Chinese Currency Breaches 7:1 Exchange Rate Against US Dollar for First Time ...

The offshore exchange rate of China’s fiat currency versus the U.S. dollar recently breached the 7:1 mark for the first time in over two years, after it touched a new 2022 low of 7.0188 yuan for every dollar on September 15. Similar to other global currencies that have depreciated in 2022, the yuan’s decline is being driven by the strengthening of the U.S. dollar. The Yuan’s Depreciation The offshore exchange rate of the Chinese currency versus the U.S. dollar breached the seven RMB per every dollar mark after it traded at 7.0188 on September 15, 2022. This is the....

Related News

Moments after the Chinese yuan’s onshore exchange rate versus the U.S. dollar slumped to 7.2458 per dollar, the Peoples Bank of China responded by stating that it will prioritize stabilizing the currency. Similar to other currencies that have been depreciating against the dollar, the yuan has now lost 12% versus the greenback so far this year.

Central Bank Warns Currency Speculators

The Chinese yuan’s onshore exchange rate against the greenback recently plunged to 7.2458 for every dollar, the lowest since January 2008. The yuan’s latest slump came just days....

The Chinese yuan’s offshore exchange rate against the U.S. dollar fell to a new all-time low of 7.33:1 just over a day after the conclusion of the Chinese Communist Party’s congress which gave President Xi Jinping the mandate to lead the country for the third time. Concerns over Xi’s unprecedented third term, as well as the reshuffle of his top team, are said to have sparked a sell-off of stocks that wiped billions from the wealth of China’s super rich. Chinese Yuan Has Depreciated by 7% Since Late August The Chinese currency’s offshore exchange rate versus the....

Investors flocking to Bitcoin explains the recent price increase of the popular cryptocurrency. In fact, it appears Chinese investors are driving the price up even further. Things are not looking all that great for the Yuan right now. After reaching an eight-year low overnight, investors are growing concerned about this fiat currency. Chinese banks slashed their forecasts for the exchange rate as well. A looming Federal Reserve interest rate hike is driving the Yuan down, and further lows are on the horizon. Anyone holding a portfolio containing Yuan will be more than concerned right now.....

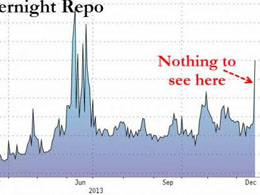

Recent reports from China indicate there may be more to the Bitcoin ban than meets the eye. According to the Financial Times (FT) the Chinese banking system is in crisis which could explain the Bitcoin ban in China. Chinese citizens seem to be running away from their own banking system in droves and their Government is closing the escape paths - including Bitcoin. During the run up of bitcoin in November you could watch the CNY currency leaking from China on sites like www.fiatleak.org and there was a breathtaking amount of Chinese currency leaking into BTC. The over night Repo rate is a....

Just a few days after plummeting to its worst exchange rate against the U.S. dollar ever, the Nigerian currency was trading at around 820 units for every dollar on Nov. 8, a report has said. An economist has suggested that the Central Bank of Nigeria’s controversial currency plan is unlikely to halt the naira’s depreciation or tame inflation. EFCC’s Crackdown on Currency Dealers The Nigerian currency’s parallel market exchange rate versus the U.S. dollar rebounded from an all-time low — 900 units per dollar — seen at the start of the month to around 805:1 by Nov. 8. Some....