Crypto Taxes in 2022: All You Need to Know According to Koinly

Cryptocurrency users can face a lot of challenges finding the right information needed for reporting taxes. Koinly, a leading cryptocurrency tax calculator and portfolio tracker for traders, has created the ultimate guide to help. Koinly Presents The Ultimate Bitcoin Tax Guide for 2022 Crypto tax regulations and laws can be confusing, leaving investors with many questions about what crypto taxation looks like – how much tax to pay on Bitcoin and the tax rate? But do not worry. Koinly brings an ultimate crypto tax guide to help answer all the questions related to crypto taxes and....

Related News

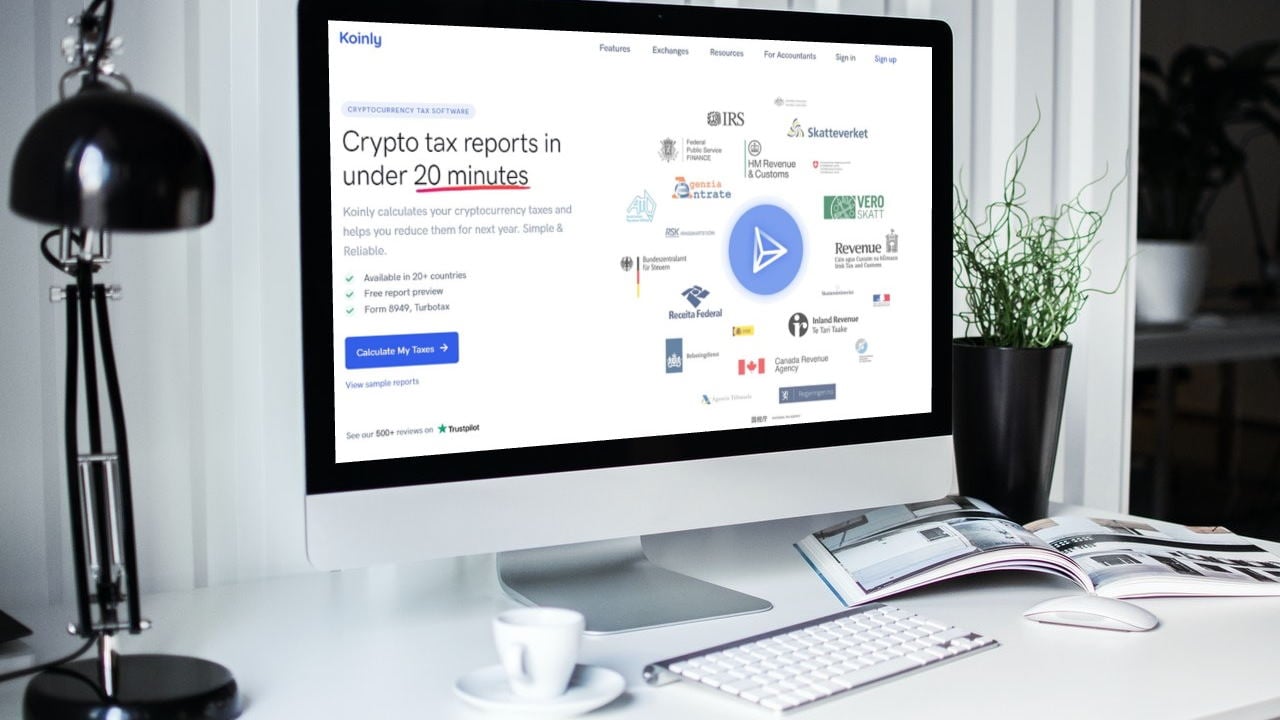

Koinly is a tax solution for cryptocurrency investors and accountants. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. Koinly was built to solve this very problem – by integrating with all major blockchains and exchanges Koinly reduces crypto tax reporting to a few minutes of work.

Robin Singh is the Founder of Koinly. He recently joined the Bitcoin.com News Podcast to talk about the challenges crypto users face with regards to taxes in 2022:

Koinly currently supports USA, UK,....

The integration provides LUNA users a way to accurately track and record their transactions to meet their tax obligations, according to Koinly's Tony Dhanjal. Crypto tax calculation platform Koinly added Terra (LUNA) wallet support to make tax calculation easier for LUNA holders as the Canadian tax report deadline draws near. Tony Dhanjal, head of tax at Koinly, said that LUNA support has been requested by many Koinly users, and with the integration, LUNA users will have a "way to accurately track and record their transactions to meet their tax obligations." Calculating crypto tax is easy....

Compiling taxes for crypto transactions has been a thorn in the side of investors for a long time. This is because, unlike traditional markets, crypto transactions can be numerous as investors move to their preferred projects, and tax filings require that all of these transactions be reported. Given this, Koinly has taken it upon itself […]

In recent years, the IRS has made one thing abundantly clear – if you make money from crypto, they want their cut. So if you’re underreporting or outright avoiding crypto taxes, be warned: the penalties are steep. Before you take the wrong turn, learn the risks from crypto tax experts, Koinly.

Is cryptocurrency taxed?

The million dollar question – and the answer is a definite yes. Virtually every country in the world requires you to pay taxes on crypto.

The exact tax you’ll pay will vary – but in general you’ll pay....

Left your crypto taxes until the last second? Here’s how to get your crypto taxes done by April 18 with the least amount of friction possible.

The IRS has been really clear that cryptocurrency is definitely taxed – and that they’re able to track crypto investments through various channels. In brief, crypto is subject to Capital Gains Tax and sometimes Income Tax. You’ll pay long-term Capital Gains Tax between 0% to 20% or you’ll pay short-term Capital Gains Tax or Income Tax between 10% to 37%, depending on your Income Tax bracket.

....