ECB Paper Marks Success Factors for CBDCs, Digital Euro

A paper published by the European Central Bank (ECB) discusses various conditions for successful implementation of central bank digital currencies (CBDCs) such as the eurozone’s own digital euro. The authors also point to different risks that such projects entail, like the danger of crowding out the private sector. ECB: Digital Euro Should Be Widely Used for Payments, Not Investment In order to create a successful CBDC, a monetary authority needs to establish the digital currency as a widespread means of payment and exchange that also has a sufficient store of value....

Related News

Is crypto already putting down CBDCs? The European Central Bank (ECB) has been researching and discussing a CBDC project called the Digital Euro for a while. They launched a public consultation to understand common needs & expectations for a Digital Euro. The feedback has been extremely negative. Unwanted This is the second consultation launched by […]

The decision on how to launch a digital euro could still be a long time coming. Financial authorities in Europe could form an investigation plan for a digital euro as early as next year, according to an executive at the European Central Bank.Holger Neuhaus, head of market innovation and integration division at the ECB, joined the Singapore FinTech Festival 2020 on Dec. 7 to discuss the global development of central bank digital currencies, or CBDCs.During the online discussion, Neuhaus claimed that the ECB expects European financial authorities to assess whether to launch a digital euro....

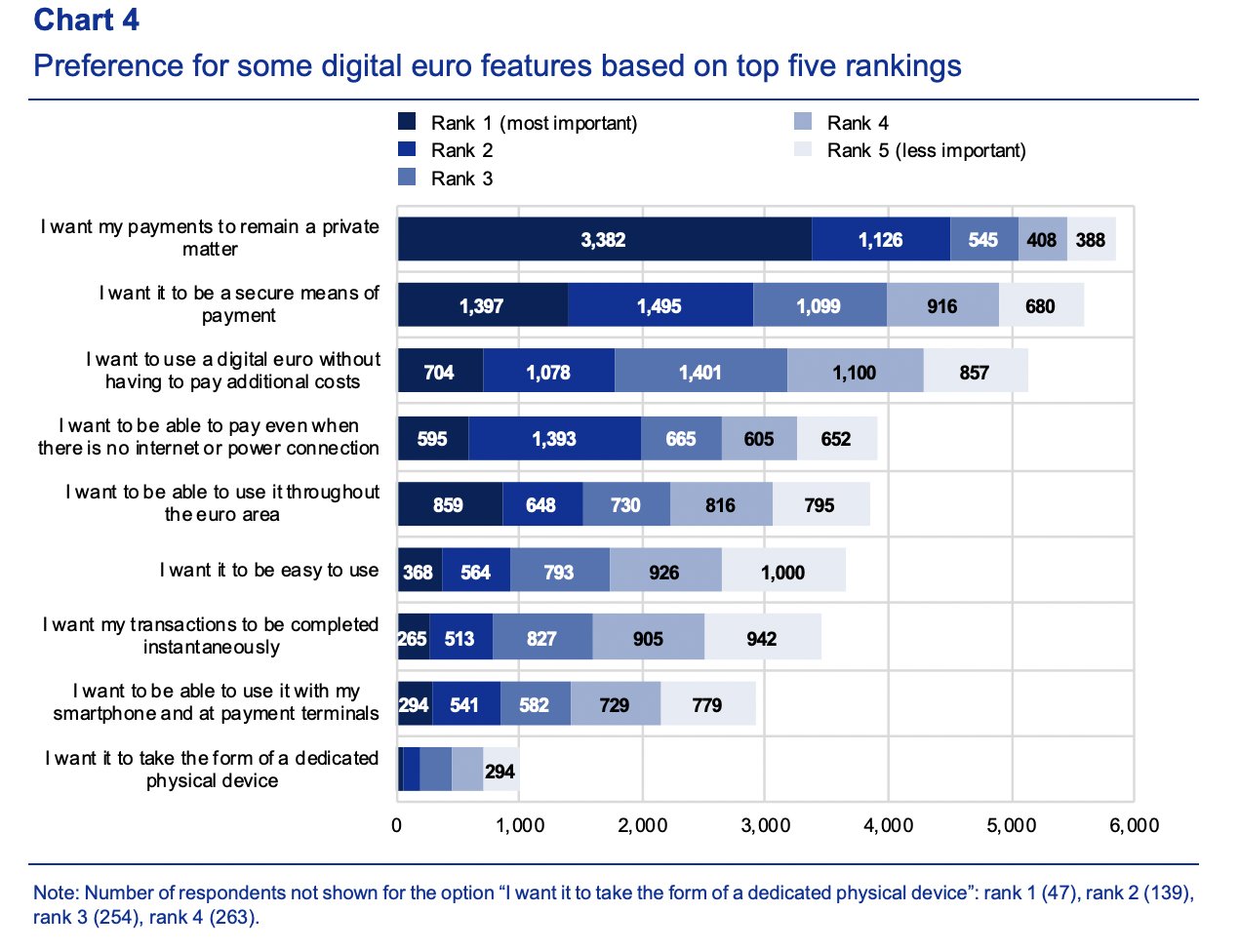

The European Central Bank working paper sought to identify issues and consensus regarding CBDCs, as well as to identify gaps in the research — such as what users want. The European Central Bank (ECB) says the introduction of digital cash in the form of central bank digital currencies (CBDCs) appears to be the "only solution" that will guarantee a "smooth continuation" of the current monetary system. The comments were made as part of an ECB Working Paper Series, which was published in August, discussing monetary policy and financial stability as it relates to CBDCs — gathering insights from....

Christine Lagarde, President of the European Central Bank, said that the ECB is aggressively pursuing the idea of a digital euro and expects to finish the testing phase by October 2025. If it goes through, it will be the EU’s first Central Bank Digital Currency (CBDC). Unlike cryptocurrencies, CBDCs aren’t decentralized or run on blockchain. They’re pegged to a country’s national currency, so the value of 1 digital euro is equal to the value of one physical euro. CBDCs have been a hot topic of debate for a long time now. Proponents believe they’re absolutely essential to....

The researchers from BIS and the World Bank identify common factors across nine central banks that face a variety of different challenges. The Bank for International Settlements, or BIS, released a paper Tuesday on central bank digital currencies, or CBDCs, and how they can be used to meet policy goals for financial inclusion. The paper drew on interviews conducted in the second half of last year at nine central banks that are currently exploring retail CBDCs. It looked at common goals across a range of economic development levels and challenges to inclusion.The paper identified two....