Crypto miner Hut 8 plans to hold 5K Bitcoin by 2022

Hut 8 CEO Jaime Leverton said the firm was on track to mine up to 3 additional BTC per day by the end of August. Toronto-based crypto mining firm Hut 8 said it plans to increase its self-mined Bitcoin holdings based on its expectation it will be able to expand its hashrate by 400%.According to a Monday announcement, Hut 8 said it expects to hold 5,000 self-mined Bitcoin (BTC) — roughly $172 million — by the end of 2021, a more than 31% increase over its current 3,806 BTC. The company said the anticipated crypto holdings were based on it being able to increase its hashrate to “2.5 – 3.0 EH....

Related News

The Cincinnati-based miner is expected to list on the NYSE under the ticker symbol GRDI in a SPAC deal with Adit EdTech to close in Q1 2022.

On Friday, the bitcoin mining operation Greenidge Generation Holdings announced the company is expanding to South Carolina in order to develop the firm’s next bitcoin mining facility. Greenidge details that the carbon-neutral Spartanburg facility will be ready in 2021 or early 2022. Bitcoin Miner Greenidge Generation Plans to Expand to South Carolina Spartanburg, South Carolina, the 12th most populous city in the state will be home to bitcoin miners by Q4 2021 or Q1 2022, according to Greenidge Generation Holdings. The Dresden, N.Y.-based firm signed a letter of intent with LSC....

Nigeria’s Securities and Exchange Commission (SEC) announced Thursday it has put plans to regulate cryptocurrencies on hold.

Cleanspark Inc., a Nevada-based corporation, said Thursday that it is acquiring U.S. bitcoin miner ATL Data Centers for $19.4 million in a deal to be completely settled in shares. Cleanspark specializes in microgrid energy software. It claims that it can use this technology at the ATL facility to create energy savings, expand total power capacity, and reduce greenhouse gas emissions. According to a press statement, Nasdaq-listed Cleanspark intends to quadruple the number of ASIC bitcoin miners in operation at ATL. This will happen once the firm adds another 30 megawatts (MW) of electricity....

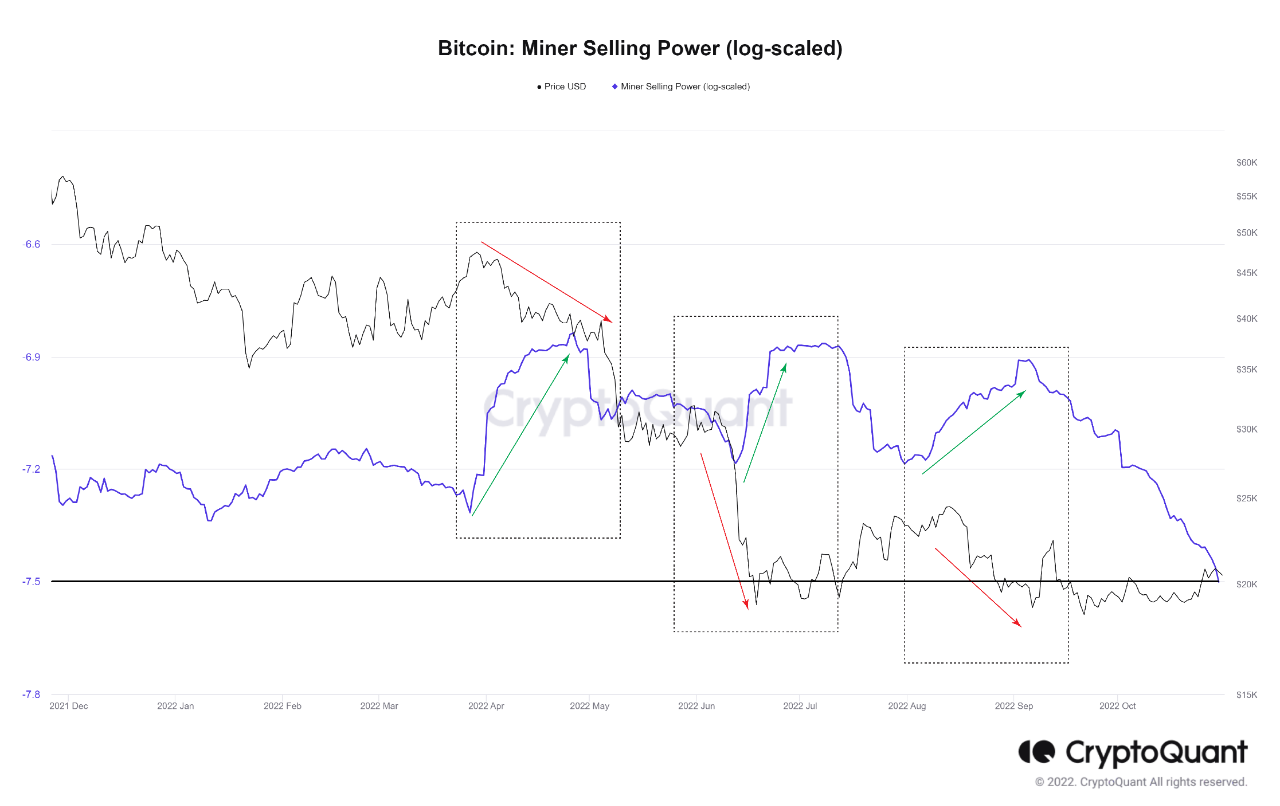

On-chain data shows the Bitcoin miner selling power is at its lowest for the year, something that could be favorable for the price of the crypto. Bitcoin Miner Selling Power Has Been Going Down In Recent Weeks As pointed out by an analyst in a CryptoQuant post, the metric has observed surges in its value a few times this year, and each time the BTC price has gone down. The “miner selling power” is an indicator that’s defined as the ratio between the Bitcoin miner outflows and the total number of coins held by this cohort (30-day moving average, log-scaled) Here, the....