Crypto Market In Jeopardy? Rising Stablecoins Dominance Signals Instability

The general cryptocurrency market has been quite unpleasant as major crypto assets have seen extended negative trends, fueling uncertainty within the sector. With the recent upsurge in the stablecoins dominance, which is considered a negative sign for cryptocurrencies, the broader ecosystem could be poised for additional pessimistic behavior. Stablecoin Dominance Growth Poses Risk To Cryptocurrencies […]

Related News

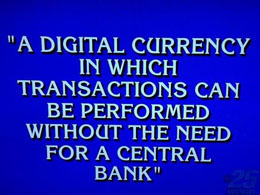

People around the world recognize this white font against the blue background. Jeopardy! Jeopardy! is currently in its 30th season and has won just as many Daytime Emmy Awards since its inception in America all those decades ago. Nowadays, the American family experience of crowding around the "telly" to watch Alex Trebek has been passed on to the next generation with Jeopardy's Kids Week, and around the world with many regional syndicated versions of Jeopardy. Jeopardy has been voted by TV Guide to be the number one Game show of all time... This must mean that Jeopardy! is an even better....

Bitcoin dominance is soaring as the overall crypto market bleeds. The current macro conditions have forced investors to take refuge in BTC and stablecoins. Related Reading | Glassnode: Bitcoin Long-Term Holders Own 90% Of Supply In Profit Bitcoin dominance has been on the rise since May this year after moving sideways in previous months. The metric, used to measure the percentage of the crypto market cap formed by Bitcoin, stands at 47% approaching levels last seen in November 2021. During this period, BTC’s price took a final move to the upside and reached $69,000 before an overall....

Bitcoin’s dominance over the entire market has continued to increase steadily over the past few weeks, even as many Bitcoin and many other cryptocurrencies started the week on a negative note. According to data from CoinMarketCap, Bitcoin’s dominance is now at 60.4%, its highest level since the 2021 bull market. This increasing Bitcoin dominance has […]

With the crypto market crash has come a renewed interest in the cover that stablecoins provide investors. As a result of this, crypto investors had flocked to stablecoins such as USDT, BUSD, USDC, etc, for this exact reason. What followed was fierce competition between these stables as they pulled for more market dominance. Evidently, USDT […]

BTC dominance can directly affect altcoins by displaying the market’s trading volume in BTC vs. altcoins. Bitcoin (BTC) is both the first and the most prominent cryptocurrency in the world when it comes to market capitalization as well as trading volume. These factors are quite significant, considering that all cryptocurrencies trade against Bitcoin and Bitcoin’s dominance can actually serve as a valuable indicator when trading all different types of cryptocurrencies.This post will offer insight on how to trade cryptocurrency while utilizing the Bitcoin dominance indicator and how to read....