JPMorgan Survey: 49% of Institutional Investors Agree Cryptocurrency Is ‘Rat ...

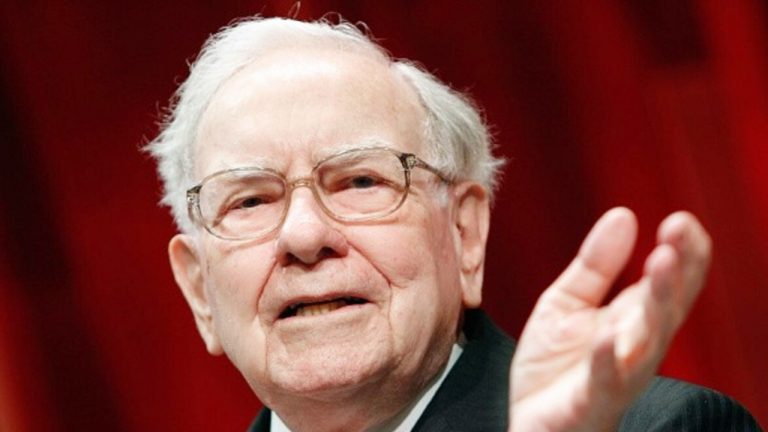

Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison Squared’ JPMorgan released the results of a survey it conducted at the firm’s 24th Macro, Quantitative & Derivatives Conference Tuesday. The event took place on June 11; it was attended by some 3,000....

Related News

Global investment bank JPMorgan says institutional investors are returning to bitcoin, seeing the cryptocurrency as a better hedge than gold. The firm’s analysts describe three key drivers boosting the price of bitcoin in recent weeks, including assurances that U.S. policymakers will not ban cryptocurrencies.

JPMorgan Sees Renewed Interest in Bitcoin

JPMorgan published a research note Thursday stating that institutional investors are returning to bitcoin. Citing the trend of money flowing out of gold into BTC, the firm’s analysts wrote:

Institutional investors....

A poll has found 22% of institutional investors are likely to buy cryptocurrency in the future. A survey carried out by JPMorgan found that one in five institutional investors at firms that don't currently trade in cryptocurrency believe their companies are likely to do so in future.The survey of more than 3,400 investors representing 1,500 institutions, found that 11% of respondents work at firms that trade or invest in crypto, while 89% do not.Promisingly however, twice as many institutions appear likely to invest into crypto ashan those who have already taken the plunge, signalling....

A survey by Nickel Digital Asset Management shows that 82% of institutional investors and wealth managers are planning to increase their cryptocurrency exposure between now and 2023. The survey reportedly asked institutional investors and wealth managers from the U.S., U.K., France, Germany, and the UAE who currently have exposure to cryptocurrencies and digital assets about their crypto investment strategies. It was conducted between May and June. According to the results, 82% of respondents expect to increase their crypto exposure between now and 2023. 40% said they will dramatically....

JPMorgan has highlighted evidence of institutional demand for bitcoin and investors moving from gold exchange-traded funds (ETFs) to the cryptocurrency. The firm points out that bitcoin demand is driven not only by younger retail investors but also by institutional investors, such as family offices and asset managers. Gold ETF Investors Moving to Bitcoin JPMorgan’s Global Markets Strategy team released a report Friday that discusses bitcoin. It also compares the flow trajectories for Grayscale Bitcoin Trust (GBTC) and gold exchange-traded funds (ETFs). The report reads: Corporate....

A recent survey from Fidelity shows 58% of institutional investors already own cryptocurrency. Related Reading: By The Numbers: Comparing Bitcoin Volatility With Nasdaq And S&P500 Institutional Investor Presence In Crypto Sector Continues To See Growth This Year As per data from an institutional investor digital assets study by Fidelity, digital asset ownership among these investors […]