Bitcoin UTXO P/L Ratio Hits 50.2 – A 30-Point Drop Could Signal the End Of Th...

Bitcoin is at a pivotal moment, with bulls struggling to reclaim prices above $85K and bears failing to push BTC below $80K. This indecision in the market has led to growing bearish sentiment as many investors speculate whether the bull cycle is coming to an end. Related Reading: BTC Bearish Momentum Fades – Short Sellers Retreat […]

Related News

After briefly trading above $59,000 in the early hours of Tuesday, Bitcoin price has now seen a significant retracement, dropping below the $58,000 price mark once again. However, despite this struggle to rally, a CryptoQuant analyst named Kripto Mevsimi recently shared an intriguing observation regarding Bitcoin price on the CryptoQuant QuickTake platform. Related Reading: Bitcoin’s Breakout Blueprint: Analyst Reveals Roadmap For Imminent Surge Bitcoin’s Sharpe Ratio Hits New Lows: Bullish Signal Or A Warning? According to the analyst, Bitcoin’s short-term Sharpe ratio has....

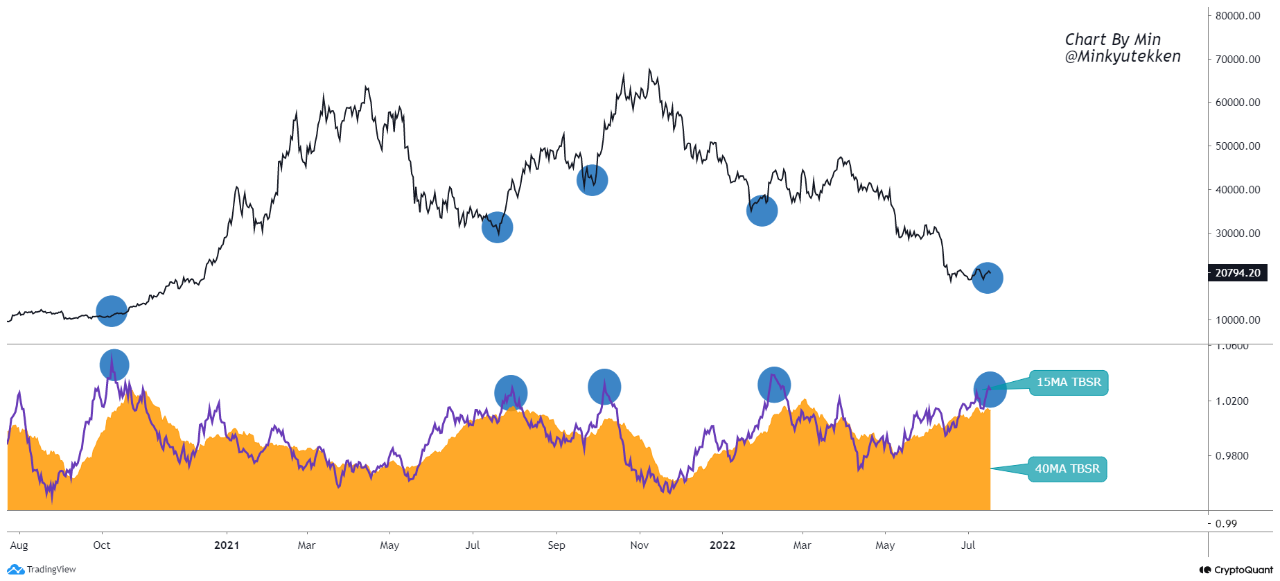

On-chain data shows the Bitcoin taker buy/sell ratio started showing a green signal shortly before the surge above $22k. Bitcoin Taker Buy/Sell Ratio Is Now Showing a “Buy” Signal As pointed out by an analyst in a CryptoQuant post, the BTC taker buy/sell ratio suggested a bounce not too long before the rally today. The […]

Andreas Antonopoulos published an interesting article last August on the effect segregated witness (Segwit) may have on the unspent transaction output set (UTXO set). I didn’t agree with the conclusions in that article, and thought about writing about it back in August. Which I didn’t. Now that the article has sailed up as hot stuff again on the....

Bitcoin faced intense selling pressure following renewed geopolitical tensions in the Middle East, as Israel launched a preemptive strike on Iran. The news sent shockwaves through global financial markets, triggering a wave of risk-off sentiment and sharp liquidations across major crypto exchanges. BTC dropped over 5% in the aftermath, briefly dipping below key moving averages […]

On-chain data shows the Bitcoin taker buy sell ratio has surged up to a high not seen since almost two years ago. Bitcoin Taker Buy Sell Ratio Observes Uplift In Recent Days As pointed out by an analyst in a CryptoQuant post, the taker buy sell ratio is now at its highest value in 636 days. The “taker buy sell ratio,” as its name suggests, is an indicator that measures the ratio between the taker buy volumes and the taker sell volumes. When the value of this metric is greater than one, it means the long volume is overwhelming the short volume right now. Such a trend suggests....