Bitcoin miners can take fresh 20% BTC price hit before capitulating, data shows

Production costs for miners are around $34,000, and together with transaction fees, miners need not worry about another $40,000 support challenge on BTC/USD. The Bitcoin (BTC) mining business is bigger than ever at current price levels, and new data shows just how unlikely a mass miner sell-off really is.As noted by popular Twitter account @venturefounder on Jan. 14, even at $42,000, the BTC/USD trading pair is around 20% above miners' cost price.Miner capitulation behind "worst" BTC price dipsDespite falling a full $27,000 below all-time highs, BTC is more enticing than ever for miners.....

Related News

Data shows the Bitcoin Difficulty is set to see a jump of around 5% in the coming network adjustment, making miners’ job tougher than ever before. Bitcoin Difficulty Is Estimated To See A Notable Spike In Next Adjustment According to data from CoinWarz, the Bitcoin Difficulty is heading toward its fifth consecutive increase. The Difficulty […]

On-chain data shows miners have sent a never-before-seen amount of Bitcoin to exchanges as the crypto touches $55k. Bitcoin Miners Send An Unusual Amount Of Coins To Exchanges As pointed out by a CryptoQuant post, on-chain data shows miners have sent an unprecedented amount of Bitcoin to exchanges. The indicator of relevance here is the […]

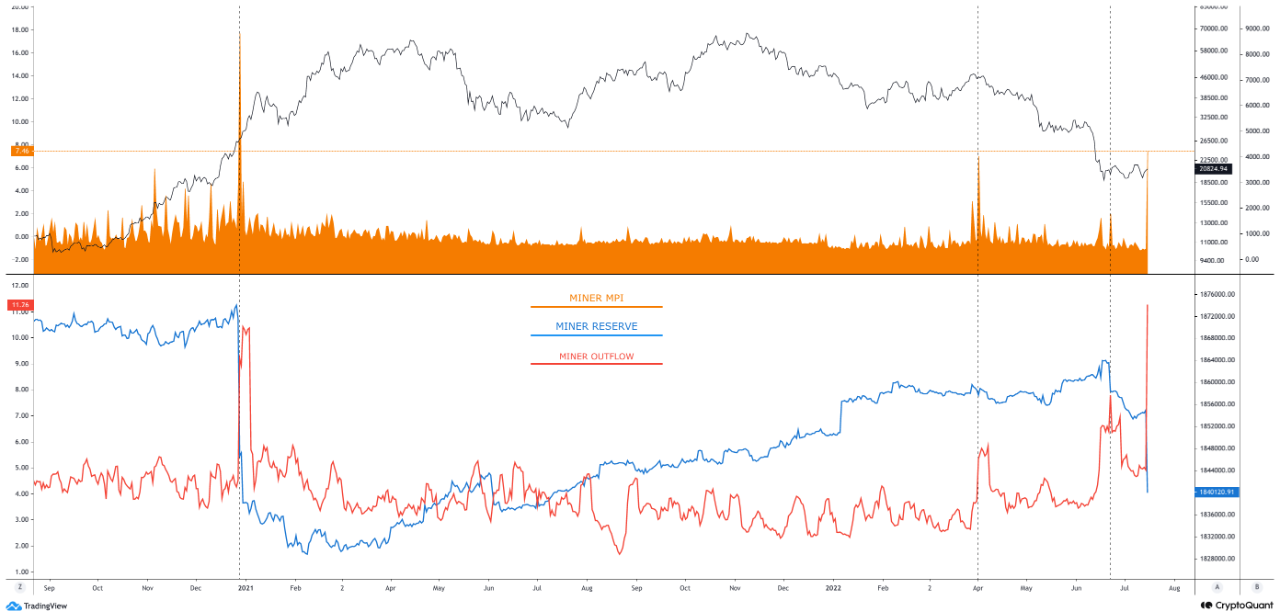

BTC and select altcoins attempted a reversal, but are facing heavy selling at higher levels, which is proof that bears remain in control of the wider market. Bitcoin (BTC) continues to face a tough battle near the psychological level of $20,000 as the bulls and the bears attempt to assert their supremacy. Trading firm QCP Capital said in their latest market circular that funding rates on derivatives markets were stable and bearish conditions were fading.Another ray of hope for the Bitcoin bulls is that Bitcoin miners may be capitulating as the recent decline in the price has made some....

The cryptocurrency economy has been higher in value than ever before as bitcoin has touched an all-time price high at $24,298 per unit. Regardless of the all-time price highs, the world’s bitcoin miners are not spending more bitcoin than usual according to onchain statistics. Bitcoin miner outflow has been higher during the bull run but also lower than the 2019 top. Speculators assume that when the price of bitcoin (BTC) rises, bitcoin mining operations will sell more coins. However, while BTC has touched a new all-time high (ATH), miners are not selling more bitcoin than usual....

On-chain data shows Bitcoin miners withdrew a large amount of coins from their wallets yesterday, suggesting they may be planning to sell them. Bitcoin Miners Transferred 14k BTC Out Of Reserve Yesterday As pointed out by an analyst in a CryptoQuant post, the BTC miner reserve observed a plunge during the past day. The “miner […]