Finance Redefined: Uniswap V3 is here, but was it worth the wait? March 17–24

An in-depth review of the most anticipated release in DeFi. Finance Redefined is Cointelegraph's weekly DeFi-centric newsletter, delivered to subscribers every Wednesday.Uniswap V3 was publicly announced yesterday and I didn’t really get a chance to write about it, so I wanted to dedicate this newsletter to a review of V3 and the AMM space in general.My initial reaction to Uniswap V3 in one, brutally honest word, was “meh.” But it got better when I read further into it, so let’s unpack what’s happening here.Uniswap V3 is a solid upgrade and it’s clear that a lot of work went into it. But....

Related News

Fees are a DeFi user’s nightmare. How can you pay less? This is a repost of Finance Redefined's latest installment, where Cointelegraph unpacks the latest developments in DeFi. The newsletter is delivered to subscribers every Wednesday.DeFi was reasonably quiet in terms of major fundamental developments, instead letting prices do the talking. Many tokens rallied, both the popular and the almost forgotten. Save for a few hiccups due to Bitcoin’s shaky price action, we are still well into DeFi season.This price action, unfortunately, means that using DeFi is pretty much impossible. Ethereum....

After months of waiting, decentralized finance protocol Uniswap announced that its V3 mainnet launch was live. Originally unveiled back in March, Uniswap’s third iteration aims to provide a more capital-efficient on-chain exchange through its latest feature of concentrated liquidity. Concentrated Liquidity In Uniswap V2, liquidity providers (LPs) were limited in that they had to adjust […]

Decentralized community governance isn’t always so decentralized. This week, one bit of news really grabbed my attention: Dharma getting criticized for allegedly trying to capture Uniswap governance.Dharma is the company behind a crypto payments and exchange app, a sort of Ethereum-based cousin of Square’s Cash App. Or at least that’s what I previously used to describe it — if you visit the website now you basically only see mentions of DeFi and some very trippy images.The Dharma website design is now very… daring. And inspired by Uniswap in some ways.Like Uniswap and Compound, Dharma is....

DeFi users got a fat stimulus check, but Uniswap’s token fell short of the community’s inflated expectations. The biggest event of this week was definitely the sudden release of Uniswap’s token, UNI, which enriched many DeFi users by at least $1200 each.Uniswap gave 400 of its tokens to anyone who had ever traded with the protocol, even if the interaction somehow failed. And by “anyone” I mean “any wallet” — some people almost certainly got more than one such allocation by having multiple wallets.Sadly, I wasn’t one of them, and to be honest I barely used Uniswap anyway. In my treatise....

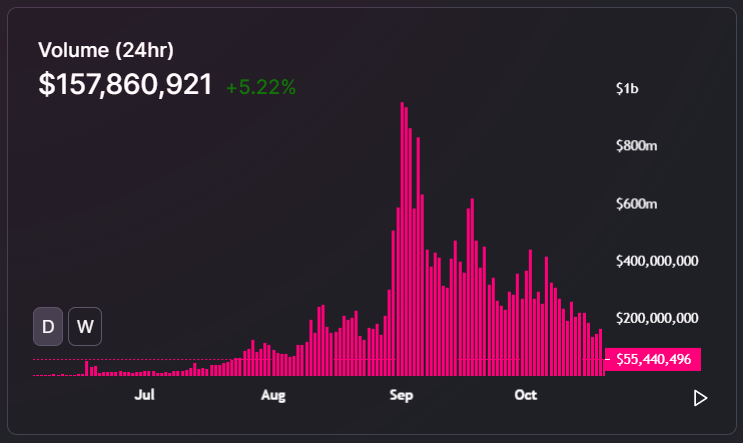

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]