Bitcoin To Dump Even Lower? This On-Chain Metric May Suggest It

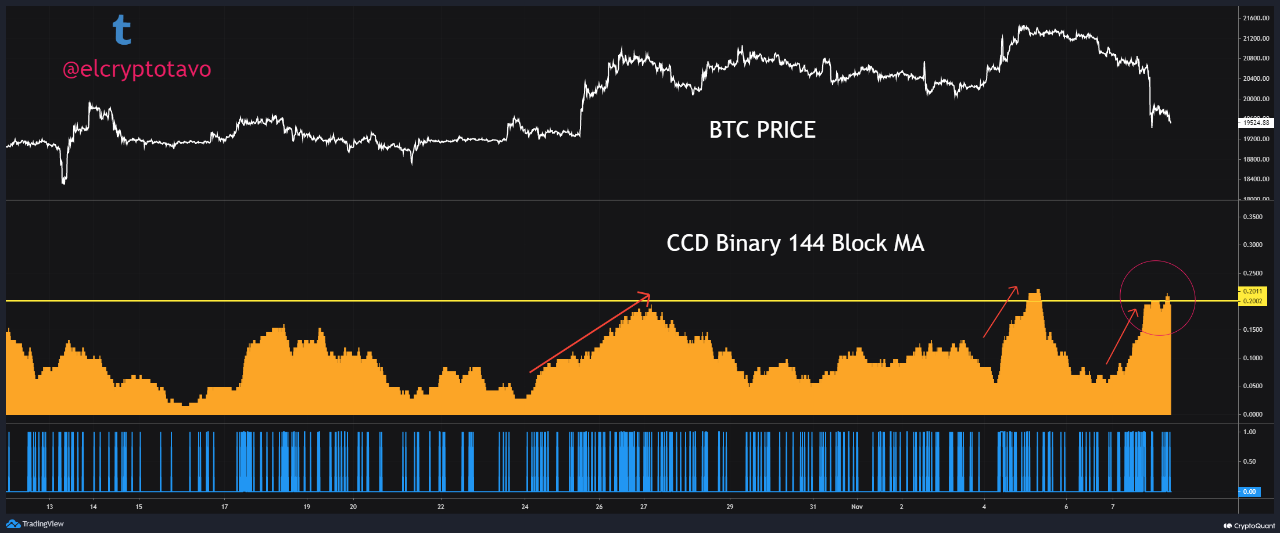

Bitcoin has sharply rebounded back to $20.4k, but is the decline actually over? This on-chain metric may suggest otherwise. Bitcoin Coin Days Destroyed Metric Has Spiked Up Over The Past Day As pointed out by an analyst in a CryptoQuant post, BTC Coin Days Destroyed is showing a spike at the moment. A “coin day” is the amount that 1 BTC accumulates after sitting still on the chain for 1 day. When any coin with some number of coin days shows any movement, its coin days reset back to zero, and are said to be “destroyed.” The “Coin Days Destroyed” (CDD)....

Related News

On-chain data shows the Bitcoin MVRV ratio has declined below one recently as the average holder has now slipped back into a state of loss. Bitcoin MVRV Is Now Back In The Historical Bottom Region As pointed out by a post on CryptoQuant, the BTC MVRV ratio has now come down into the region below “one” once again. The “Market Value to Realized Value” (or MVRV in short) ratio is an indicator that’s calculated by dividing the market cap of Bitcoin with its realized cap. The “realized cap” measures the cap of BTC by weighting each coin in circulation....

On-chain data shows Bitcoin whales are dumping as they make up almost 90% of the transactions to exchanges, but BTC holds support above $60k. Bitcoin Exchange Whale Ratio Says Nearly 90% Of Transactions Are From Whales As pointed out by a CryptoQuant post, BTC has continued to hold support above $60k despite on-chain data showing whales are dumping their coins. The indicator of relevance here is the “exchange whale ratio.” This metric measures the ratio between the top ten inflow transactions to exchanges and the total volume of Bitcoin moving to exchanges. With this ratio, the....

Bitcoin price has been stuck trading within a small symmetrical triangle. These continuation patterns tend to suggest another equal sized move down is coming. However, a sweep of lows would “perfect” a buy setup that could initiate a pump and dump fractal from years ago. The pump and dump would be designed to further confuse […]

On-chain shows Bitcoin miner outflows have been elevated recently, suggesting miners were involved in the recent selloff that took the price of the crypto below $42k. Bitcoin Miner Outflows Spiked Up Before The Crash Below $42k As pointed out by an analyst in a CryptoQuant post, BTC miners seem to have been one of the sellers behind the price drop to $42k. The relevant indicator here is the “miner outflow,” which measures the total amount of Bitcoin exiting wallets of all miners. When the value of this metric spikes up, it means miners are moving a large number of coins out of....

On-chain data shows the Bitcoin exchange whale ratio has started to sharply rise, a sign that these humongous holders may be beginning to dump. Whales Are Behind Almost 90% Of Bitcoin Exchange Inflows Right Now As pointed out by an analyst in a CryptoQuant post, whales may be ramping up dumping, a sign that could be bearish for the price of BTC. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top ten Bitcoin transactions to exchanges and the total exchange inflows. Since the 10 biggest transactions to exchanges usually belong to the....