Short the dollar: How Goldman's bearish stance uplifts Bitcoin Q4 sentiment

Analysts at Goldman Sachs are bearish on the U.S. dollar in the near term. Goldman Sachs, the $71.4 billion investment bank, is reportedly bearish on the U.S. dollar. For Bitcoin (BTC), which has recently rallied above the dreaded $11,100 level, this could serve as a potential catalyst.Bitcoin is heading into the last two months of the year with significant uncertainty. But if the dollar continues to slump, it could buoy the momentum of BTC and gold in the fourth quarter.The daily chart of Bitcoin. Source: TradingView.comWhy Goldman Sachs is not optimistic on the dollarZach Pandl, the....

Related News

Large institutional investors have since been turning their attention to shorter-term investments. This tracks with retail sentiment following the price decline of bitcoin from the $30,000 territory. This has put the digital asset in a perilous position, and despite the recent recovery that saw BTC touch $25,000, bearish sentiment continues to be the order of the day, causing the inflows into short bitcoin to balloon over this time. Short Bitcoin Inflows Grow Short bitcoin inflows have been on the rise for a couple of months now. When the ProShares’ short bitcoin ETF had first launched....

Andrew Left, a controversial figure behind Citron Research, renowned for his critical stance on crypto and often bearish stance on various high-profile stocks, has found himself on the other side of the law. Recently charged by the US Securities and Exchange Commission (SEC), Left is accused of orchestrating a deceptive $20 million scheme that manipulated […]

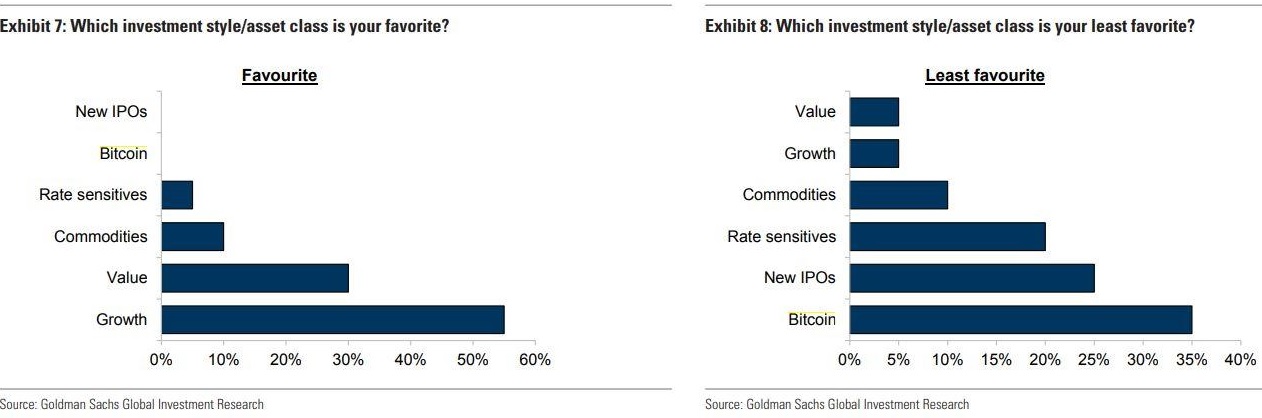

Bitcoin (BTC) is the least favored investment among chief investment officers (CIOs), according to a recent survey by Goldman Sachs. Goldman Sachs Survey Reveals Negative Sentiment Two roundtable discussions for chief investment officers of hedge funds were recently hosted by investment bank Goldman Sachs. According to the bank, bitcoin is their least preferred investment. The […]

Per a report from CNBC, banking giant Goldman Sachs has become the first U.S. bank to complete a cash-settled Bitcoin over-the-counter (OTC) transaction. The financial institution will officially announce this achievement in the short term, said the source cited by the mainstream media. Related Reading | Goldman Sachs Will Now Offer Its Clients Ethereum Funds Via […]

Several multi-billion dollar banks including Goldman Sachs, Santander and Morgan Stanley have officially left the R3 blockchain consortium, an organization established by R3CEV to focus on the development of industry standard blockchain-based systems. R3 CEV Shake Up Sees Member Banks Leave Consortium. A few days after Goldman Sachs’ bailout was....