Bitcoin jumps toward $49K amid fears 5%-plus inflation is here to stay

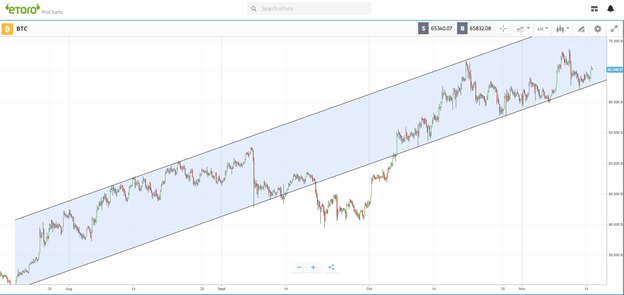

The rush to so-called safe-haven cryptocurrency appears despite concerns that the Federal Reserve would taper its $120 billion a month asset purchasing program. Bitcoin (BTC) inched higher on Sept. 18 as the focus shifted to the Federal Open Market Committee's (FOMC) policy meeting in the wake of lower inflation numbers last Tuesday.The BTC/USD exchange rate approached $49,000 on the Coinbase exchange, hitting $48,825 before turning lower on interim profit-taking sentiment. Nonetheless, the move uphill raised expectations that the pair would hit $50,000, a psychological resistance target,....

Related News

Bitcoin could hit $50,000 in the coming sessions as more and more institutions accumulate it against their fears of dollar-linked inflation.

First major upgrade in four years set to accelerate Bitcoin innovation After briefly eclipsing all-time highs on shocking inflation figures, Bitcoin settled down to finish the week with 2% losses as the long-awaited Taproot upgrade was activated At its peak on Wednesday, Bitcoin flirted with the $69K level. Within a few hours however, fresh fears […]

While the conflict in Ukraine is a hot topic, fears of rising inflation continue to haunt Americans residing in the country, as economists and analysts note U.S. inflation will likely remain high. Inflation is likely going to be worse than initially feared this year, Goldman Sachs explained in a report published on Sunday. Moreover, in terms of inflation coupled with the Ukraine invasion, an economics professor at American International College (AIC) stressed there’s “a perfect storm brewing.”

Goldman Sachs: ‘Strong Jobs Market and Rising Inflation Could....

Bitcoin decoupled from the Nasdaq to denote a 2.7% gain as U.S. inflation numbers recorded a new 40-year high.

U.S. CPI data came lighter than expected at 8.5% in July, but rampant inflation is still present in the energy sector; bitcoin jumps.