Defi Economy Is Recovering Faster Than Most Crypto Assets After Market Rout

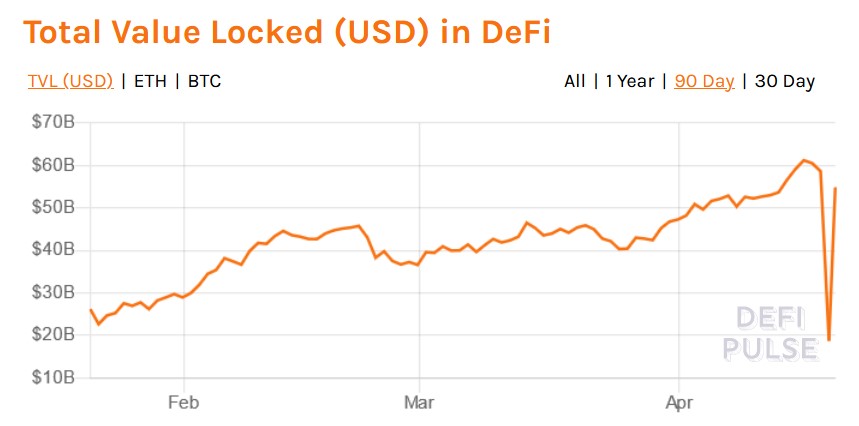

Decentralized finance (defi) exchanges and tokens are recovering a lot faster than a great number of digital assets that lost more than 40% in value last week. Defi tokens like curve, kyber network, terra, hxro, and more have been seeing double-digit gains. On May 23, the defi economy’s aggregate total-value locked (TVL) dropped to a low of around $50 billion and has since gained $17.4 billion. Defi Economy Lifts Higher Than the Rest Defi fans are seeing the economy improve a bit after many decentralized finance tokens lost a significant amount of value during the recent market rout.....

Related News

While digital currencies like bitcoin and ethereum lost roughly 10% in value during the last seven days, the decentralized finance (defi) economy has weathered the storm better than the top two leading crypto assets. A slew of blockchain games coins, defi tokens, and metaverse assets like gala, crypto.com coin, wax, kadena, wonderland, and avalanche have seen double-digit gains during the last 24 hours.

TVL in Defi Weathers the Crypto Economy Storm

While bitcoin (BTC) has hovered just above the $60K zone in consolidation, the defi economy and a number of other crypto assets....

Decentralized finance (defi) has been hit hard by the recent crypto market rout as the total value locked (TVL) across 118 different blockchains has slipped below the $100 billion mark to today’s $74.27 billion. The TVL in defi today is down more than 70% from its December 2, 2021, all-time high (ATH) at $253.91 billion. Moreover, since December 2021, the top smart contract platform tokens have lost 70% in value against the U.S. dollar as well, sliding from $823 billion to today’s $245 billion.

Defi Continues to Get Slammed by the Market Carnage, Top Smart Contract....

Digital asset markets have recaptured some of the losses taken three days ago, as a great majority of the crypto economy has started to rebound after the market rout. Bitcoin has climbed above the $18k handle once again and a myriad of crypto assets are up between 1-6% during the last 24 hours. After dropping to a low of $16,300 per coin, bitcoin (BTC) has rebounded 11.3% to where the price stands today at $18,138 per unit. BTC is still up 33% for the last 30 days, 54% for the last 90 days, and 139% against USD for the last 12 months. Bitcoin’s dominance index, in comparison with the....

The crypto-economy has been sliding in value during the last 48 hours as the current market valuation for all 13,000+ crypto assets is $1.83 trillion. Furthermore, the total value locked (TVL) in decentralized finance (defi) protocols has slipped below the $200 billion mark to $196.02 billion on Sunday morning (EST). Meanwhile, Ethereum’s dominance is 55.54% of the current aggregate TVL held in defi today with $108.88 billion. Value Locked in Defi Protocols Sink, Ethereum Loses Decentralized Finance Dominance The value in defi protocols has slipped from the $251 billion mark at the....

The DeFi sector saw a sharp drooped in its Total Value Locked, according to DeFi Pulse data. At the time of writing, the metric is recovering quickly and stands at $54.93B. Sitting at the number six spot on the top 10 DeFi protocols by TVL with $3.88B, SushiSwap could be on the verge of taking […]