The Metric That Says A Further 50% Drawdown For Ethereum Is Possible

Past trend of the Ethereum value captured per byte metric suggests that a 50% drawdown from here is still possible for ETH. Ethereum Value Captured Per Byte Currently Stands At $0.30, Double The Previous Bear Bottoms As per the latest data released by Glassnode, ETH may still possibly have potential for a further 50% plummet […]

Related News

Despite the ongoing bearish action of the market, Ethereum is showing signs of strength in some areas. In a significant landmark, the leading altcoin has surpassed Bitcoin, the largest digital asset, in a key metric that has defined industry strength. Ethereum Is Dominating An Important Metric A recent report from Leon Waidmann, a market expert […]

Ethereum rides ahead on the crypto market’s most recent trend to the upside. As of press time, ETH, BTC, and larger cryptocurrencies show signs of recovery with potential for continuation in the short term, if they manage to break above their resistance levels. Related Reading | Ethereum Price Surges 30% Over Last Week Lows, Addresses Holding Over 0.1 ETH Reach New ATH As of press time, Ethereum (ETH) trades at $2,788 with a 6.5% profit in the last 24 hours. Data from Arcane Research indicates that Ethereum has seen its seventh 50% drawdown since its inception. The second crypto by....

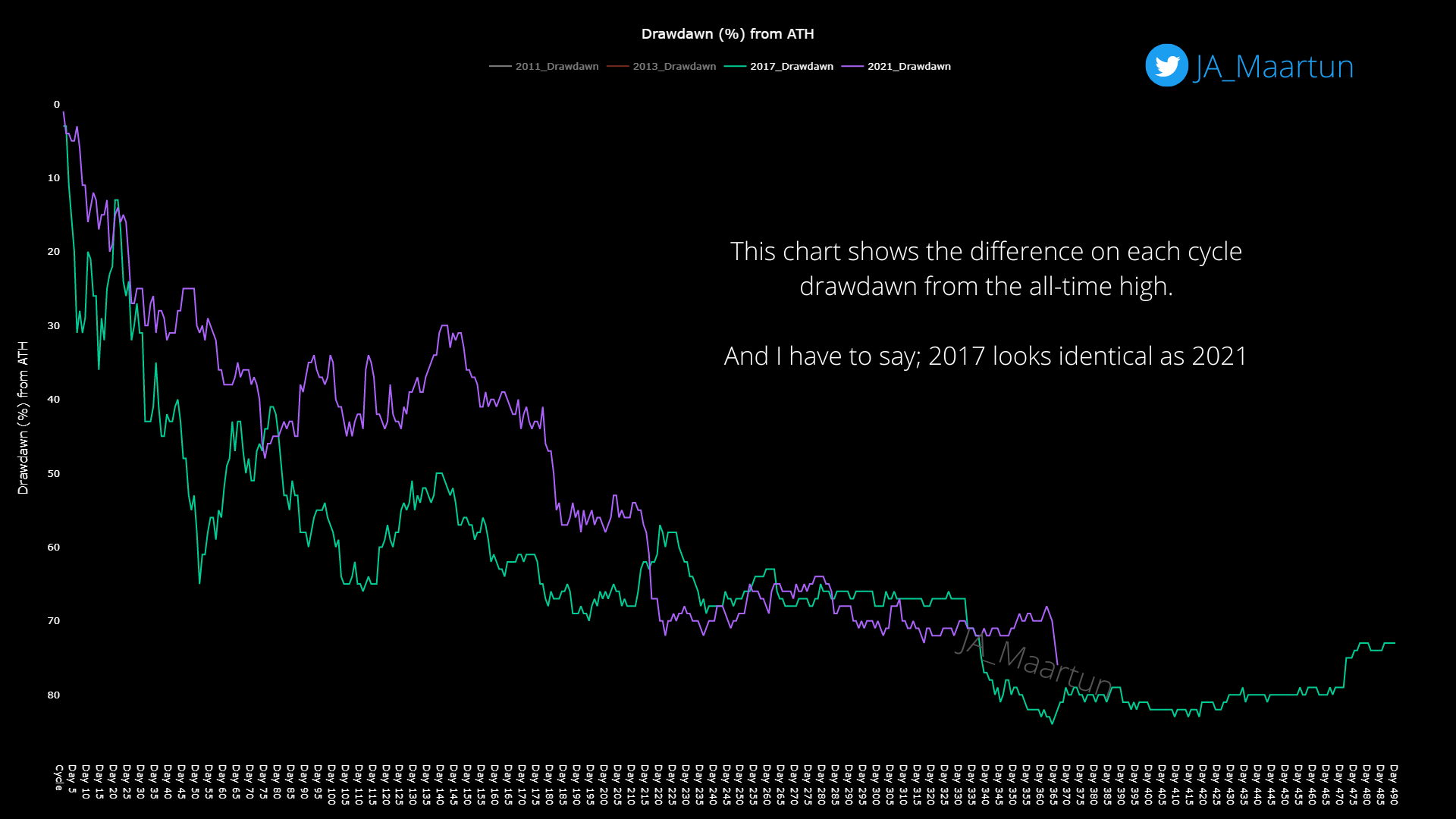

A quant has pointed out the similarities between the 2017 and 2021 Bitcoin cycles, something that could hint at how the rest of this bear market might play out. Both 2017 And 2021 Bitcoin Cycles Saw New Lows Around The 365-Day Mark Since The Top As explained by an analyst in a CryptoQuant post, the two cycles are more similar than one might expect them to be. The indicator of relevance here is the “drawdown from ATH,” which measures the percentage decrease in the price of Bitcoin following the all-time high during each cycle. Here is a chart that shows the trend in this metric....

An analyst on social media platform X has highlighted a crucial support level for PEPE, as the meme coin faces a significant drawdown from its recent highs. Based on historical price trends, the analyst noted that PEPE has consistently experienced an average drawdown of approximately 64% following each local peak. The ongoing correction has placed […]

The drawdown in bonds is not much less than bitcoin’s drawdown from its all-time high. Legacy finance is demonstrating to be just as volatile as bitcoin.