High DeFi yields could threaten ETH 2.0 staking participation: ConsenSys

The latest Q3 DeFi report from ConsenSys expresses concern about DeFi’s threat to ETH 2.0 staking The rise of DeFi and high yielding liquidity provision opportunities could act as a barrier to participation in staking when ETH 2.0 Phase 0 finally launches according to a new report.The ConsenSys Q3 DeFi Report has taken a deep dive into emerging trends and warns that staking on Ethereum’s forthcoming Beacon Chain may be limited by better earning opportunities on decentralized finance protocols.ConsenSys believes it’s likely that Phase 0 of the ETH 2.0 upgrade will launch before the end of....

Related News

The DeFi economy continues to be built on Ethereum. A new report from ConsenSys highlights the extent to which the Ethereum network drives decentralized finance. The Ethereum (ETH) network continues to be a major driving force behind decentralized finance, signaling the continuation of a trend that began around mid-2020, according to a new quarterly DeFi report by ConsenSys. By the end of June 2021, 2.91 million unique Ethereum addresses had interacted with at least one DeFi protocol, representing 65% growth from the previous quarter. “As community driven education, simple user interfaces,....

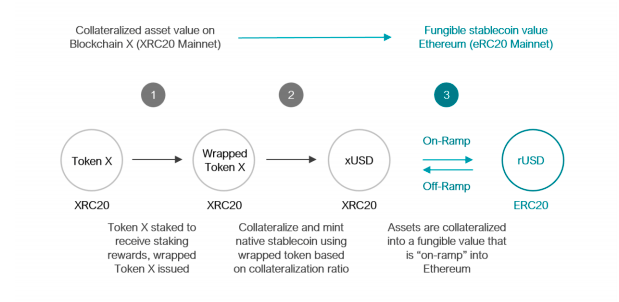

Participation in the DeFi and staking ecosystems has seen explosive growth over the last year, with the combined sectors currently accounting for over $50 billion in value. DeFi growth was predominantly fueled by the breakthrough success of Ethereum-based projects such as Aave, Compound, and Uniswap, utilizing ERC20 stablecoins like USDC and Dai to generate yield. […]

Staking is now available for Ethereum 2, but are the returns and conditions worth it? The long awaited deposit contract for Ethereum 2.0 has finally been deployed opening the doors to staking opportunities for ETH holders.Deposits began in earnest with over $1 million in ETH landing in the contract within the first half an hour according to observers like The Crypto Cactus.“$1,000,000 locked in $ETH 2.0 in 30 minutes … Just remember for anyone staking, one way bridge.I have sent across 32 ETH.”At the time of writing, around eight hours after the official announcement, just over 14,000 ETH....

Staking cryptocurrencies on proof-of-stake blockchain networks has become one of the popular methods to generate consistent returns on crypto. Whereas DeFi offers the potential for spectacular yields at very high risk, staking offers a more steady return of around 15% on average, according to the current numbers on stakingrewards.com. Still considerably higher than anything you’d […]

Lex Sokolin said that post-Merge, DeFi projects will have to compete with the returns offered by the core ETH protocol. As the Ethereum Merge draws near, many are speculating on its economic effects. To provide a clearer view to those who anticipate the major upgrade, Lex Sokolin, the head economist at ConsenSys, shared his insights in an interview with Cointelegraph. The expert discussed the effect of the EMerge on users, developers and businesses. Additionally, Sokolin also cleared up some misconceptions about the Merge and explained how the new development can have an impact on the....