New Zealand’s Past, Pūtea and Future: CBDC Vs. Bitcoin

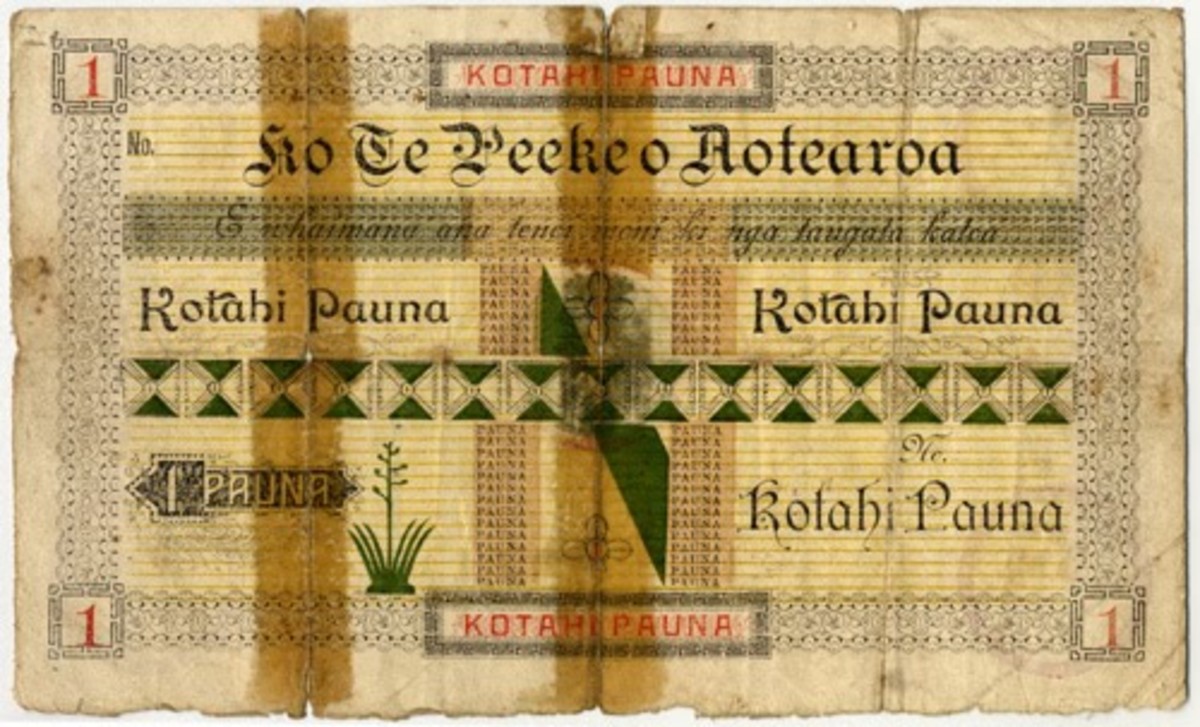

Source Currently, there is global attention focused around the evolution of money. The trend of exponentially evolving technology is disrupting finance and governance, it is impacting all corners of the world. In my home country of Aotearoa, aka New Zealand, the movement toward future money is palpable, from statements by the central bank (RBNZ) about re-evaluating money itself, to a movement toward Māori (indigenous) economic self-governance (tino rangatiratanga).This article is about the future of money from a sovereign perspective. My aim is to show that New Zealand is not built....

Related News

A tech leader and software company director has said that the setup of a national FinTech organization will push New Zealand’s economic growth. Mitchell Pham, tech leader and director of NZTech, said that New Zealanders should care about FinTech as electronic interactions will play an important role across the country’s economy, according to Scoop News, a New Zealand news website. After gathering support from NZTech and the New Zealand government, FinTechNZ was launched last week. Pham is reported as saying that e-commerce as a subset of FinTech is important for the future of small to....

The Retail CBDC will be tested in a limited retail environment with 10,000 participants and three major banks. On top of its wholesale central bank digital currency (CBDC) projects and proof-of-concept Retail CBDC testing with corporates, the Bank of Thailand (BOT) will extend the scope of CBDC development aimed at retail to a pilot phase. A possible real-life application of the "Retail CBDC" will be conducted inside the private sector on a limited scale. As the Aug. 5 announcement on the official page of the BOT goes:“The BOT will assess the benefits and associated risks from the Pilot to....

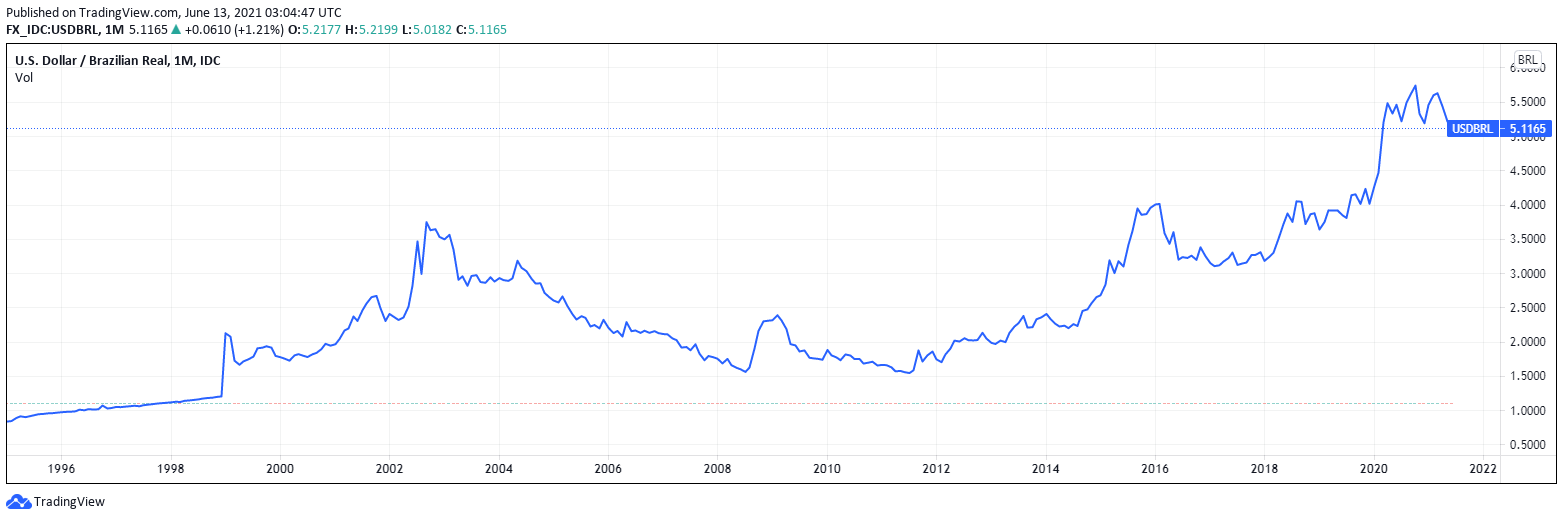

Brazil’s central bank, the Banco Central do Brasil (BCB), is pushing for more time to roll out its central bank digital currency (CBDC). Earlier in May, BCB released a document covering the general guidelines and characteristics of Brazil’s future CBDC. Roberto Campos Neto, BCB’s chief central banker, also stated earlier last year that the country […]

The United States is embarking on a campaign toward the introduction of a CBDC, or central bank digital currency. As part of the White House’s first-ever comprehensive framework, the Treasury Department is now suggesting the creation of a national stablecoin or CBDC. To counter China’s advancements on the CBDC, five panelists at a hearing for the […]

The Bank of England's CBDC-related job listings range from solution architect to senior manager. The United Kingdom’s central bank, the Bank of England, or BoE, still maintains that it is unsure on a path forward regarding a central bank digital currency, although the entity is looking to hire at least seven CBDC-related job positions. The job listings recently surfaced on the BoE’s job posting website. One such position searches for a “Stakeholder Analyst - Central Bank Digital Currency (CBDC).” As per the site, the bank is also searching for a project analyst, a solution architect, a....