New report reveals top-graded exchanges at three-year peak volume dominance

The CryptoCompare report ranked the performance of several crypto exchanges across metrics such as security and asset diversity to conclude their findings. Recent data from market analyst firm CryptoCompare reveals that the leading six cryptocurrency exchanges, as per the company's analytical model, were responsible for a three-year high in spot volume throughout the month of August. The metric grades all cryptocurrency exchanges across a multitude of areas — including legal/regulatory cases, data provision, security and market quality, among others — and ranks them in a list accordingly.....

Related News

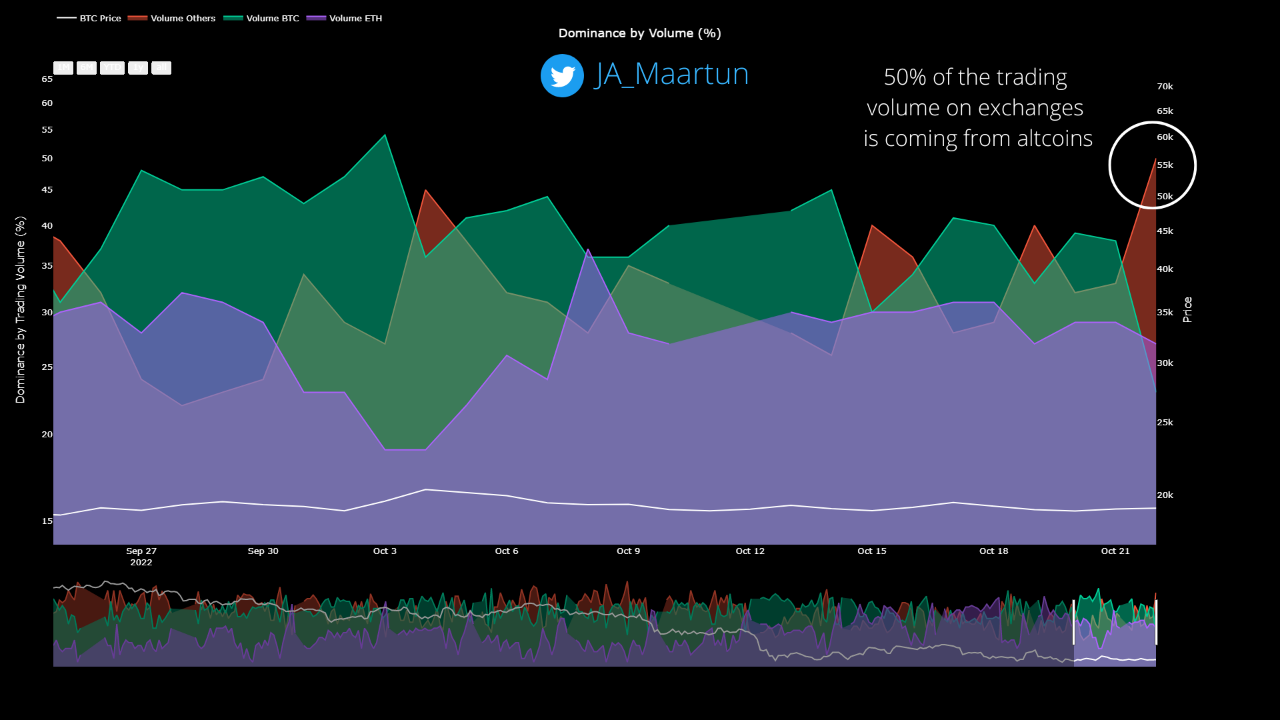

Data shows the altcoin dominance by volume on exchanges has now risen to 50%, here’s what happened to Bitcoin the last two times the crypto market saw such a shift. Altcoins Are Now Contributing To 50% Of The Volumes On Exchanges As pointed out by an analyst in a CryptoQuant post, altcoins have started to dominate after Bitcoin was number one for an entire month. The relevant indicator here is the “trading volume,” which is a measure of the total amount of coins being traded on centralized exchanges. The percentage to this total trading volume being contributed by an....

A recent report released by the world's leading investment bank Goldman Sachs has revealed that the currency pair Bitcoin-Yuan comprises of 80% of the global trading volume on the Bitcoin exchanges. The report titled, "The Future of Finance: Redefining The Way We Pay in the Next Decade," was written by payments analysts at the bank's research division, James Schneider and SK Prasad Borra. The second highest traded currency pair is BTC/USD. However, the report failed to touch upon the fact that Chinese exchanges often don't charge any fee for trading, leading to a spurt in trading....

India remains firm on its idea to introduce the Central Bank Digital Currency (CBDC) in 2022-23. In the recent most development in regards to the same, the Reserve Bank of India (RBI) has proposed a graded approach for the introduction of the CBDC. The annual report released by the Reserve Bank Of India stated the […]

Surging BTC outflows from centralized exchanges suggest the Bitcoin markets could be in an accumulation. The number of Bitcoin held on centralized exchanges has consistently fallen since late May, with roughly 2,000 BTC (worth roughly $66 million at current prices) flowing out of exchanges daily.Glassnode’s July 12 Week On-Chain report found that Bitcoin reserves on centralized exchanges have fallen back to levels not seen since April, the month that saw BTC blast to its all-time high of roughly $65,000.The researchers noted that during the bull run leading up to this peak, relentless....

Classic ether (ETC) trading volume has now fallen more than 99% from its peak over the summer. The digital currency, which powers the alternative ethereum blockchain, ethereum classic, came into existence in July amid a stream of enthusiasm. However, data suggests these high hopes have now fallen off. CoinMarketCap data reveals 24-hour trading volume repeatedly fall below $600,000 today, a figure that represented less than one-half of 1% of its all-time high of $155m reached on 3rd August. Yet, the tepid trading volume represents a mere glimpse of the low transaction activity ethereum....