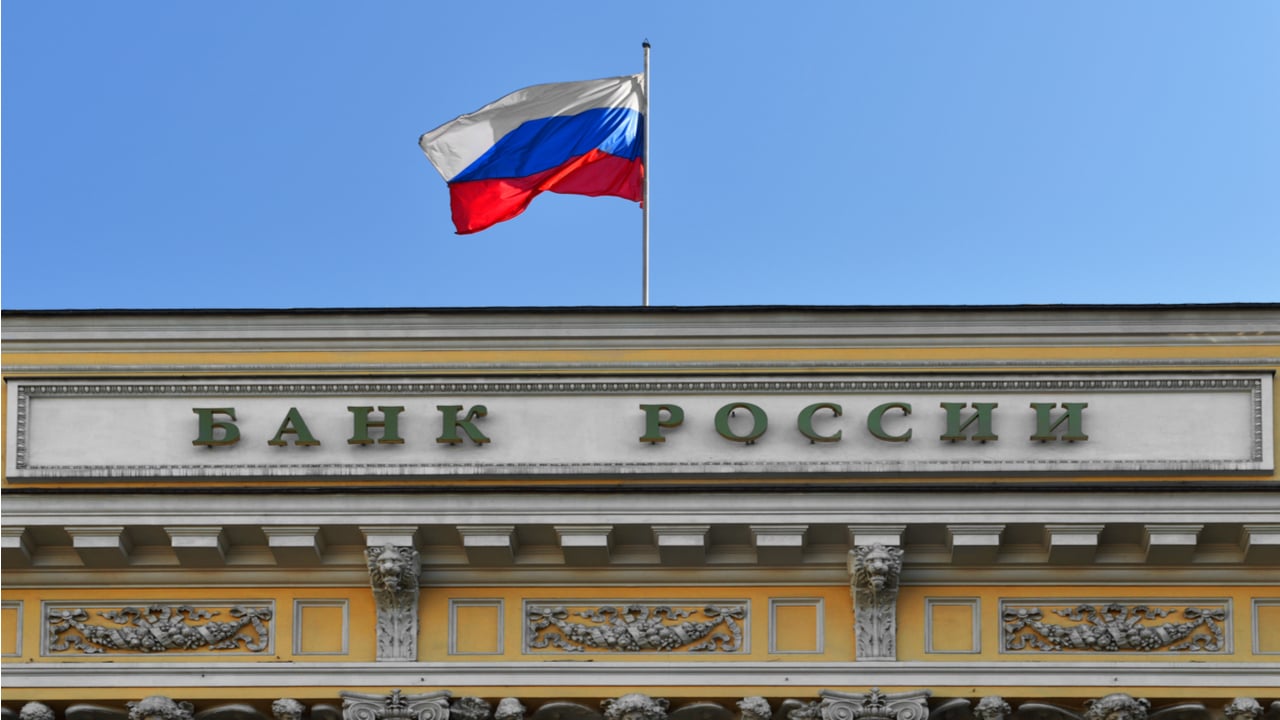

Russia's Central Bank tries to stem the tide of rubles leaving bank accounts

With the declared intent of reducing risk, the moves look to cut new investors off from opportunities to get out of the ruble. Beginning investors in Russia will soon find themselves with fewer options to beat plummeting interest rates offered at Russian savings accounts. In addition to the investors themselves, the big losers are likely to be trading apps like Robinhood, which aim at first-timers.Per a Dec. 30 announcement, the Central Bank of Russia is working to get securities trading platforms to toe the line on "risk-reduction" measures first passed in July. In the latest....

Related News

The Bank of Russia has become the third central bank this year targeted by external attacks, losing over $31 mln or 2 bln rubles from its correspondent bank accounts. A correspondent bank account, also known as a Vostro account, is created by banks to settle transactions on behalf of its clients or partner financial institutions. In most cases, a correspondent bank account holds the funds of top-tier clients or high profile investors of the central bank. Inability to prevent hacking attacks. In December, Bank of Russia Executive Ekaterina Gelbova, an official in the central bank’s press....

Russia’s central bank wants to limit the amount of cryptos and digital rights acquired by non-professional investors. The central bank of Russia proposed to set limits on annual cryptocurrency investments by non-professional investors.The Bank of Russia suggested that unqualified investors in Russia should not be allowed to invest more than 600,000 Russian rubles ($7,800) in digital assets per year.The authority laid out the new proposal in an explanatory note referring to Russia’s newly passed crypto law, “On Digital Financial Assets,” or DFA. The official statement stipulates that the....

The central bank of Russia has advised commercial banks on how to identify and block cards and wallet accounts used by shady businesses. Along with illegal forex dealers and financial pyramids, the regulator has also listed crypto exchangers as suspicious entities. New AML Recommendations by Bank of Russia Target Cryptocurrency Exchangers Russia’s central bank has issued a set of criteria that banks can use to identify cards and e-wallets used by companies operating in the shadow economy, Forklog reported. According to the monetary authority, these include not only illegal forex....

Amid the Ukraine-Russia conflict, the Russian ruble has managed to rebound despite the strict sanctions imposed against the Russian Federation. The country’s central bank has taken a few steps to protect the nation’s currency as the Bank of Russia revealed a fixed price for gold and rubles. Furthermore, after pegging the fiat currency to gold, on Friday Russia’s central bank announced a surprise interest rate cut that starts Monday.

EU Leaders and Western Allies Create Stricter Sanctions Amid Ruble Rebound

At the end of February, after the conflict started....

Cryptocurrency transactions of more than 600,000 rubles (roughly $8,000) will have to be declared or be considered a criminal act. The government and central bank in Russia have reached an agreement on how to regulate cryptocurrencies, according to a Tuesday announcement.Russia's government and central bank are now working on a draft law that will define crypto as an "analogue of currencies" rather than digital financial assets, set to be launched on Feb. 18. Cryptocurrencies would function in the legal industry only if they have complete identification through the banking system or....