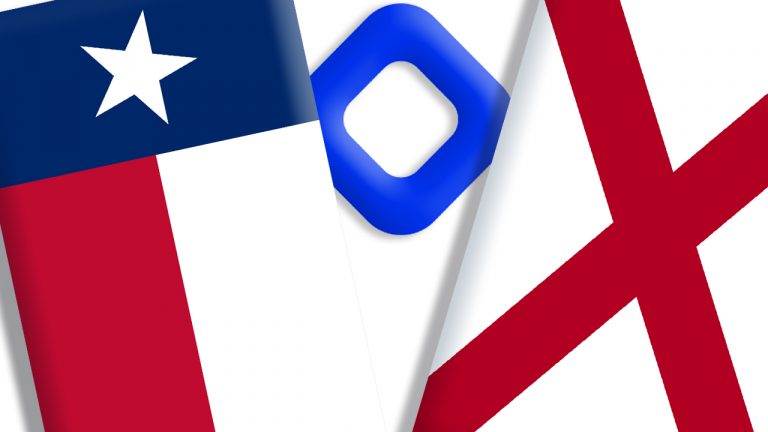

Three US States Going After BlockFi In Regulatory Crackdown

New Jersey, Texas, and Alabama have individual state regulators issuing concerns that New Jersey-based DeFi firm, BlockFi, is offering unregistered securities. Regulators seem to particularly point to BlockFi’s Interest Account (BIA), which offers rates that consumers are now becoming accustomed to in DeFi – but that have blown traditional banking rates out of the water. The ‘Unusual Three’ Crypto in it’s relatively early emergence in discussions around regulation and broader adoption, has largely been considered a somewhat bipartisan topic. Which makes the....

Related News

Several states’ securities regulators have been furrowing their brows with regards to BlockFi Interest Accounts (BIA) lately. This includes BlockFi’s home state of New Jersey, who was arguably one of the more strict in their action towards the firm; New Jersey issued a cease and desist that instructed the firm to stop offering their BIA product before the end of this week. Now, securities regulators in New Jersey have pumped the brakes for a moment, extending that deadline. However, in the meantime, Vermont has joined the ranks of New Jersey, Texas, and Alabama for issuing....

The crypto lender Blockfi is now dealing with regulators from five states as Kentucky has joined the fray against the firm’s Blockfi Interest Accounts (BIAs). On July 30, Blockfi shared a statement on Twitter that explained the Kentucky Department of Financial Institutions (DFI) has sent the company an order that aims to ban new BIA accounts. Blockfi Now Has Problems With Regulators From 5 States The New York City-based cryptocurrency finance company Blockfi was founded in 2017 by co-founders Zac Prince and Lori Marquez. The firm is a cryptocurrency lending firm that offers....

The crypto lending giant BlockFi is facing regulatory scrutiny from a handful of states in America ahead of a proposed public listing. BlockFi’s eventful 2021 has continued in the second half of the year as state regulators in the United States began to crack down on the company’s crypto interest-bearing accounts. The move likely marks another operational headache for the non-bank lender in a year of substantial fundraises and public listing plans interspaced by controversy and technical blunders.State regulators going after crypto interest-bearing accounts may also stand as a bellwether....

Fresh off the heels of Blockfi’s issues with the New Jersey Bureau of Securities, the company is now having problems in the state of Alabama. The director of the Alabama Securities Commission (ASC), Joseph Borg, explained on July 21 that he issued a show cause to the firm. Borg wants Blockfi to explain why the ASC should not copy New Jersey’s cease and desist as Alabama regulators also seem to believe they might be selling unregistered securities. Blockfi has received another order from the Texas State Securities (TSS) Board for the same reason. Alabama....

Wu also pitched Singapore, where his current company Matrixport is based, as a strong contender to serve as "a hub for crypto innovations." Jihan Wu, crypto billionaire and the co-founder and ex-CEO of Bitcoin (BTC) mining giant Bitmain, believes that the current wave of regulatory interventions in the crypto industry may be “a good thing in the long term.”Speaking to CNBC during the Asia Tech x Singapore conference this week, Wu noted that the sector had already grown almost to “a trillion dollar market cap industry,” with over 10% of United States citizens having some involvement with....