This Indicator Says Bitcoin Still Hasn’t Reached A Bear Market Bottom

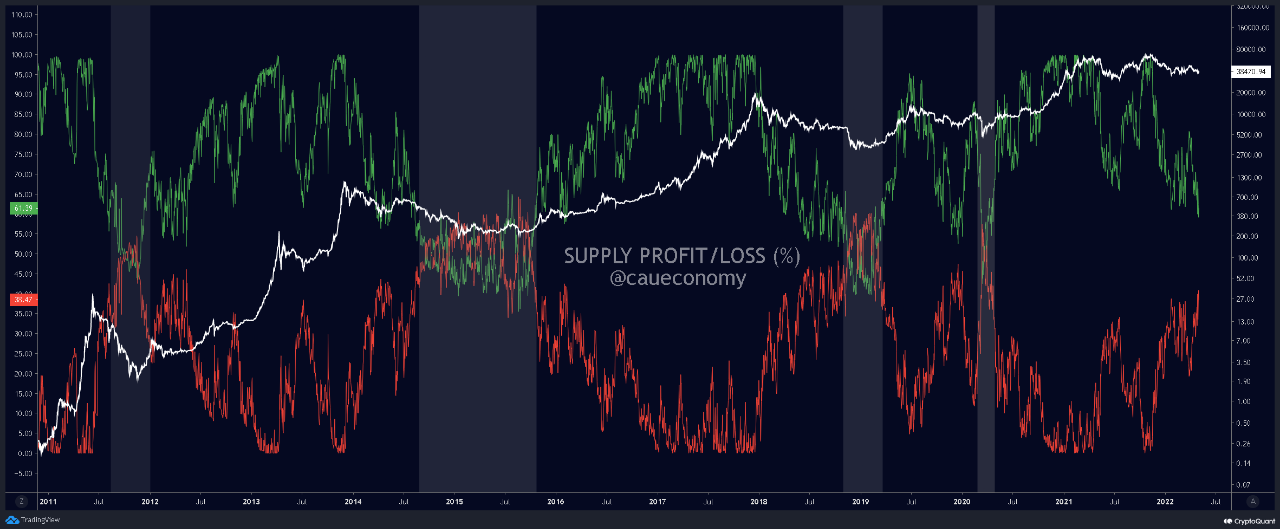

On-chain data shows Bitcoin hasn’t yet hit a bear market bottom as the supply in profit is still more than that in loss. Bitcoin Supply In Profit/Loss Says A Majority Of Network Is Still In Profit As explained by an analyst in a CryptoQuant post, past trend may suggest that the current BTC market still […]

Related News

On-chain data shows the Bitcoin NUPL metric currently has values that would suggest the bear market is yet to hit in full swing, if the coin is in one. Bitcoin NUPL Value Still Not As Low As Previous Bear Markets As pointed out by an analyst in a CryptoQuant post, the BTC NUPL metric suggests market hasn’t neared a bear market bottom yet. The “net unrealized profile/loss” (or NUPL in short) is an indicator that tells us about the ratio of profit and loss in the Bitcoin market. The metric’s value is calculated by taking the difference between the market cap and the....

This week, Bitcoin's 150-day EMA is set to close below its 471-day EMA for only the third time in history. Bitcoin (BTC) could undergo a massive price recovery in the coming months, based on an indicator that marked the 2015 and 2018 bear market bottoms.What's the Bitcoin Pi Cycle bottom indicator? Dubbed "Pi Cycle bottom," the indicator comprises a 471-day simple moving average (SMA) and a 150-period exponential moving average (EMA). Furthermore, the 471-day SMA is multiplied by 0.745; the outcome is pitted against the 150-day EMA to predict the underlying market's bottom.Notably, each....

The chase for the bitcoin bottom is still on since the digital asset fell below its $20,000 price level. Given that the bear market has not been long in the making, it stands to reason that the bull market isn’t here just yet. However, being able to pinpoint when the cryptocurrency has reached as low as it will go can help make smart investment choices and the previous bear trends can shine a light to how it might play out. Previous Bitcoin Bear Markets The most recent bitcoin bear markets point towards some important trends that may occur before a bitcoin bottom is established. The 2018....

The Bitcoin June candle close is ugly, and clearly shows indecision in the market. Is the bull market structure broken, or are new highs still likely this year? No one knows, and price action has reached a stalemate. However, the Ichimoku indicator could not only provide information on what happens if support holds or fails […]

Knowing how to spot market reversals and when to buy the dip is nearly impossible, but the RSI indicator can help. When an asset enters a bear phase and the headlines are negative, analysts project further downside, and the sentiment shifts from optimism to pure gloom and doom. This results in panic gripped traders dumping their positions near the bottom of the downtrend instead of buying. How can traders go against the herd and build the courage to buy in a bear market? It is not easy because if they purchase too early, the position may quickly turn into a loss. However, if they wait for....