Quant Explains Why This Bitcoin Bear Market Is Different From Others

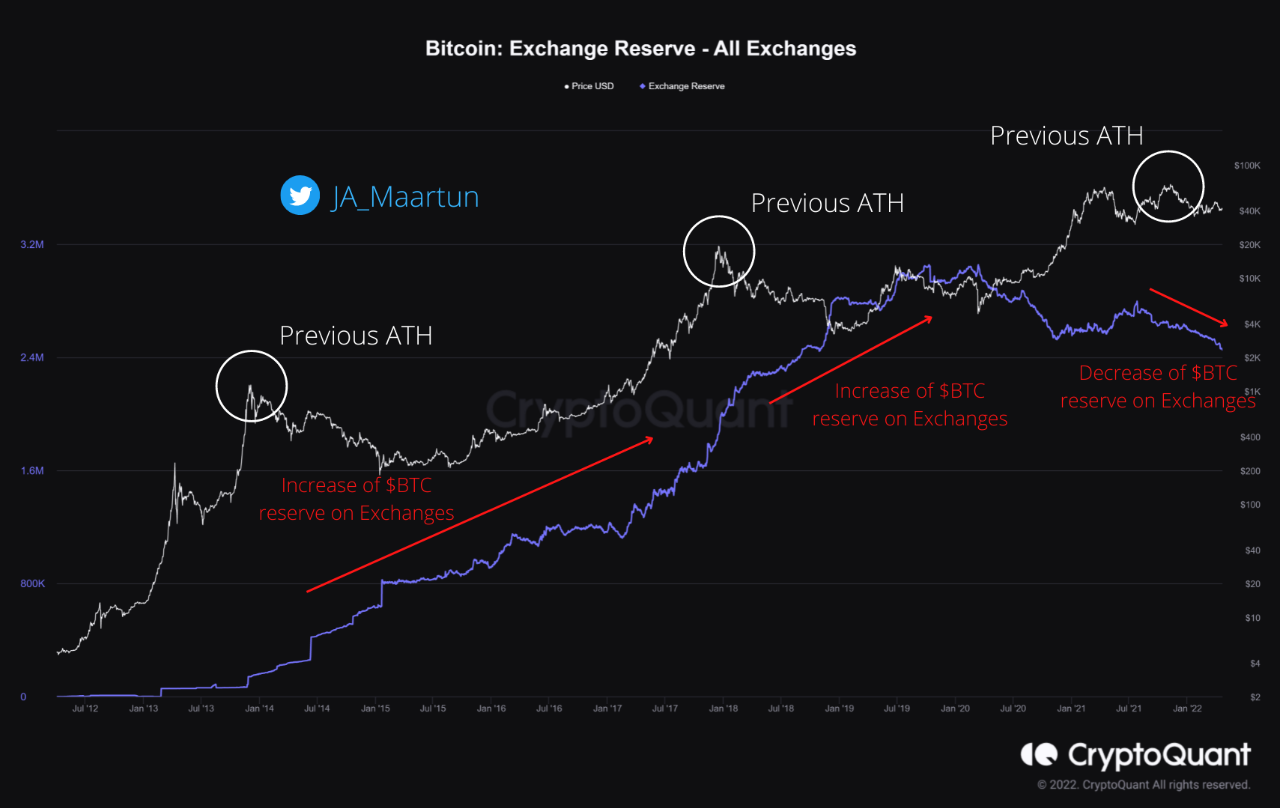

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

Related News

Interoperability enabling network Quant has gained 10% in the last 24 hours amidst the general crypto bear market. The token is inexorably climbing up the price charts while other tokens struggle to keep their heads above water. The crypto is steadily gaining, testing new highs after its yearly low in June when its price dipped below $50. The Quant blockchain was a project geared toward solving the issue of interaction among multiple blockchains. Since its inception in 2018, the token began an upward climb from below $1, culminating in an all-time high just below $400. This unprecedented....

While the broader crypto market continues to linger in bear territory, one cryptocurrency continues its steep climb undeterred and now occupies rank #27 in the top cryptocurrencies by market capitalization. Related Reading: TOP 5 Cryptos To Watch This Week – BNB, BTC, ETH, QNT, LEO Quant (QNT) was trading at half its price exactly one month ago. Today, QNT broke through the $200 mark for the first time since November last year and is currently writing its fifth weekly green candle, according to TradingView. At the time of writing, Quant is trading at $216. Apparently, the QNT is currently....

Quant (QNT) has been a shining star in the cryptocurrency market recently, posting a remarkable 28% gain in just seven days. As the price of Quant (QNT) climbs to new heights, savvy investors are beginning to look for new opportunities with even greater profit potential. Enter Mpeppe (MPEPE), a meme coin that has been gaining […]

A quant has explained how the Bitcoin exchange reserve on-chain indicator differs between the current crash and that of May’s. After Spiking Ahead Of The Crash, Bitcoin Exchange Reserves Have Resumed Downtrend As explained by an analyst in a CryptoQuant post, the current trend in BTC exchange reserves is quite different from when the crypto […]

A quant has explained how the movement of whales differed between before and after the Ethereum merge went live. Ethereum Funding Rates Reached An All-Time Low Just Before The Merge As pointed out by an analyst in a CryptoQuant post, a lot of ETH investors bet on the price going down around the merge’s completion. The relevant indicator here is the “funding rate,” which measures the periodic fee that perpetual futures contract traders exchange between each other. When the value of this metric is positive, it means long investors are paying a premium to the short holders....