The Striking Similarities Between The 2017 Bitcoin Peak And Now

Bitcoin is now trading over $7,000 below its peak reached to start the year – a peak that is more than double its previous all-time high. And while believers in the cryptocurrency are certain this is just another pullback before more price discovery, the similarities between the 2017 top and now are undeniably striking. Here’s […]

Related News

A crypto analyst has revisited long-term charts from 2012-2015, noting that the current Bitcoin (BTC) cycle shows striking similarities to this timeline, in terms of the Relative Strength Index (RSI) and price action. During the 2017-2015 bull run, BTC experienced one of the strongest multi-year advances before bottoming out. The market expert claims that the same sequence of peaks and pullbacks observed in that timeline is now unfolding again in this cycle. Bitcoin RSI Comparison Signals Bottoming Structure Bitcoin’s latest momentum study by crypto analyst Tony Severino has drawn....

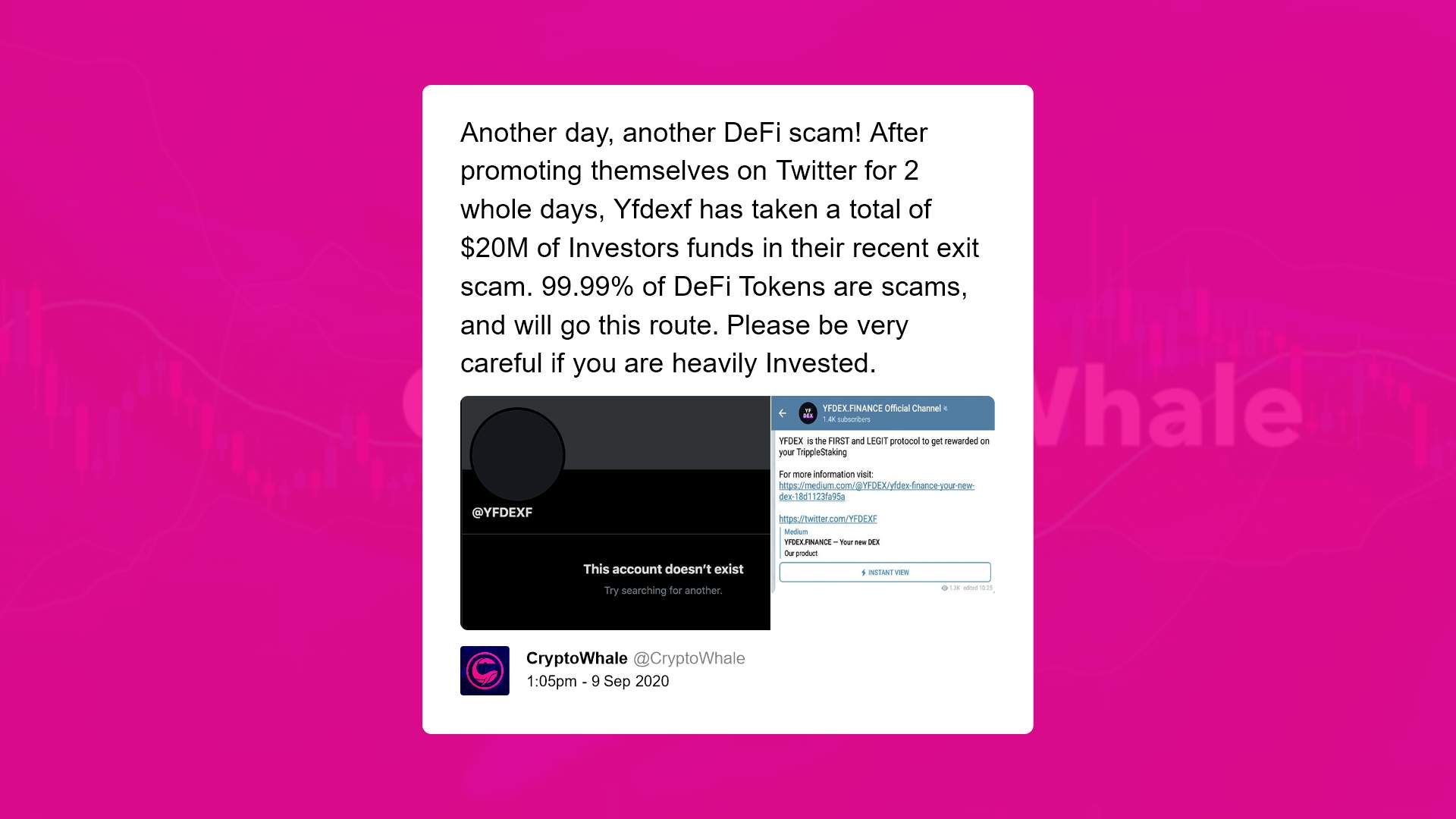

Many have drawn similarities between DeFi and the ICO craze of 2017, and it’s easy to see why as well. To begin with, both operate(d) primarily on the Ethereum network. However, it’s the flood of fly by night projects that links the two in the minds of many. With that, in recent times, critics have […]

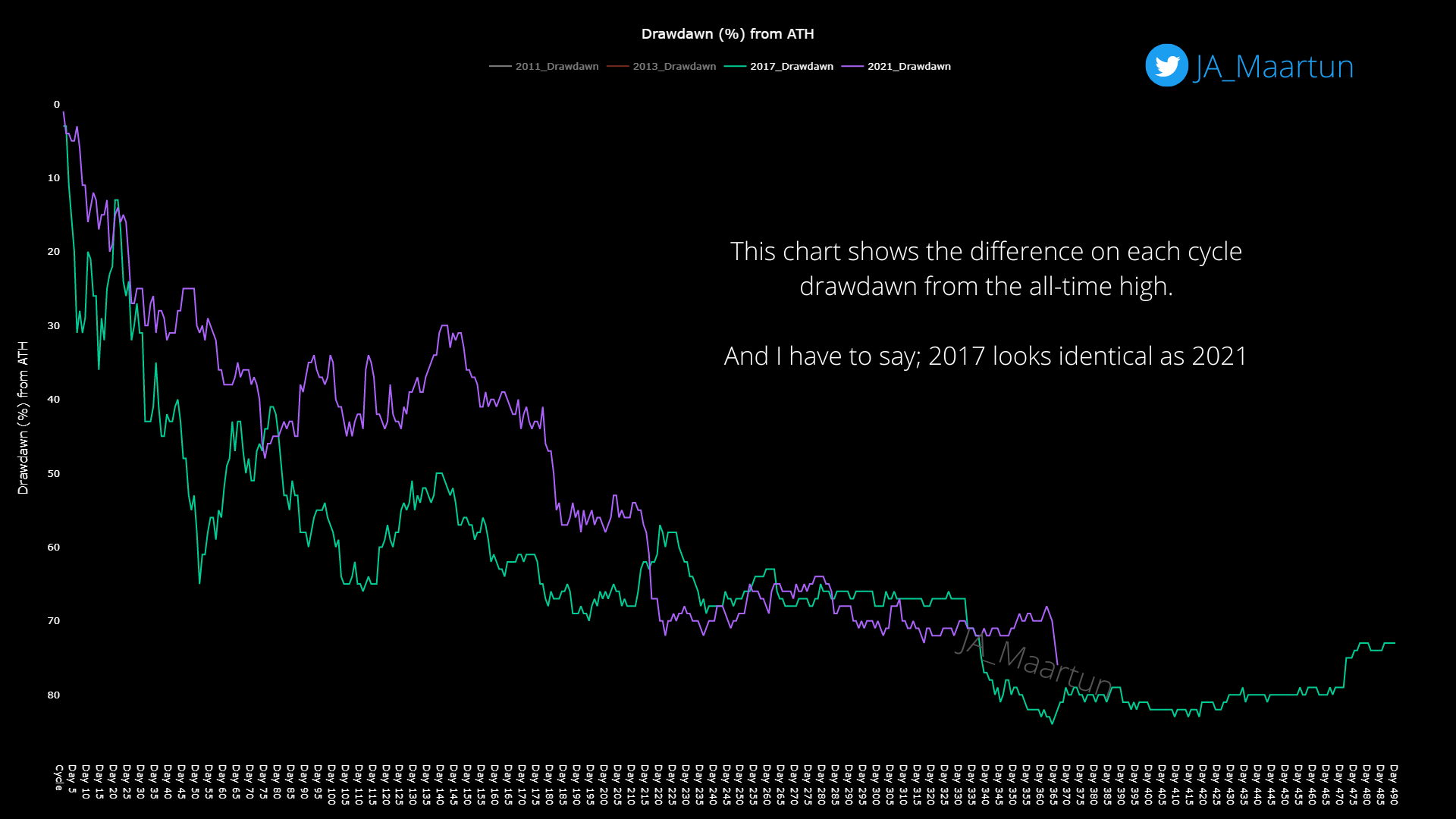

A quant has pointed out the similarities between the 2017 and 2021 Bitcoin cycles, something that could hint at how the rest of this bear market might play out. Both 2017 And 2021 Bitcoin Cycles Saw New Lows Around The 365-Day Mark Since The Top As explained by an analyst in a CryptoQuant post, the two cycles are more similar than one might expect them to be. The indicator of relevance here is the “drawdown from ATH,” which measures the percentage decrease in the price of Bitcoin following the all-time high during each cycle. Here is a chart that shows the trend in this metric....

Historical analysis suggests that the amount of time it takes for the Bitcoin price to double may accelerate during this bull run. The price of Bitcoin has doubled in the past 75 days, prompting some analysts to question whether the market is approaching over-extension.However, historical analysis from Bitcoin monitoring team CaseBitcoin suggests the Bitcoin markets could accelerate further, noting that BTC’s “doubling time” — the time taken for price to increase by 100% — shrunk down to just 12 days just before the peak of the 2017 bull run.3/ How low can it get? In 2017, the fastest....

XRP has been through a rollercoaster over the past few days, tumbling in a crash alongside the rest of the crypto market. The crash drove XRP’s price to a flash low of $1.64 before it recovered to $2.36, with volumes surging 164% above the 30-day average. This flash crash created a notable downside wick on XRP’s price chart, which, according to a technical analyst, is reminiscent of a 2017 price structure that suggests that the cryptocurrency is about to enter into a massive rally. XRP 2017 And 2025 Setup Shows Striking Similarities XRP’s recent flash crash has grabbed....