Uniswap tops $50B in lifetime volume, but where's it coming from?

Leading Ethereum-based DEX Uniswap has now crossed the $50 billion mark in lifetime volume, although some are skeptical about the sources of the platform’s liquidity. Leading decentralized exchange Uniswap has surpassed $50 billion in all-time trade volume, a major milestone for the DEX sector.On Dec. 15, Uniswap creator Hayden Adams tweeted data indicating the platform has processed a life-time volume of $51.7 billion across 26,000 unique trading pairs — equating to nearly $2 million per pairing on average. Looks like @UniswapProtocol passed $50b in all time volume last week. This is....

Related News

Popular decentralized exchange (DEX) platform on Ethereum, Uniswap, celebrates a major milestone. Via its official Twitter account, the team behind the protocol announced that it has processed $1 trillion in all-time trading volume. Related Reading | Coinbase Is on a Downwards Spiral and Could Be Taking your Crypto with It As seen below, this metric has been on an uptrend since September 2020. At that time, the protocol processed less than $10 billion in cumulative trading volume. The $1 trillion milestone was reached in less than a year as Uniswap went processing around $250 billion....

One of the largest decentralized exchange (dex) platforms in terms of trade volume, Uniswap, has announced that the dex community has approved a governance proposal to support the Polygon blockchain.

Uniswap to Support Polygon PoS Blockchain

In terms of trade volume, statistics show that Uniswap version three (v3) commands the largest 24-hour trade volume with $1.5 billion swapped during the last day. As far as total-value locked (TVL) in defi is concerned, Uniswap has $8.6 billion on December 19, 2021. That’s the second-largest TVL below Curve Finance’s $21.8....

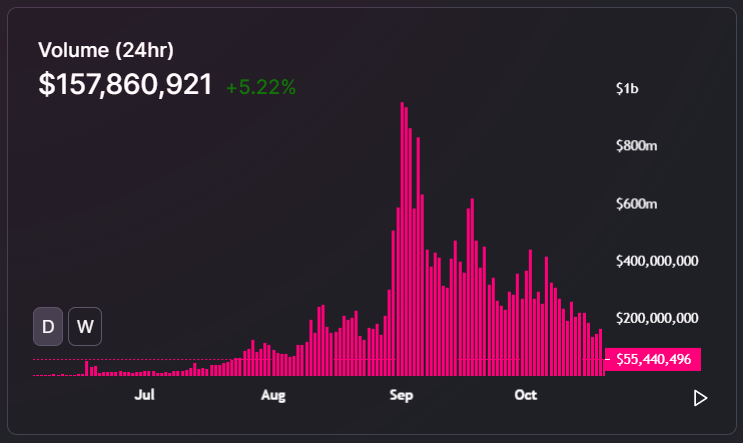

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

The greater DeFi category has given birth to a variety of cryptocurrency market winners over the last year or so, but few have become as dominant as Uniswap. Not only has the related UNI token performed incredibly well itself, Uniswap’s dominance has resulted in DEX volume growing more than 1,000 times from this point last […]

Several users have aired complaints about the new version, especially its higher gas fees. The founder of Uniswap, Hayden Adams, has reported that the launch day of Uniswap’s v3 iteration was more successful than its predecessor in terms of volume.In a tweet on May 6th, Adams declared the launch of Uniswap v3 the day before a resounding success. He noted that over its first 24 hours of going live v3 had already processed more than twice the volume that v2 saw in its first month.Dividing Uniswap’s volume by total value locked, or TVL, Adams asserted the platform is operating with greater....