prominent fixtures in the crypto....

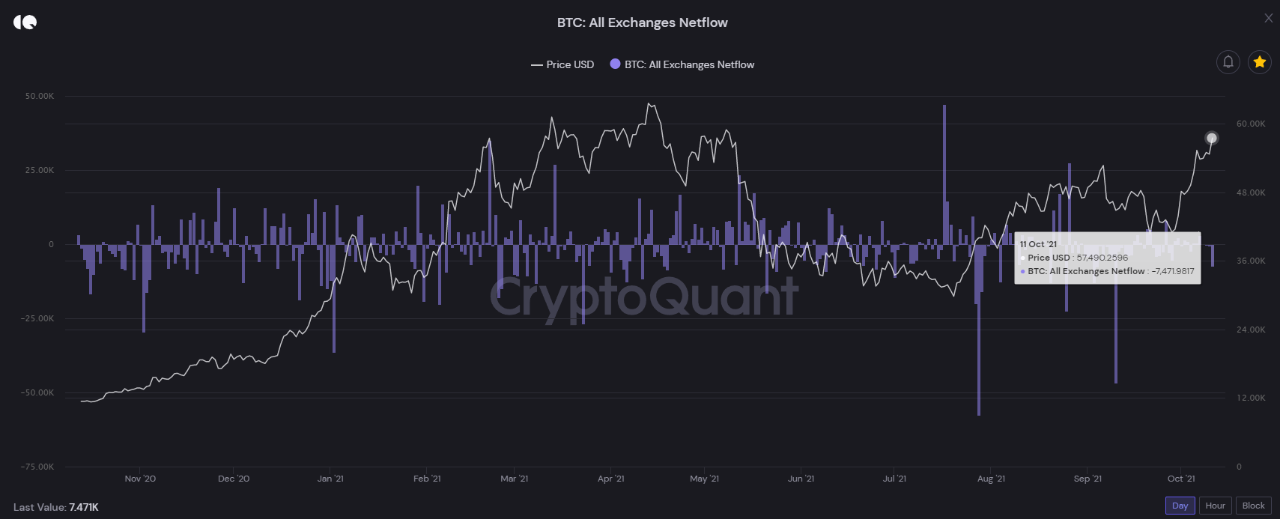

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

Bitcoin has maintained high prices well into the first week of November. The month is expected to follow bullish trends that were triggered in the previous month and bitcoin has not been disappointed in this regard. However, some metrics remain low compare to the price of BTC. This could be as a result of investors taking profit in the market but low enough to draw attention to them. BTC had seen a lot of investment pour into it the week after the first ETFs went live. The record-breaking $1.4 billion inflow for the week had pushed the price of the digital asset towards a new all-time....

Polygon was up by nearly 20% to start the week, as the token rallied to its highest level since May. Today’s surge comes as crypto markets were mostly in the green, with avalanche also hitting multi-week highs, and as of writing, is up by over 10% on the day.

Polygon (MATIC)

Polygon (MATIC) was one of the most notable gainers in crypto markets on Monday, as prices rose by nearly 20%.

Following a low of $0.7464 on Sunday, MATIC/USD raced to an intraday high of $0.9269 to start the week.

This is the highest level the token has traded at since May 9,....

Ethereum trends show it’s becoming more valuable as ETH 2.0 draws near. Thus, institutional investors are clamoring to get in on the action before it is too late. A signal for this has been ETH Futures have been trading at a higher basis premium than BTC Futures on CME. ETH Futures have continuously traded at a higher rolling basis than BTC Futures for the past three months. This could show that institutional investors are more bullish on ETH’s future in comparison to BTC. But other factors have also led to the ETH Futures trading so high. Related Reading | Ethereum Fee Burns Clocks....