Bitcoin Taker Buy/Sell Ratio Plunges To Lowest Since 2018: Strong Sell Signal...

Bitcoin is trading at a pivotal level where its previous all-time highs, set in January and May, are now being tested as support. This zone has become a critical battleground for bulls and bears, as fear spreads through market sentiment. Many investors are bracing for further declines, worried that a break below these levels could accelerate downside momentum. Related Reading: Bitcoin STH Cost Basis Aligns With Critical Indicator: Support Builds Around $100K Level Fresh on-chain data adds weight to these concerns. According to CryptoOnchain, insights from CryptoQuant charts reveal a sharp....

Related News

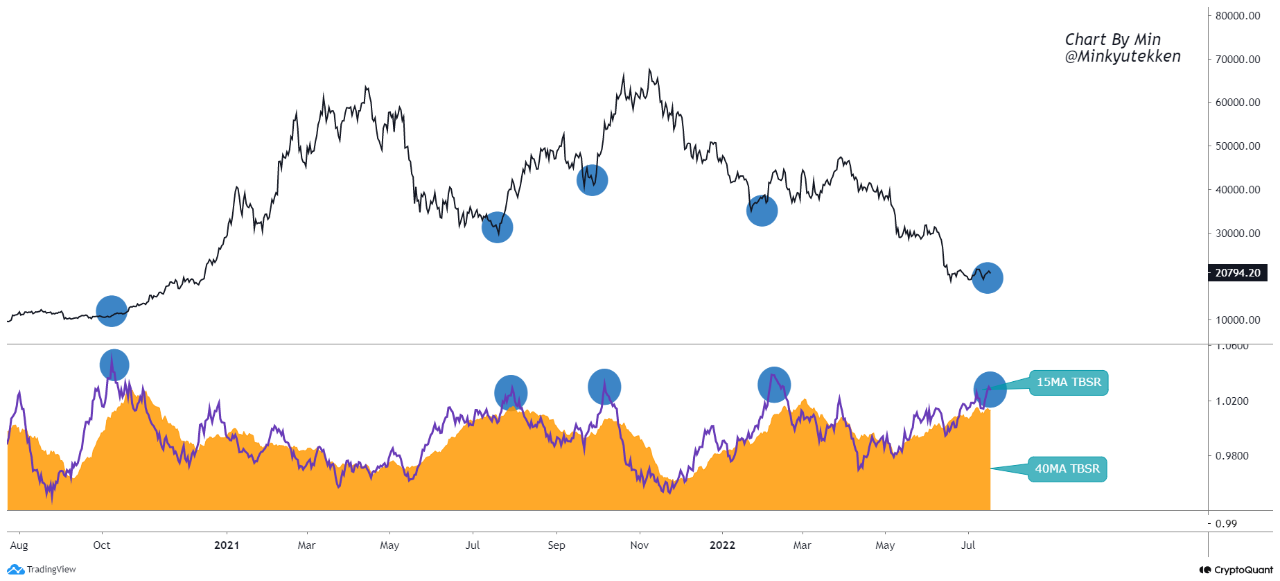

On-chain data shows the Bitcoin taker buy/sell ratio started showing a green signal shortly before the surge above $22k. Bitcoin Taker Buy/Sell Ratio Is Now Showing a “Buy” Signal As pointed out by an analyst in a CryptoQuant post, the BTC taker buy/sell ratio suggested a bounce not too long before the rally today. The […]

On-chain data shows the Bitcoin taker buy/sell ratio is now lighting up a “buy” signal as the price of the crypto begins to take off. Bitcoin Taker Buy Sell Ratio Suggests Now May Be A Good Time To Buy As explained by an analyst in a CryptoQuant post, the taker buy sell ratio metrics can be used to find viable entry and exit spots in the market. The “Bitcoin taker buy volume” is an indicator that measures the volume of buy orders filled by takers in perpetual swaps. Similarly, the “taker sell volume” measures the amount of sell orders. The “taker....

On-chain data shows the Bitcoin taker buy sell ratio has surged up to a high not seen since almost two years ago. Bitcoin Taker Buy Sell Ratio Observes Uplift In Recent Days As pointed out by an analyst in a CryptoQuant post, the taker buy sell ratio is now at its highest value in 636 days. The “taker buy sell ratio,” as its name suggests, is an indicator that measures the ratio between the taker buy volumes and the taker sell volumes. When the value of this metric is greater than one, it means the long volume is overwhelming the short volume right now. Such a trend suggests....

The latest trend in the Bitcoin taker buy-sell ratio could suggest a bearish reversal may be coming soon for the cryptocurrency. Bitcoin Taker Buy Sell Ratio 100-Day EMA Has Encountered Resistance An analyst in a CryptoQuant Quicktake post explained that the asset may be heading towards a correction due to the taker buy-sell ratio coming across strong resistance. The “taker buy sell ratio” is an indicator that keeps track of the ratio between the Bitcoin taker buy and taker sell volumes. When the value of this metric is greater than 1, it means that the taker buy or the long....

On-chain data shows the Bitcoin taker buy/sell volume is now showing a “buy” signal as the crypto looks to be gearing up for a new rally. Bitcoin Taker Buy/Sell Volume Says Now May Be The Time To Buy As pointed out by an analyst in a CryptoQuant post, the BTC taker buy volume recently reached a value that has historically been a green signal for the crypto. The “taker buy volume” is an indicator that measures the long volume of Bitcoin on derivatives exchanges. The metric works by checking orders on the book to see how many takers are buyers. This volume divided by....