Bitcoin On-chain Data Suggests Huge Outflow From Miners

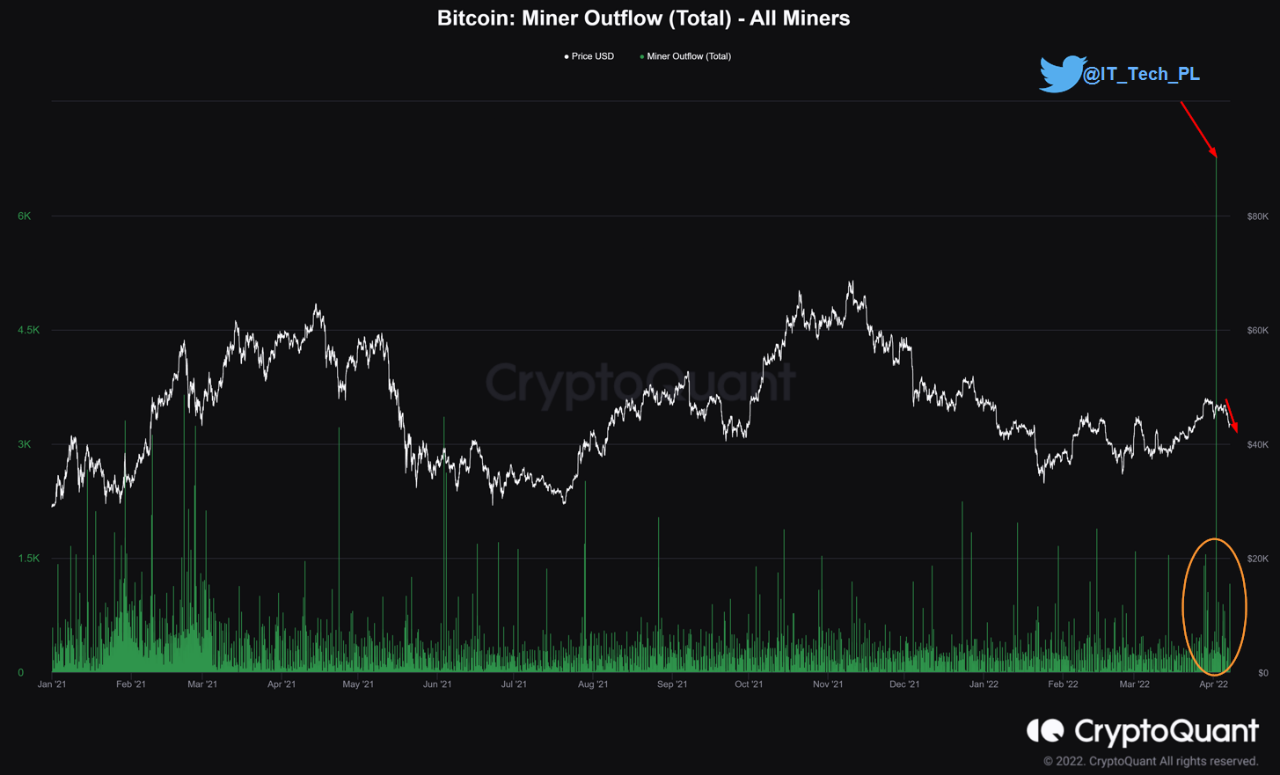

Bitcoin on-chain data shows that miners have transferred a huge amount of coins to cryptocurrency exchanges. On-chain Data Suggests Miners Transferred 11,816 BTC To Exchanges As pointed out by a CryptoQuant post, 20 July saw a huge outflow from Bitcoin miners. The total outflow from that day is around 12k. Here is a chart that illustrates the trend in all miners BTC outflow over the last one year: BTC miner outflow seems to have spiked There are a few interesting features in the chart. This sudden rise of almost 12k BTC observed on Wednesday is the most since May, when the price of the....

Related News

On-chain data suggests Bitcoin miners seem to have dumped big recently as their outflow has spiked to the largest value since more than a year ago. Bitcoin Miner Outflows Have Observed A Large Spike Recently As pointed out by an analyst in a CryptoQuant post, F2Pool miner wallets transferred a huge amount of coins shortly […]

On-chain data shows Ethereum has observed a large exchange outflow recently, a sign that buying may be going on in the market. Ethereum Exchange Supply Hits Lowest In 5.5 Years After $181 Million Outflow According to data from the on-chain analytics firm Santiment, ETH has just witnessed its largest exchange outflow day since August 21st. […]

On-chain analysis shows huge Bitcoin outflows from crypto exchange Binance. BTC might keep the rally up and break $40k. Huge Bitcoin Outflows On Binance As pointed out by a CryptoQuant post, the crypto exchange has observed huge outflows of BTC on Monday. The Binance Outflows indicator shows the amount of Bitcoin transferred from the Binance exchange wallets to personal or other exchange wallets. On the other hand, the inflows show how many BTC were sent into Binance wallets from other types of wallets. The indicator of most interest here is the the Binance Bitcoin netflow, which is just....

A look at what increasing capital outflow from China suggests about bitcoin adoption, and what implications a Chinese slowdown might have for the bitcoin price going forward. At the end of last month, we learnt that Chinese capital outflows during 2015 totaled $676 billion net. The data marks only the third net capital outflow since the turn of the millennium, and by far the biggest, with the other two coming in at less than $140 million net (2012,2014). The outflow comes against a backdrop of wider economic weakness in China and emerging markets, and quantifiably highlights China’s....

On-chain data shows the Bitcoin MPI has spiked up recently, suggesting that miners may have started to dump the crypto. Bitcoin Miners’ Position Index (MPI) Has Sharply Risen Recently As pointed out by an analyst in a CryptoQuant post, some data suggests BTC miners may have began to dump the coin following recent rally. The […]