Ethereum Institutional Interest is Rapidly Growing; Here’s What On-Chain Data...

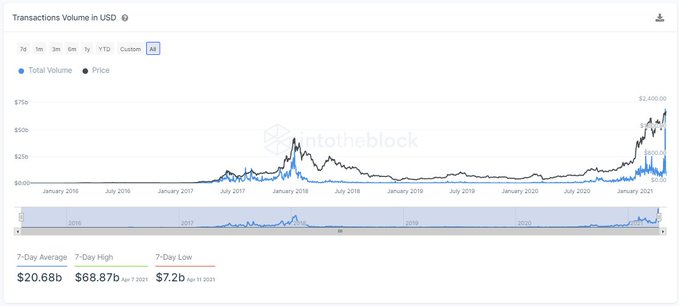

Ethereum is not getting flipped by Binance Smart Chain anytime sooner, shows on-chain indicators. Blockchain analytics platform IntoTheBlock gathered data on Ethereum transactions with volumes greater than $100,000. The portal noted that the second-largest blockchain network processed $20.68 billion worth of transactions in the week ending April 11, leading to a record high volume transfer […]

Related News

The CME has become the largest bitcoin futures exchange by open interest amid institutional onboarding.

In the rapidly evolving landscape of digital finance, Ethereum is quickly establishing itself as the primary infrastructure for global on-chain capital markets. From tokenized bonds and money market funds to institutional liquidity rails, the world’s capital is beginning to migrate to an ecosystem where transactions are programmable, auditable, and borderless. Why Is Ethereum Chosen As The Default Choice For Global Rails The global capital markets are moving on-chain to Ethereum because it is credibly neutral. ETH has never experienced downtime, and it possesses the economic security....

In a shocking development, the price of Ethereum has fallen below the key $4,000 level as the ongoing bearish pressure in the broader crypto market intensifies. On-chain data shows that a notable portion of ETH is still being withdrawn from crypto exchanges in the face of the growing market volatility. Investors Are Still Withdrawing Ethereum […]

After two weeks of a disappointing run, Ethereum (ETH) is once again capturing institutional interest as major funds and asset managers step into the smart-contract platform. Related Reading: Ethereum Founder Sparks Market Shock After Massive ETH Sell-Off – Here’s How Much According to recent data, Bitmine Immersion Technologies purchased approximately $251 million worth of ETH, […]

Ethereum has been outperforming bitcoin for a while now. The altcoin had managed to grow so rapidly that it is now about half the market cap of bitcoin despite being more than 5 years younger. This outperformance had continued through the bull market and now even into the bear market. Ethereum has taken one step further to overtake bitcoin in yet another metric, and that is the amount of open interest in the asset. Open Interest Flips Bitcoin New data from Glassnode has shown an interesting development when it comes to the open interest in both Bitcoin and Ethereum options. Bitcoin had....