US debt ceiling crisis: A catalyst for crypto’s ultimate decoupling?

Many in and beyond the crypto industry believe that the political standoff around the debt ceiling increase makes digital assets more attractive in the long run. The United States federal government’s default on its debt has been averted — at least for now. On Oct. 7, the Senate voted to increase the debt limit by $480 billion, a sum needed for the world’s biggest borrower to keep paying off its obligations until early December.The deal secured a temporary resolution for a weeks-long partisan standoff that had investors both within and far beyond the U.S. unsettled. The once unimaginable....

Related News

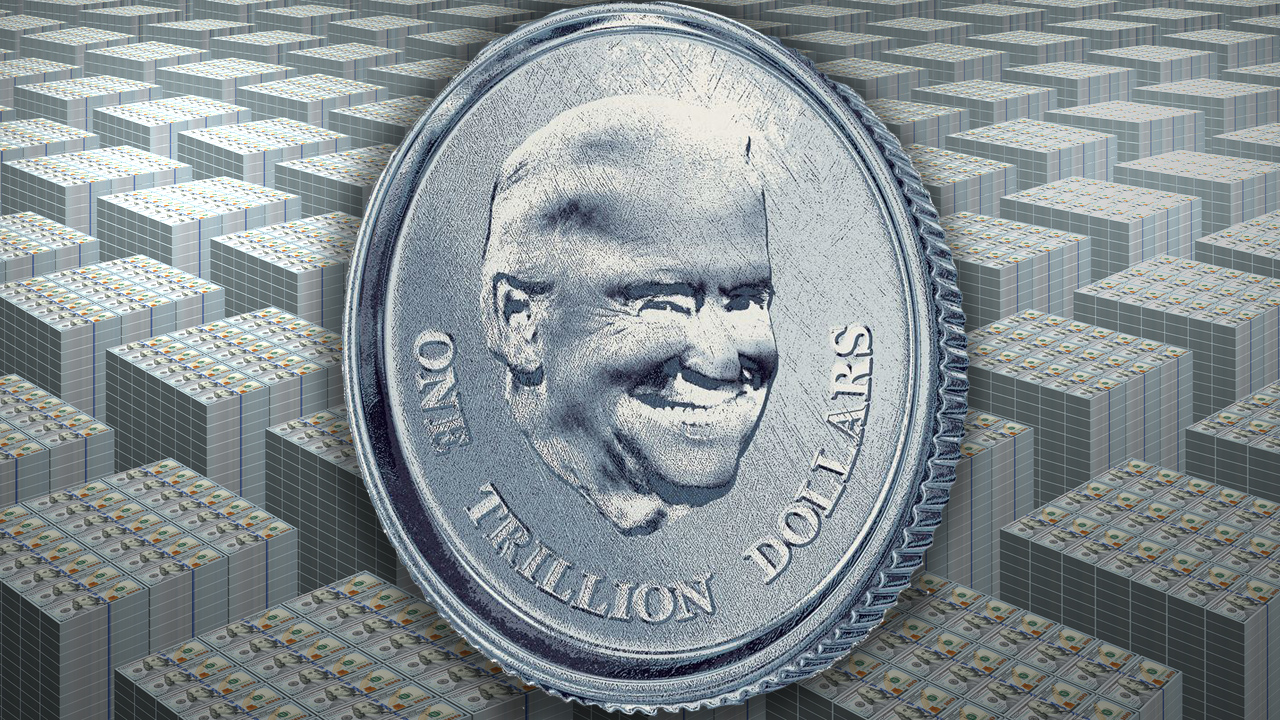

American politicians have been clamoring about the U.S. facing a significant debt crisis and the debt ceiling putting the country at risk of default. Joe Biden spoke about the debt ceiling and told Republicans to “just get out of the way” when it comes to the decision. Meanwhile, a number of U.S. bureaucrats are floating the idea of minting a $1 trillion platinum coin in order to magically bolster the treasury with cash. Trillion-Dollar Coin Concept Strongly Considered by US Politicians, Former US Mint Director Says Platinum Coin Can Be Minted in Mere Hours Simply creating....

With the current macroeconomic crisis unfolding and many European countries at risk of debt defaults, bitcoin enters the ring as a neutral reserve asset.

Fiat money extends the debt cycle and traps citizens in ever-increasing inflation — but bitcoin forces a reckoning.

The unfolding drama inside the Greece's debt-struck economy has been captivating and heartbreaking at the same time. It has given us - the common people - a preview of a once-wealthy country, falling prey to the 2008's Wall Street implode, and further reaching to the verge of being called a bankrupt. But considering Greece as the sole sufferer of some economic meltdown is a mistake. The country's plight can now be compared with more than 20 other nations that have reported to be going through a similar debt trap. A recent analysis by the Jubilee Debt Campaign has further brought forth the....

Bitcoin has enjoyed a pivotal moment, thanks to the ongoing Greek debt crisis, which resulted in capital controls and an influx of funds towards the cryptocurrency. Indeed bitcoin prices have eventually landed back above the $300 mark, following a long period of consolidation around $220 earlier in the year. The prospect of shifting back to a potentially worthless drachma has led several Greeks to move their money to bitcoin, as some websites have offered bitcoin loans and investments while others offered to purchase Greek products using the cryptocurrency. This could allow Greek citizens....