Chinese Traders Still a Major Influence the Crypto Market, According to Experts

Chinese traders still exert a major influence in the cryptocurrency market, even with all the distinct issues they must now face to operate. This is the opinion of several experts in the field that have weighed in on how the recent prohibitions and ban proposals from China are really affecting how Chinese bagholders that conduct their business in Asian and worldwide exchanges. Chinese Traders Still Big in the Market Chinese traders still have a big influence on how crypto markets move even with all of the difficulties they have to operate, according to different experts with knowledge....

Related News

The sudden announcement of inspections of major Bitcoin operators by the Chinese Central Bank caused panic and a significant drop in Bitcoin price within just a day. In the past few days, Bitcoin has been shedding most of the gains of the end of 2016 and early 2017. These gains were attributed mostly to activities of Chinese traders who did huge volumes in the market, thereby singlehandedly increasing the global demand for Bitcoin. Government impact. One characteristic that the users of Bitcoin have always boasted about is the fact that the government cannot control or determine what....

As the bitcoin community seeks consensus on how to address bitcoin transaction time, a meeting this month in Silicon Valley could indicate how likely the chances are for consensus, according to Bloomberg. The proceedings will likely reflect the impact of China’s miners, who are estimated to control 70 percent of all bitcoin mining. Consensus on what to do to improve transaction time is considered to be important to bitcoin’s future. Failure to address this challenge could undermine the 4,475% bitcoin growth over the past five years. Worries Of China’s Influence. Some bitcoin enthusiasts....

The price of bitcoin has substantially decreased over the past few days after it reached a multi-month high of US$740 on major exchanges. Experts unanimously agree that the price has fallen due to the inaccurate reporting of “capital controls” the Chinese government is supposedly planning to impose on bitcoin. Currently, 95% of bitcoin trades are handled and processed by Chinese exchanges in its local market. Major Chinese bitcoin exchange BTCC alone handles a daily trading volume of 1.9 million bitcoin, which is larger than cumulative trading volume of Japan and US-based exchanges. Since....

The price of bitcoin surged nearly 20% during the week ending 3rd June, rising to its highest point in 20 months. But what was the cause of the increase? Mainstream media sources have largely attributed this sharp increase to demand from the Chinese market, prompted by yuan devaluation. But not everyone agreed with this explanation, as some market experts asserted that the rally was tied to other developments both within and outside of the digital currency ecosystem. Xu Qing, a spokesperson for Huobi, painted a different picture. Though Qing represents one of the largest bitcoin exchanges....

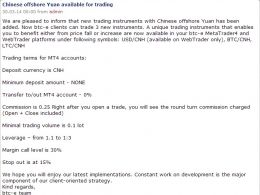

BTC-e has opened up USD/CNH, BTC/CNH, and LTC/CNH markets today. Withlooming PBOC action that would end Chinese Bitcoin exchange's access to domestic bank accounts, Chinese traders are undoubtedly looking for new exchanges to trade on. Along with Chinese RMB (CNH to BTC-e) trading comes RMB deposits, which are handled through an international bank. An international bank means that Chinese traders wishing to convert fiat to crypto through this route will be subject to the Chinese $50,000 annual limit. In fact, people are starting to realize that the PBOC's still shrouded notice to regional....