Short-Term Panic For Bitcoin Likely After Upcoming Fed Rate Cut, Market Exper...

With the Federal Reserve’s rate cut only a few days away, a crypto expert has shed light on the aftermath of Bitcoin‘s performance once the interest rate is decreased, particularly on September 18, which has been a major discussion within the general community. Bitcoin’s Short-Term Panic Is A “High Probability” In a cautionary post on […]

Related News

Bitcoin is still battling with the recent market crash that occurred last weekend, which has caused the leading cryptocurrency asset to enter a bearish phase. Given the sharp pullback from its all-time high of $126,000, a wave of uncertainty and fear has been observed among BTC investors, especially short-term holders. Short-Term Bitcoin Holders Struggling With […]

Former BitMEX CEO Arthur Hayes thinks the upcoming interest rate cuts by the US Federal Reserve (Fed) could ignite a short-term crypto market crash. Fed Is Doing A Colossal Mistake, Hayes Says Delivering a presentation titled ‘Thoughts on Macroeconomic Current Events’, at the Token2049 event in Singapore on September 18, Hayes indicated he is not […]

Weak hands are panic selling, but long-term BTC holders have seen it all before. While new entrants to Bitcoin markets have been panic selling at a loss, the recent market slide has not vexed the old hands.Heavy selling in response to hints from Elon Musk that Tesla may soon sell its BTC stash saw Bitcoin prices tumble to their lowest levels in 20 weeks as the markets found support near $42,000 on Monday, May 17.According to on-chain analytics provider, Glassnode, the crash predominantly saw newer traders exiting from their positions at a loss while long-term hodlers stood their....

Market participants are eagerly awaiting the upcoming Federal Open Market Committee (FOMC) meeting, which is expected to play a crucial role in shaping the short-term outlook for Bitcoin and other digital assets. The spotlight is on the potential for an interest rate cut, and many traders and investors have been speculating about it for some […]

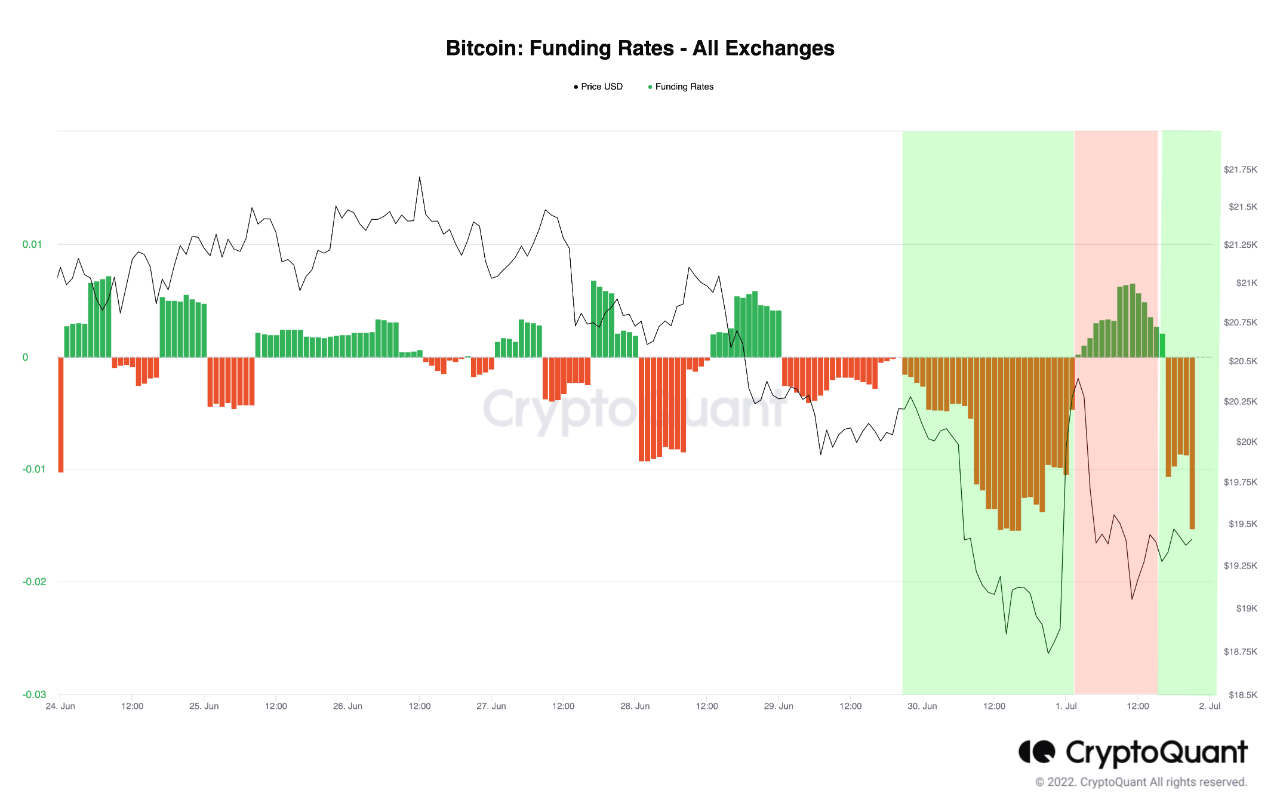

On-chain data shows Bitcoin funding rates have sunk into deep negative values, something that could pave way for a short squeeze in the market. Bitcoin All Exchanges Funding Rate Has A Red Value Right Now As pointed out by an analyst in a CryptoQuant post, BTC may see a slight uplift in the short term […]