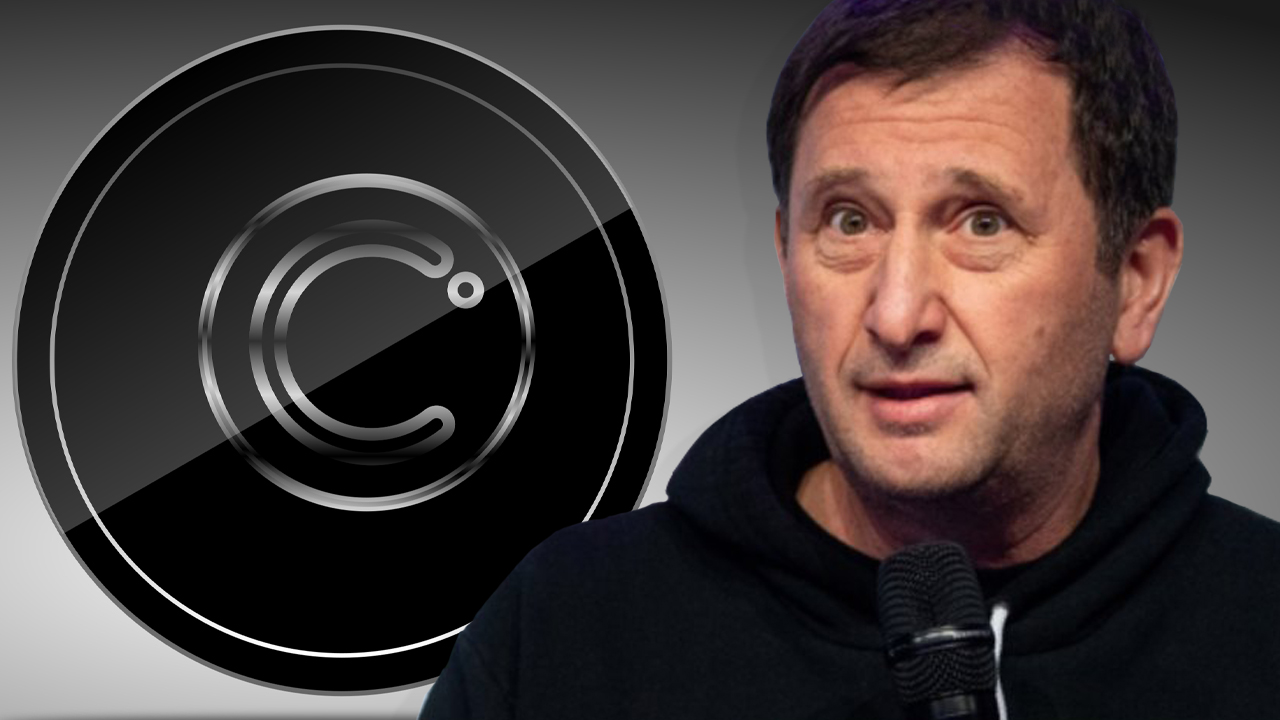

Celsius Network’s Bankruptcy Chapter Closes, Signals Revival For Crypto Lender

Failed crypto lender Celsius Network has received bankruptcy court approval for its plan to transform into a creditor-owned Bitcoin mining firm, as reported by Bloomberg. The approval is part of a wider proposal aimed at repaying customers who have frozen their accounts for over a year. Celsius Network’s Path To Recovery US Bankruptcy Judge Martin […]

Related News

Another crypto lender, Celsius Network, has sought bankruptcy protection in the U.S. “Customer claims will be addressed through the Chapter 11 process,” the company said. Two other crypto firms recently filed for bankruptcy protection: Voyager Digital and Three Arrows Capital (3AC). Celsius Follows Voyager, Files for Chapter 11 Bankruptcy Crypto lender Celsius Network announced Wednesday that it has “filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the Southern District of New....

Celsius Network Ltd., the crypto lender that filed for Chapter 11 bankruptcy protection on July 13, is looking to release roughly $50 million worth of crypto assets to Celsius custody account holders. Reportedly, the Celsius custody accounts did not participate in the earn and borrow program. A court hearing concerning the matter of relief will take place on October 6.

Celsius Files Debtors’ Motion to ‘Reopen Withdrawals for Certain Customers’

Court documents show that Celsius is looking to release roughly $50 million in funds to select customers. The....

Crypto lender Celsius Network, one of the biggest in the world, has filed for Chapter 11 bankruptcy protection, joining a string of crypto asset organizations that have restructured in response to a severe sell-off in cryptocurrencies this year. The news is the latest high-profile crypto bankruptcy as crypto values collapse, making Celsius the latest victim […]

Ever since Celsius paused withdrawals on June 12, the company has been the focus of attention due to the lender’s financial hardships. A month later, Celsius filed for bankruptcy in the U.S. by leveraging the Chapter 11 process. Two days after the bankruptcy filing, a report disclosed that two people familiar with the matter allege that the private lending platform that owes Celsius $439 million is Equitiesfirst.

FT Sources Allege Private Lending Platform That Owes Celsius $439M Is Equitiesfirst

During the last few weeks, bankruptcies, liquidations, and insolvencies have....

During the last 30 days, the Celsius Network’s native token CEL increased in value by over 140% against the U.S. dollar. On July 13, just before the lending company filed for Chapter 11 bankruptcy, CEL was exchanging hands for $0.961 per unit. Following the news that the company filed for bankruptcy protection, the native crypto asset dropped 58% to a low of $0.40 on the same day. CEL has managed to climb back from the drop as the digital currency is currently swapping for prices between $0.69 to $0.73 per coin on July 14.

So-Called CEL Short Squeeze Attempt Slips, Token Drops....