Mark Cuban Hit by Iron Finance Token Crash, Calls for Defi Regulation

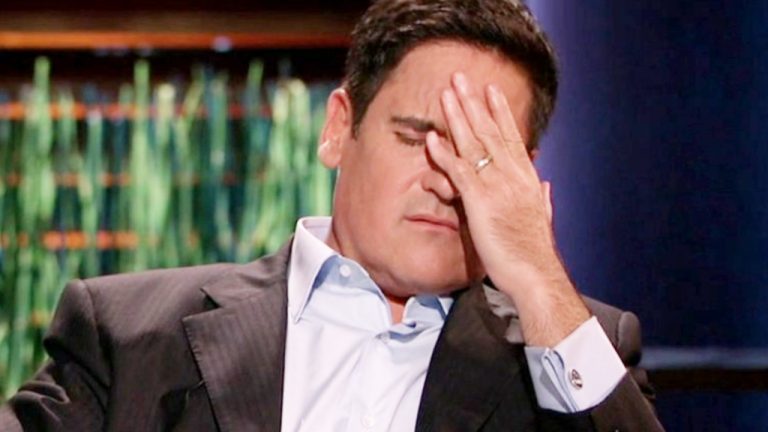

Billionaire investor and Shark Tank star Mark Cuban has called for cryptocurrency regulation focusing on decentralized finance (defi) and stablecoins after a token he invested in collapsed from $64 to near zero. Cuban Wants Defi and Stablecoin Regulation After Investing in Collapsed Token The billionaire owner of the NBA team Dallas Mavericks, Mark Cuban, invested in a token that crashed from about $64 to near zero Wednesday. Iron Finance called the collapse of its iron titanium token (TITAN) “the world’s first large-scale crypto bank run.” The price of the token is....

Related News

After a bank run on the Iron Finance protocol cost him dearly, Mark Cuban is calling for regulation to define “what a stablecoin is and what collateralization is acceptable.” Billionaire investor and DeFi proponent Mark Cuban has called for stablecoin regulation after losing money on what he dubbed as a “rug pull” on the Iron Finance protocol. According to Iron Finance, the partially collateralized stablecoin project was the subject of a “historical bank run” that resulted in the price of the IRON stablecoin moving off peg. As a consequence, the price of Iron’s native token TITAN crashed....

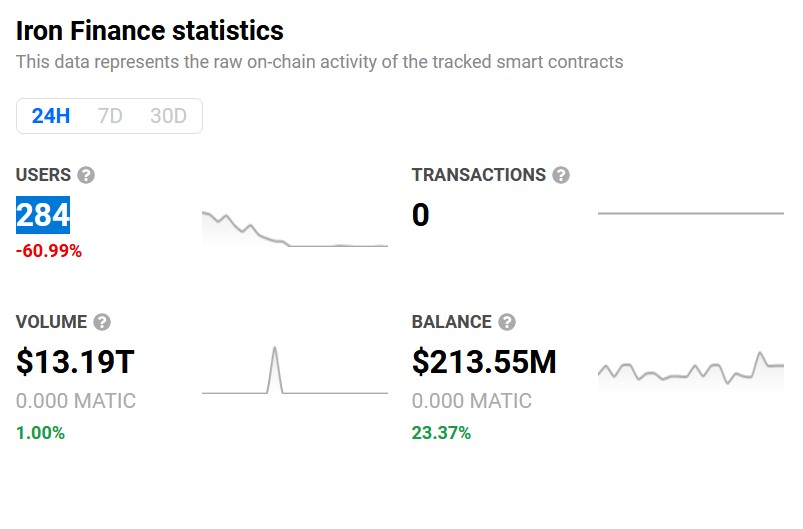

The Iron Finance stablecoin fiasco caused cries for regulation and shed light on the importance of complete collateralization. The cryptoverse has been overrun with negative events lately. One of the most recent ones was the Iron Finance bank run that occurred on June 16. Iron Finance is a multi-chain, partially collateralized stablecoin protocol with the main goal of providing a dollar-pegged stablecoin to be used for DeFi applications. It was the first large-scale bank run in the cryptocurrency market.Iron Finance’s stablecoin, IRON, is a partially collateralized token soft pegged to the....

Mark Cuban has been publicly bullish on Ethereum and DeFi. The billionaire has gone all-in on this sector. He believes dApps have great potential to build a new financial system. However, some protocols carry higher risk, sometimes that leads to a higher reward or a bigger loss, as Cuban himself just discovered. The billionaire got […]

Mike Novogratz suggests DeFi projects add KYC and AML features now instead of waiting on regulators to crack down on the entire sector. Decentralized finance (DeFi) has emerged in 2021 as one of the fastest-growing trends in the crypto sector and as the unique features of DeFi begin to work their way into traditional finance, executives from crypto and conventional business circles warn that regulation could be on the way if the protocols don't take steps to self-regulate. On June 23, Mike Novogratz, CEO of Galaxy Digital, warned that DeFi protocols will soon need to decide if they want to....

On June 13, the billionaire investor and co-host of the television series Shark Tank, Mark Cuban, explained his fascination with decentralized finance (defi) in an editorial published to his blog. Cuban details that many defi organizations are different because they are not corporate entities or based in the United States. He believes that “no one owns majority control” of these operations which makes them “permissionless” innovations. Mark Cuban Sees Massive Potential When It Comes to Permissionless Finance The entrepreneur Mark Cuban has been in the crypto space....