New Chainlink Addresses Hit Highest Levels Since January – LINK Network Growt...

Chainlink is trading at crucial demand levels after days of consolidation below the $20 mark, struggling to reclaim momentum amid broader market uncertainty. The entire crypto market has faced heightened volatility and instability following weeks of selling pressure. Investors remain on edge after Friday’s Bybit hack, which saw $1.5 billion worth of ETH stolen, further fueling market-wide fear and caution. Related Reading: Bitcoin Faces Serious Price Compression – What Happened Last Time Despite the uncertainty, Chainlink is showing signs of strength. Key data from Glassnode reveals that....

Related News

While the broader crypto market is currently trying to recover from the shock surrounding FTX and the accompanying fears of a contagion effect, Chainlink has recorded the highest price increase within the top-100 by market cap within the last 24 hours. At press time, the LINK price was up 6.2% from the previous day, trading at $8.71. Over the past seven days, Chainlink has even posting a whopping plus of around 13%. Trading volume has grown to $1.435 billion in the last 24 hours, up 161% from the previous day. Related Reading: Will Binance Oracle Hamper Chainlink Growth Amid The Bullish....

Chainlink (LINK) is proving to be remarkably resilient in a challenging market. The digital asset stays at about $16.64, but recently its network reached a noteworthy milestone when 2,298 new addresses entered the ecosystem, signifying the most major increase since January. Although LINK is always trying to breach the $20 pricing limit, this increase of activity suggests a rising adoption. Related Reading: Against The Tide: SEI Climbs 16% As Market Wobbles Post Bybit Hack Market Dynamics Present A Multifaceted Picture The trading patterns of LINK indicate a persistent struggle with the $18....

LINK could drop to nearly $4 by December 2022 given its failure to close above a key resistance level despite strong whale accumulation. Chainlink (LINK) returned to mimic the broader crypto market downtrend as its price fell alongside top coins Bitcoin (BTC) and Ether (ETH) on Nov. 8. LINK plunged by as much as 10% into the day to reach $8. While BTC and ETH slipped by approximately 6.5% and 9%. That contrasts with the trend witnessed on Nov. 7, wherein LINK rallied 14% to $9.25, its three-month high, while BTC and ETH dropped 1.5% and 0.5%, respectively.LINK/USD two-hour price chart.....

On-chain data shows the top 100 whales on the Chainlink network have again started accumulating the asset recently, retracing their earlier distribution. Top Chainlink Addresses Have Been Adding Since The Start Of November In a new post on X, on-chain analytics firm Santiment has discussed about the latest trend in the holdings of the top Chainlink addresses. Santiment defines “top addresses” as the 100 largest wallets on the network. Related Reading: Bitcoin, Ethereum Plunge Triggers Near-$600 Million Crypto Long Flush This category would naturally include the largest of....

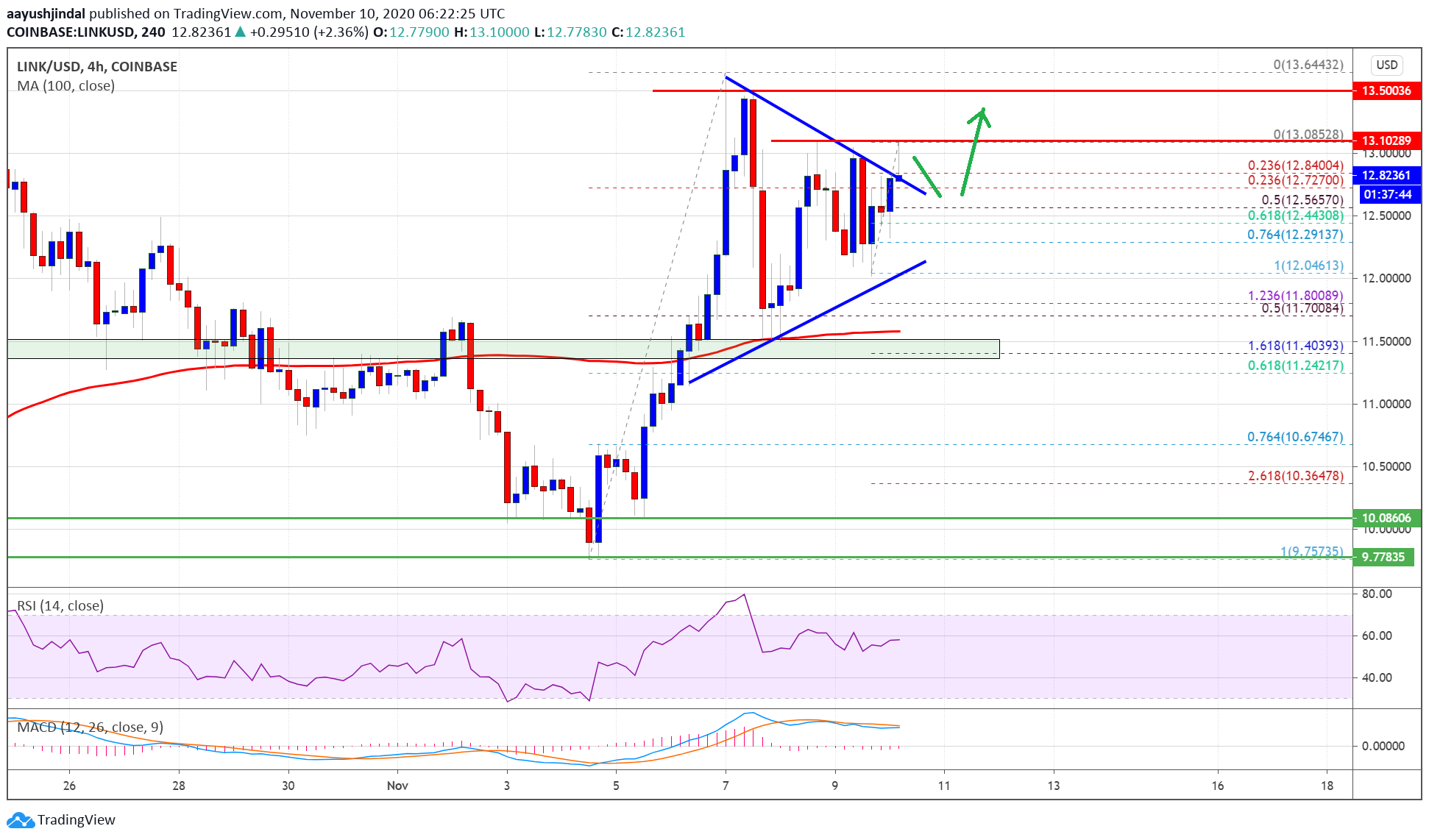

Chainlink (LINK) seems to be following a nice uptrend above $12.00. There are high chances of more gains once the bulls manage to clear the $13.10 and $13.50 resistance levels. Chainlink token price is trading in a positive zone above the $12.00 support against the US dollar. The price is facing hurdles near $13.10, but […]