Bitcoin prepares for CPI showdown as BTC price dips below $19K cost basis

BTC price performance declines in line with U.S. equities ahead of classic volatility engendered by CPI data. Bitcoin (BTC) followed analysts’ predictions with sideways action continuing near $19,000 at the Oct. 11 Wall Street open.BTC/USD 1-hour candle chart (Bitstamp). Source: TradingViewBitcoin price follows stocks downhillData from Cointelegraph Markets Pro and TradingView followed BTC/USD as the pair sat at important support ahead of fresh macro triggers.Brief dips below the $19,000 mark the day prior had been short lived, with sellers subsequently returning in an attempt to effect a....

Related News

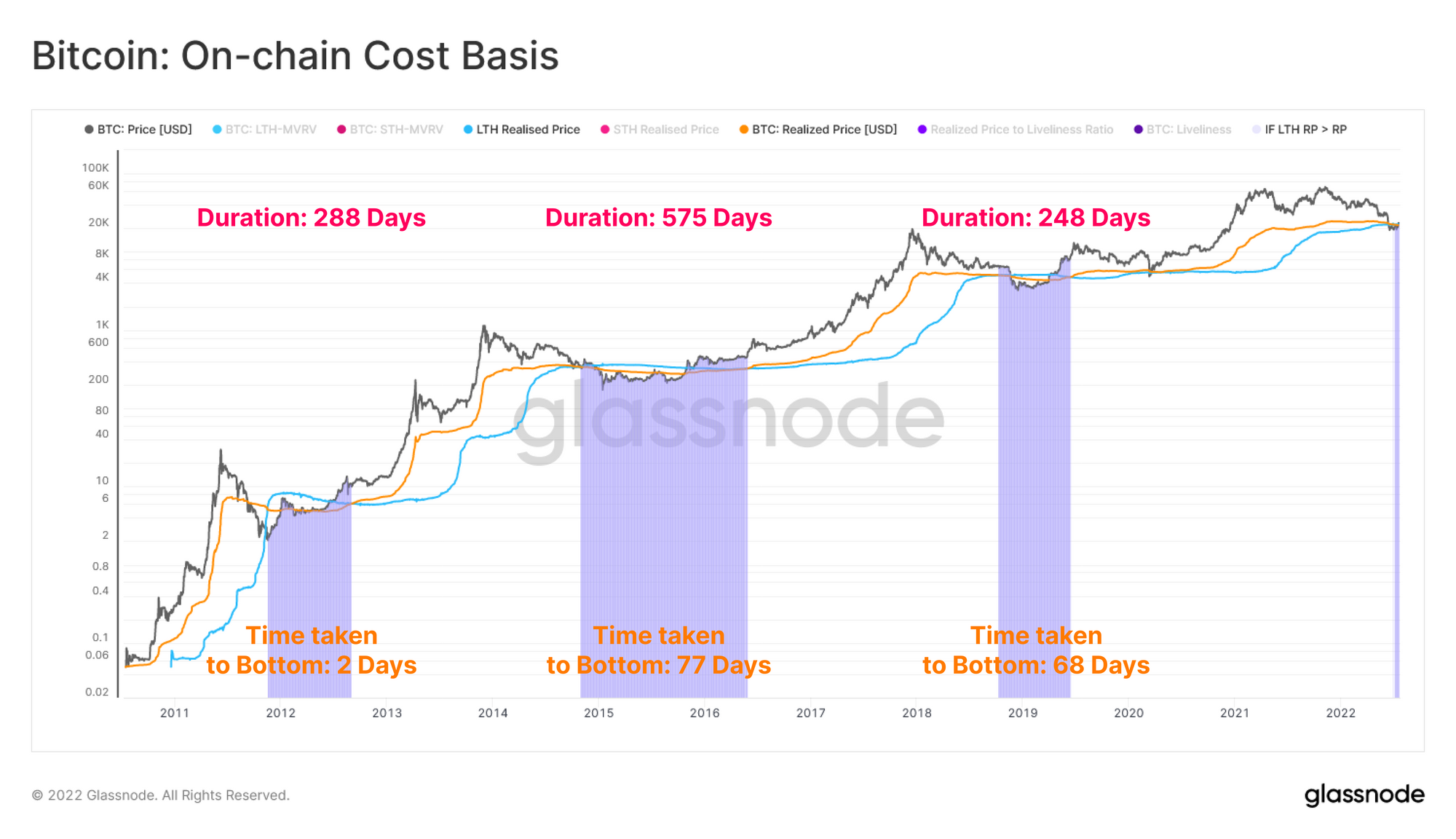

Data from Glassnode shows the Bitcoin long-term holder cost basis is currently above the realized price of the crypto. Bitcoin Long-Term Holder Cost Basis May Have Hints For Bear Market Length As per the latest weekly report from the analytics firm Glassnode, the LTH cost basis has remained below the realized price for a period […]

The complex-sounding but insightful Long-Term & Short-Term Holder Realized Price Ratio is tipped to repeat its historical bull signal. A "favorite" Bitcoin (BTC) price signal could be about to turn bullish — and upside has always resulted, data shows.As noted by podcast host Preston Pysh on Oct. 18, the Long-Term & Short-Term Holder Realized Price Ratio (LTHSTH-RPR) looks primed to print a bull flag.Chart hints at return of the bullsIt may sound wordy, but LTHSTH-RPR is one of the most accurate Bitcoin price indicators. Its creator, Bitcoin 2021 conference organizer Dylan LeClair,....

But more inexperienced investors have been choosing to become long-term Bitcoin holders, limiting sell-side risks below $30,000. Bitcoin (BTC) could undergo one last bear market capitulation if "whales" — addresses that hold more than $1 million worth of Bitcoin — ramp up their selling pressure, according to on-chain analyst Willy Woo.Room for another Bitcoin drop?Woo assessed the average price at which short-term investors entered the Bitcoin market across history and charted the daily change in the value. That resulted in a cost basis, a metric that signals when "inexperienced" traders....

After a period of bearish trend throughout last week, Bitcoin’s price is now slowly picking up its pace as it heads toward the pivotal $112,000 mark. During this negative action, short-term BTC investors appear to be the ones taking the impact of the crash the most, as the price drops below the STH’s Realized Price. […]

Bitcoin is trading in the $117,000 price region following a rather eventful week, which allowed investors to experience both sides of the market volatility. Notably, the premier cryptocurrency established a new all-time high at $124,457 before experiencing a sharp crash to below $118,000 driven by recent US PPI data. As enthusiasts await the asset’s next move, prominent analytics firm Glaasnode has unveiled the potential price targets based on short-term holders’ (STH) market activity. Related Reading: Bitcoin Prepares For Make-Or-Break Move As Textbook Triangle Meets Tight Range....