Japan’s largest investment bank Nomura readies new crypto subsidiary

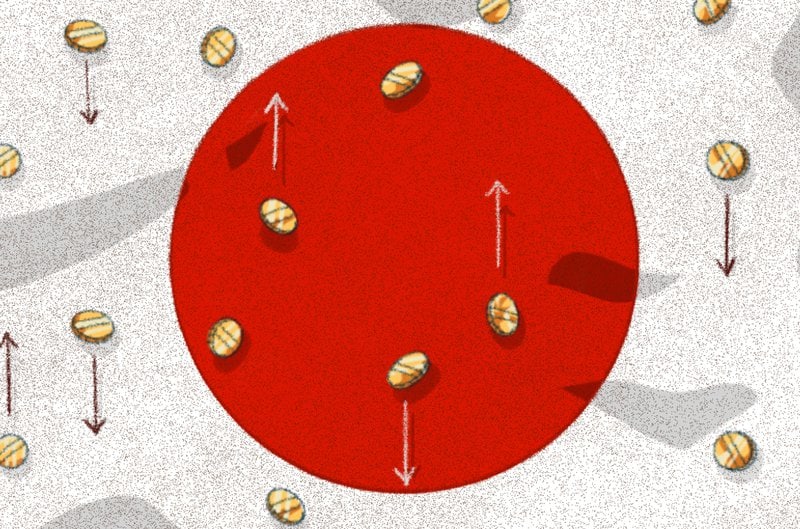

The leading Japanese bank plans on establishing a crypto subsidiary outside of Japan and will acquire about 100 personnel to work in the digital asset space. The largest investment bank in Japan, Nomura, is set to establish a new subsidiary company to help institutional clients invest in cryptocurrency and nonfungible tokens (NFTs).The Financial Times reported on Tuesday, May 17, that people with knowledge of Nomura’s plans said the firm will bring together several crypto services under one single company with a staff of about 100 people by 2023.Nomura is one of Japan’s ten largest banks....

Related News

Leading Japanese Investment bank, Nomura has decided to launch a crypto subsidiary. This new unit by Nomura shall be operated outside of Japan with a team of 100 personnel by the end of next year. This move is primarily concerned with facilitating institutional clients could invest in cryptocurrencies and non-fungible tokens. The report from Financial […]

Japan’s largest investment banking broker is set to launch a subsidiary focused on institutional bitcoin and cryptocurrency products.

“Staying at the forefront of digital innovation is a key priority for Nomura,” said president and group CEO of Nomura Holdings Kentaro Okuda. Nomura, one of the largest investment banks in Japan, has established a venture capital arm aimed at investing in companies focusing on crypto and blockchain.In a Wednesday announcement, Nomura said the business, named Laser Digital, will “provide new value in the area of digital assets” for clients under the Switzerland-based holding company Laser Digital Holdings AG. The investment bank said it chose Switzerland based on its “robust regulatory....

The joint venture by Japan’s largest investment bank Nomura, CoinShares and Ledger will offer institutional services for bitcoin and other digital assets.

Nomura Holdings began trading bitcoin derivative contracts this week including options and futures citing increased institutional demand.