Core Scientific may consider bankruptcy following uncertain financial conditi...

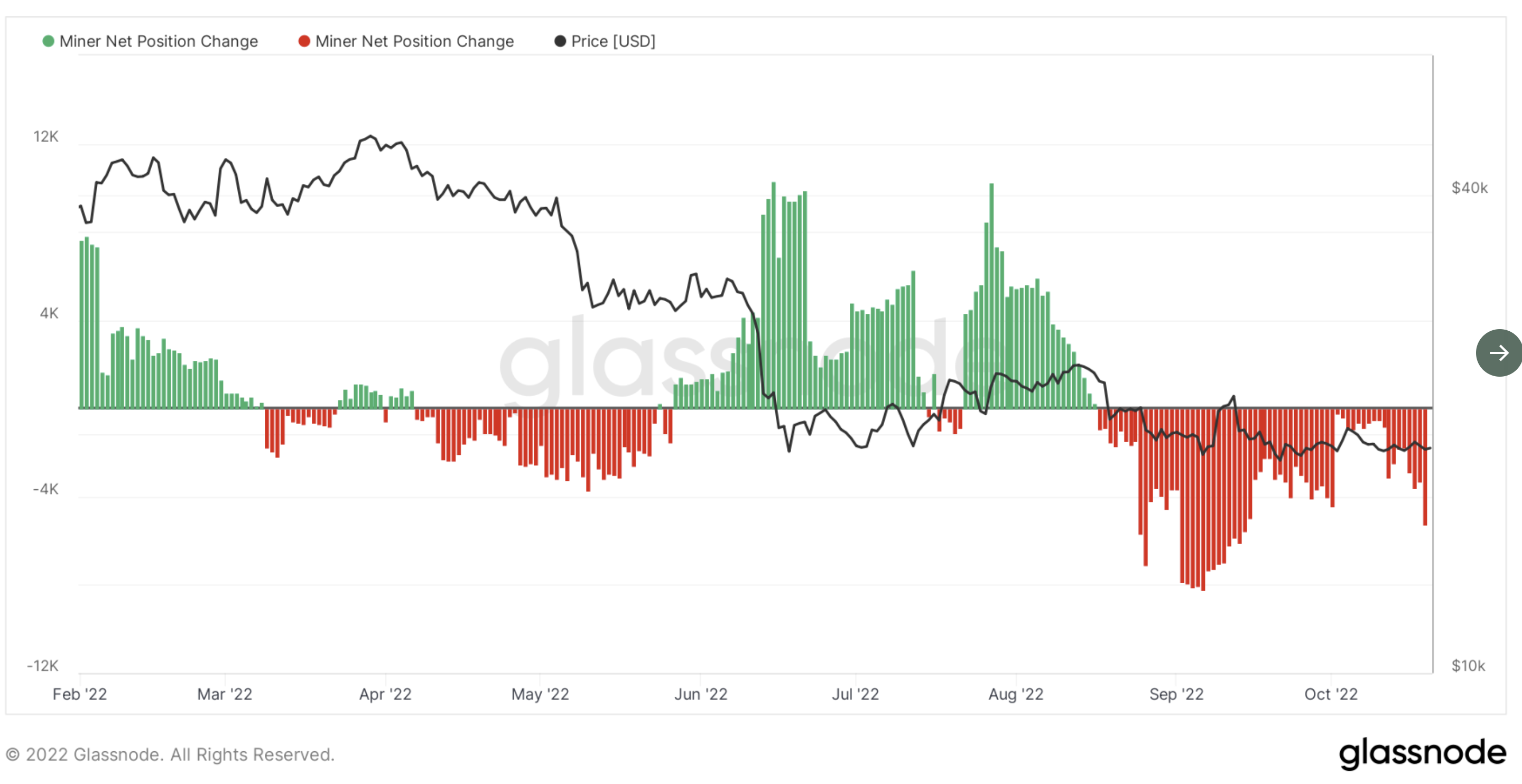

The mining firm has cited the low price of Bitcoin, electricity costs, an increase in the BTC hash rate, and litigation with Celsius playing a role in its financial difficulties. Bitcoin mining firm Core Scientific is reportedly considering a potential bankruptcy amid a group of its convertible bondholders consulting restructuring lawyers.According to a Nov. 1 report from Bloomberg Law, the Core Scientific bondholders worked with legal firm Paul Hastings following a United States Securities and Exchange Commission filing suggesting financial distress. The Oct. 26 filing indicated that the....

Related News

One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due for Oct. and early Nov. 2022. SEC Filing Shakes Core Scientific Investors, CORZ Slides 97% in 12 Months Bitcoin miners are having issues after the price of bitcoin (BTC) has slid roughly 70% against the U.S. dollar since Nov. 10, 2021. Moreover, the network’s mining....

Core Scientific is the latest in the line of Bitcoin miners accelerating a pivot toward AI, selling 1,900 BTC and signaling that more is coming. Core Scientific Expects To Sell All Of Its Bitcoin Holdings In Q1 2026 Core Scientific has filed its annual report with the US Securities and Exchange Commission (SEC) and it […]

Miner capitulation is here. Core Scientific talks about potential bankruptcy, highlighting that cash resources will be depleted by the end of the year.

Core Scientific claims to be losing approximately $53,000 per day to cover the increased electricity tariffs that Celsius refuses to pay. Crypto lender Celsius Network's legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the....

The largest publicly traded Bitcoin miner in the U.S. by hash rate and mining fleet, Core Scientific (CORZ), issued a bankruptcy warning in a filing with the SEC on Oct. 26. Shortly thereafter, the stock took a nosedive. The stock plummeted from $1.02 to $0.22. While the CORZ stock was trading at $10.43 at the beginning of the year, it is now down 97% year-to-date. Notably, the Bitcoin price was unimpressed by the news. As NewsBTC reported, a Bitcoin miner capitulation is currently the biggest intra-market risk. Therefore, it is questionable whether the risk of a capitulation event is now....