Wanted: Economist for Digital Currencies, Fintech as Bank of Canada Studies a...

The move comes as the central bank continues to research how a central bank digital currency would work as well as the possible risks.

Related News

Interest in blockchain technologies in Canada is growing rapidly as new fintech startups and blockchain ventures are launched and governments indicate they are interested in the possibility of Canada becoming a global fintech/blockchain hub. Even the central Bank of Canada is getting in on the act conducting experiments with blockchain technology and digital currencies. A recent AdvantageBC study said that Canada, particularly the western province of British Columbia, is well positioned with technical expertise and a vibrant fintech ecosystem to lead the world as a global fintech hub of....

Canada’s central bank, the Bank of Canada, and five other Canadian banks (like a growing number of banks around the world) are experimenting with blockchain technology and a possible digital dollar as the growing demand for digital fintech payment systems puts the squeeze on the traditional banking sector. At a recent IMF/World Bank conference hosted by the U.S. Federal Reserve, an estimated 90 central banks, including the Bank of Canada, came forward to talk about their research into and experiments with distributed ledger technology (DLT), the blockchain and digital currencies. The big....

Global economists continue to question the implications of blockchain implementation for central bank digital currencies. Blockchain, the underlying technology of cryptocurrencies like Bitcoin (BTC), is not the right solution for a central bank digital currency, according to an economist at Switzerland’s central bank.Carlos Lenz, chief economist at the Swiss National Bank, argued that blockchain-based decentralization features are not efficient for a state-controlled digital currencies like a digital franc, German-language Swiss newspaper The Handelszeitung reported Thursday.The economist....

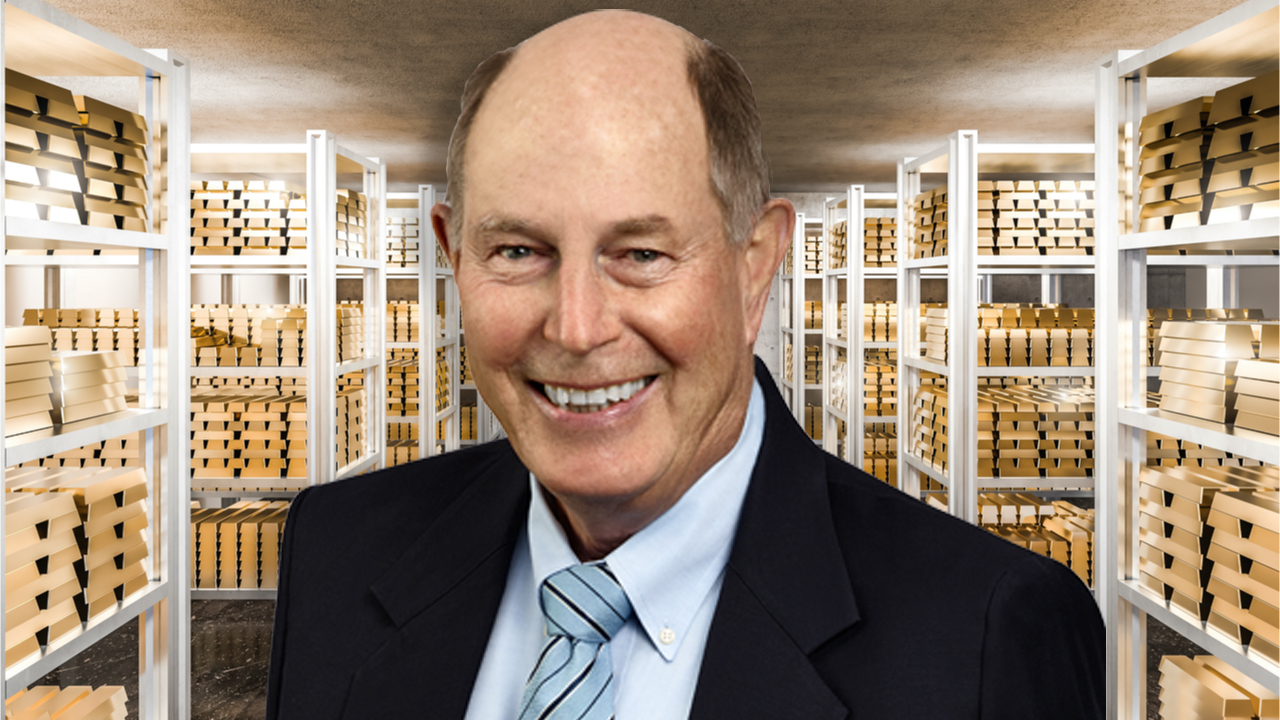

The economist David Dodge, the former seventh governor of the Bank of Canada, says gold is an “antique instrument,” and he believes Canada’s central bank got rid of its gold reserves for this very reason. Despite saying gold is an outdated financial tool, Dodge said that the leading crypto asset bitcoin (BTC) has no place in the Bank of Canada’s reserves.

David Dodge: The Bank of Canada ‘Holding This Antique Instrument of Stability Called Gold Really Didn’t Make Any Sense’

David Dodge, the former seventh governor of the Bank of....

The Bank of Canada has been heavily researching blockchain technology, Bitcoin, and the use of digital currencies. Just recently, a team of central bank researchers published a report called “Canadian Bank Notes and Dominion Notes: Lessons for Digital Currencies” examining issues they believe revolve around private and public cryptocurrencies. Is....