Grayscale may jumpstart the next phase of the Bitcoin bull run tomorrow

A release of funds from lock-up traditionally heralds the start of price upside and ends consolidatory phases, data shows. Bitcoin (BTC) may have traded sideways for much of last month thanks to Grayscale, but the status quo will soon change.According to data from on-chain analytics resource CryptoQuant, the price premium of the Grayscale Bitcoin Trust (GBTC) just hit its lowest since April 2019.Grayscale lock-up ends WednesdayGrayscale has made the headlines frequently this year thanks to record BTC purchases and record demand, but despite the inflows, BTC/USD has not continued to gain.As....

Related News

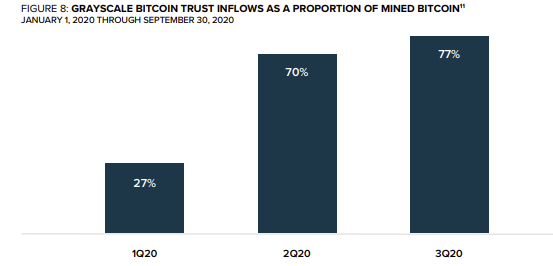

Bitcoin (BTC) traders and investors may face a supply deficit as major firms increase their stockpiling of the cryptocurrency, according to Dan Tapeiro of New York-based global macro fund DTAP Capital. “SHORTAGES of Bitcoin [is] possible,” the founder tweeted on Thursday. “Barry Silbert’s Grayscale Investments Trust is eating up BTC like there is no tomorrow. If 77 percent of all newly mined turns into 110 percent, then it’s lights out.” The statement came after Grayscale released […]

Crypto analyst KrissPax has revealed that the Dogecoin price has completed the first part of its bull phase, similar to what happened in the 2021 bull run. The analyst further provided insights into what is to come next for Dogecoin. Dogecoin Price Completes First Bull Phase In an X post, KrissPax mentioned that the Dogecoin price has completed its first up-phase this bull cycle, similar to the 2021 and 2017 bull runs. He noted that those previous cycles recorded two additional up-phases with huge percentage gains. Based on this, Dogecoin could record two more up-phases before its price....

Ethereum upgrades could jumpstart a $40 billion staking industry, according to a JP Morgan report. JP Morgan estimates that the staking industry is currently worth $9 billion and that this number could balloon to $40 billion by 2025. The report speculates that the launch of ETH 2.0 would lead to more adoption of the coin […]

Grayscale Investments is shutting down its Grayscale XRP Trust and liquidating its XRP holdings in order to distribute cash proceeds to the trust’s shareholders. The firm cited difficulty in converting XRP into U.S. dollars following the lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Ripple. Grayscale Axes XRP Trust Grayscale Investments announced Wednesday that it is commencing the “dissolution of Grayscale XRP Trust.” The company detailed that on Dec. 22, the U.S. Securities and Exchange Commission (SEC) decided “to file a federal court....

The Grayscale Investment manager undertakes another phase of balancing its Grayscale DeFi fund. This round of rebalance inculcate the adjustment of the project’s Digital Large Cap Funds. This move marks its second balancing process after its launch in July 2021. An announcement on January 3 revealed the in-depth adjustments to Grayscale’s two funds. The first rebalancing employed the Flexa payment network’s native collateral coin. Related Reading | Could Kazakhstan Turmoil Cause Another Bitcoin Hash Crash? Hence, Grayscale DeFi Fund’s weighting was rebalanced....