Microstrategy In Red: Paper Loss Amounts To $330 Million

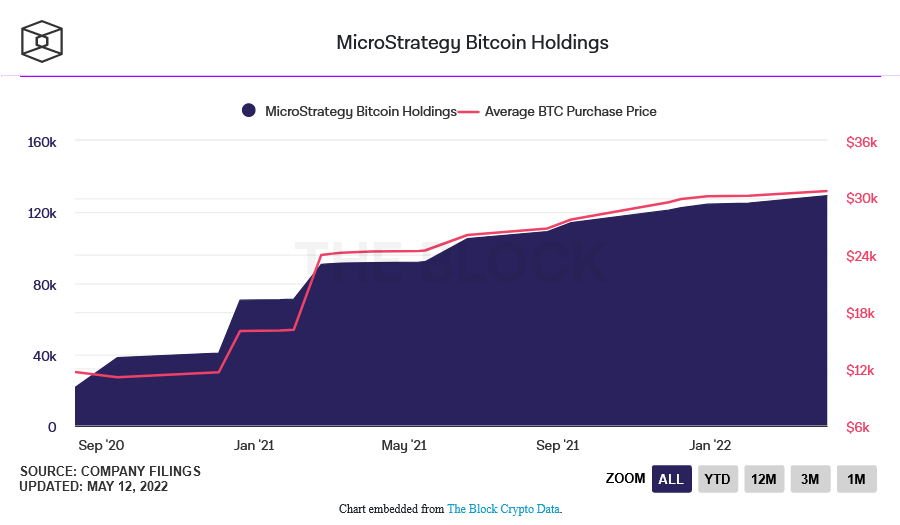

As a result of the recent cryptocurrency market fall, Michael Saylor’s company, MicroStrategy, now has an unrealized loss on its bitcoin assets. With approximately 130,000 BTC, the company is the largest corporate owner of the principal digital asset. Despite the carnage in the market, Michael Saylor remains optimistic, saying that bitcoin will recover and return […]

Related News

As of Sept. 30, MicroStrategy held 114,042 BTC at an average purchasing price of $27,713. MicroStrategy added almost 9,000 Bitcoin to its holdings in Q3, bringing its total BTC stash to a valuation of around $7 billion. The company highlighted the purchase of 8,957 BTC in its Q3 report on Oct. 28, with the firm’s perma-bull CEO Michael Saylor stating that there is more BTC accumulation to come:“Today, MicroStrategy is the world’s largest publicly traded corporate owner of Bitcoin with over 114,000 Bitcoins. We will continue to evaluate opportunities to raise additional capital to execute....

As of June 30, 2021 MicoStrategy held an approximated 105,085 BTC with a carrying value of $2.051 billion, at a total impairment loss of $689.6 million since acquisition of the digital asset. Business intelligence and mobile software firm MicroStrategy has pledged to buy more Bitcoin despite reporting impairment losses of $424.8 million in Q2. This is only a paper loss however based on the price of Bitcoin at the end of the quarter and does not reflect a realized loss. Depending on how you add the figures up, MicroStrategy appears to have made nearly a billion dollars more from Bitcoin....

MicroStrategy currently holds a total of 125,051 BTC acquired for $3.78 billion at an average price of $30,200 per Bitcoin. MicroStrategy, the fortune 500 company with a 125,051 Bitcoin (BTC)-strong treasury, announced its Q4 2021 financial results on Feb. 2.The institutional software solution provider reported a net loss of $146.6 million incurred in impairment charges on its Bitcoin holdings. The high impairment losses added to the company’s operating expenses which saw a 125% increase at $248 million as compared to the same quarter last year.An impairment loss is a recognized reduction....

MicroStrategy has announced an additional Bitcoin purchase to the tune of $489 million. MicroStrategy has bought even more Bitcoin (BTC) despite the current price struggles for the largest crypto by market capitalization.According to an announcement on Monday, the business intelligence firm purchase 13,005 BTC at an average price of $37,617 for a combined total of about $489 million.Monday's report takes MicroStrategy's Bitcoin balance sheet north of the 100,000 mark with the firm now holding 105,085 BTC.At the current BTC spot price, MicroStrategy's Bitcoin holdings are worth $2.74....

MicroStrategy’s holdings are valued at more than $5.9 billion, representing more than $2.2 billion in gains since its initial purchase in August 2020. Business intelligence firm MicroStrategy has added 1,434 Bitcoin to its coffers after purchasing the crypto asset at an average price of $57,477.According to a Thursday filing with the Securities and Exchange Commission, MicroStrategy purchased 1,434 Bitcoin (BTC) between Nov. 29 and Dec. 8 for roughly $82.4 million, making its total holdings 122,478 BTC. With the recent buy, MicroStrategy’s holdings are valued at more than $5.9 billion,....