Bitcoin Monthly Stats: Cost Basis, Long-Term Holders, And The Cyclical Bottom

In this month’s The Bitcoin Monthly, ARK Invest focused on Ethereum and the Merge. As a side dish, they did publish some premium and review-worthy stats that we’re about to cover. Never mind the market, the Bitcoin network keeps producing block after block regardless. The stats that this whole activity produces can be critical in understanding the market, though. Related Reading: WATCH: Waiting On The Bitcoin Monthly: Will Crypto Sink Or Soar? BTCUSD August 31, 2022 That’s where ARK Invest’s The Bitcoin Monthly comes in. The publication defines itself as “an “earnings report”....

Related News

ARK argues that bearish continuation has limited room left to run, as on-chain indicators bottom out. Bitcoin (BTC) has a “neutral to positive” outlook despite staying below $20,000, according to ARK Investment Management.In its latest "Bitcoin Monthly" report, the American asset management giant flagged signs that BTC price action is close to bottoming.Wood: "We're waiting for more capitulation signals"One of Bitcoin’s most vocal supporters, ARK and CEO, Cathie Wood, have stuck with BTC exposure as the market continues to fall from all-time highs.The latest Bitcoin Monthly release....

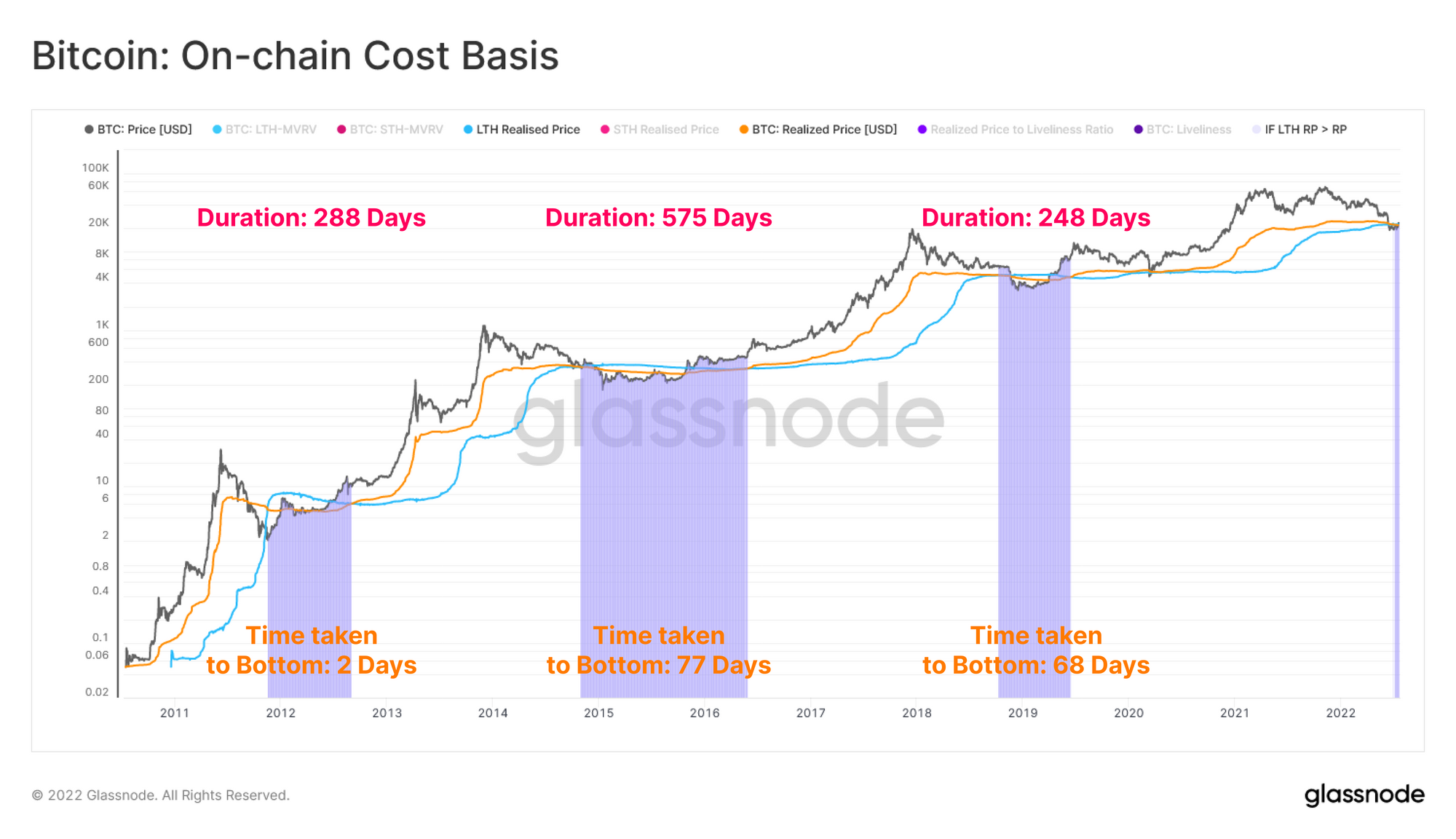

Data from Glassnode shows the Bitcoin long-term holder cost basis is currently above the realized price of the crypto. Bitcoin Long-Term Holder Cost Basis May Have Hints For Bear Market Length As per the latest weekly report from the analytics firm Glassnode, the LTH cost basis has remained below the realized price for a period […]

The complex-sounding but insightful Long-Term & Short-Term Holder Realized Price Ratio is tipped to repeat its historical bull signal. A "favorite" Bitcoin (BTC) price signal could be about to turn bullish — and upside has always resulted, data shows.As noted by podcast host Preston Pysh on Oct. 18, the Long-Term & Short-Term Holder Realized Price Ratio (LTHSTH-RPR) looks primed to print a bull flag.Chart hints at return of the bullsIt may sound wordy, but LTHSTH-RPR is one of the most accurate Bitcoin price indicators. Its creator, Bitcoin 2021 conference organizer Dylan LeClair,....

Bitcoin has seen a rebound since retesting the short-term holder Realized Price, a sign that this historical on-chain support may be holding. Bitcoin Short-Term Holder Realized Price Just Acted As Support As explained by CryptoQuant author IT Tech in an X post, Bitcoin found support around the short-term holder Realized Price during the latest dip. The “Realized Price” here refers to an on-chain indicator that measures the cost basis of the average investor on the BTC network. Related Reading: Bitcoin HODLers Spend 97,000 BTC—Biggest Move This Year When the price of the....

Bitcoin price is barely above $20,000 per coin – a shock to most new and long-time holders of the cryptocurrency alike. The selloff took the cryptocurrency back down to its production cost, which has acted as a bottom in the past. In this article we’ll take a closer look at the cost to produce each […]