Curve liquidity providers see $3M windfall from $11M Yearn Finance exploit

A hacker has made off with $2.8 million after draining $11 million from Yearn Finance’s V1 DAI vault. DeFi protocol Yearn Finance has reported that its V1 yDAI vault was exploited by a hacker to the tune of $11 million on Feb. 5. However, the hacker failed to reap the lion’s share of the heist, with Curve liquidity providers making more from the attack than its mastermind.While the vault lost $11 million in total, Yearn developer “Banteg” tweeted that the hacker had only been able to profit to the tune of $2.8 million. The team has suspended all deposits to its V1 DAI, USDC, USDT, and TUSD....

Related News

Curve and yearn.finance are among the few decentralized finance projects that have interesting yield farming products to offer. Their volumes have shot upwards due to consistent community involvement. Nevertheless, the price of their governance tokens is reflecting the boom. Anil Lulla, co-founder/COO of Delphi Digital – a New York-based digital asset research firm, attempted to […]

Popular DeFi protocol Yearn Finance has launched a new product, a yield generator called yvBOOST. Part of its suite of vaults, this product will complement the “Backscratcher” vault and will allow users to earn and boost rewards in the Curve-based token 3CRV. “Backscratcher” offers rewards in Curve’s, an Ethereum exchange liquidity pool, native token CRV. […]

Yearn Finance reported that a legacy yETH product was hit by an exploit that allowed an attacker to mint a massive amount of fake tokens and swap them for real assets. Related Reading: Bitcoin Miners Face A Harsh December: Rising BTC Difficulty, Falling Hashprice According to on-chain alerts and protocol statements, the attacker created a near-infinite supply of yETH in a single transaction, then used those tokens to pull ETH and liquid-staking derivatives from liquidity pools. The incident was first flagged on November 30, 2025, and the total impact has been reported at roughly $9....

Alchemix and Yearn.Finance appear to be squaring off with Curve and PoolTogether, but for now there appear to be harmonious solutions. With millions and even billions of dollars at stake, industrial-scale yield farming is leading to pockets of resistance as some projects refuse to be left with the chaff. In the past week, team members from no-loss lottery project PoolTogether and exchange liquidity pool provider Curve Finance have proposed ways to reduce the load Yearn.Finance strategies place on their protocols and governance tokens. In a Tweet on Sunday, PoolTogether co-founder Leighton....

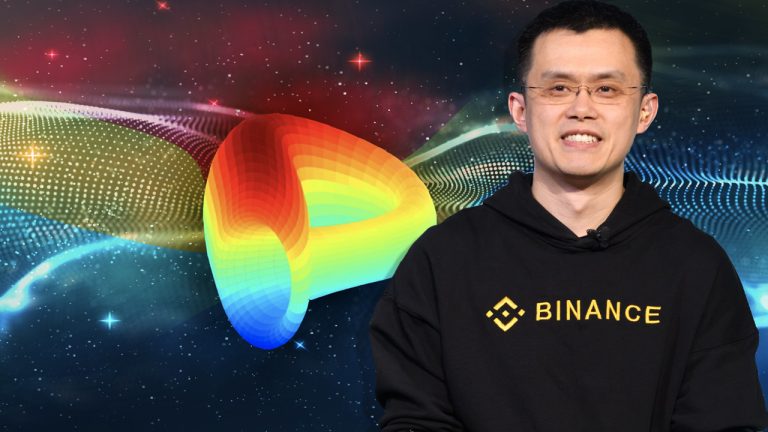

Following the recent Curve Finance attack, Binance CEO Changpeng Zhao announced that the exchange had recovered $450 million from hackers. The decentralized finance (defi) platform Curve saw roughly $570 million siphoned from the application on August 9. Binance Boss Says Exchange Froze 83% of the Curve Finance Hack Funds, Domain Provider Says Exploit Was DNS Cache Poisoning Four days ago, the crypto community was made aware that the Curve Finance front end was exploited. Curve fixed the situation but $570 million was removed from the defi protocol. The attackers, however, decided to send....