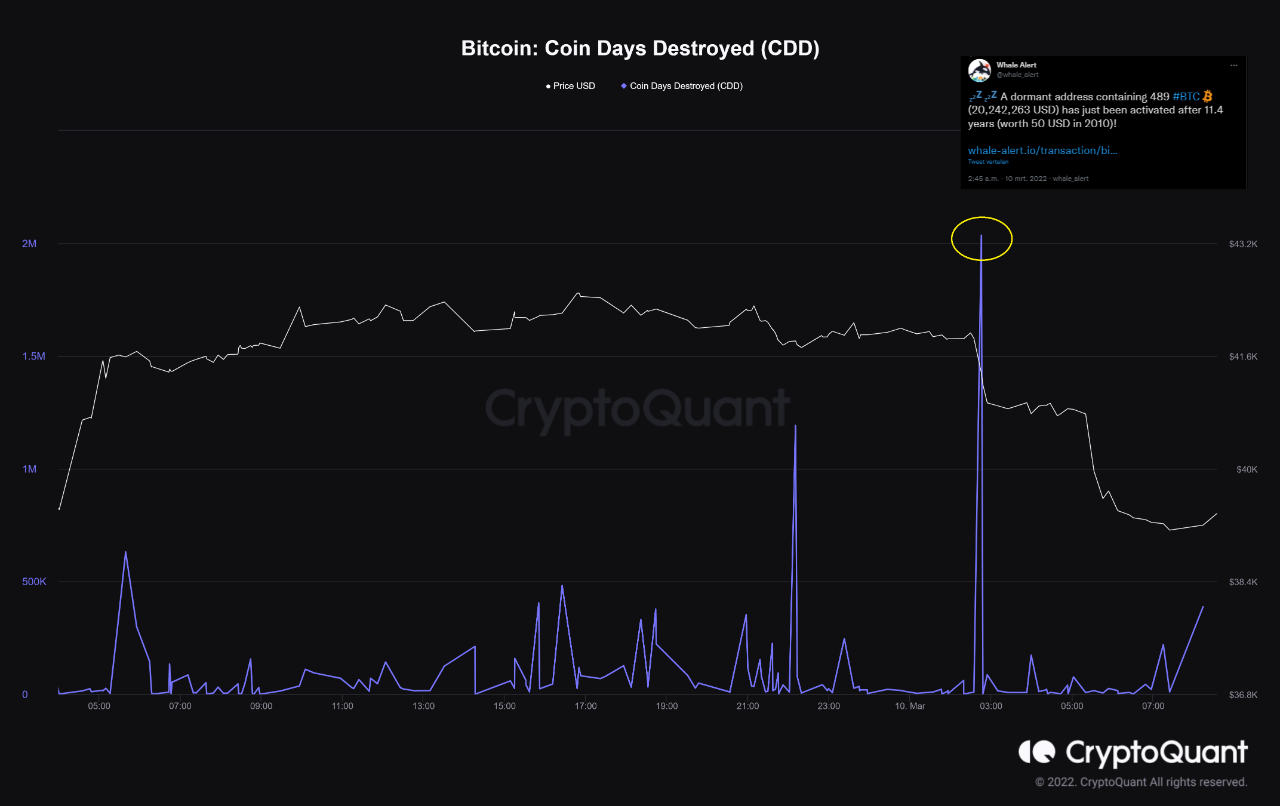

Bitcoin On-chain Data Suggests 11-Year Old Coins Worth $20M Behind The Drop

On-chain data suggests that dumping from 11-year old coins worth $20 million may be behind the recent Bitcoin price drop. 11-Year Old Bitcoin Moved Shortly Before The Drop below $40k As pointed out by an analyst in a CryptoQuant post, a large amount of dormant coins since eleven years ago seems to have moved a […]

Related News

The Bitcoin price is lingering just under $19,000 at the time of writing, not far from the local low of $18,300. When the Consumer Price Index (CPI) and Producer Price Index (PPI) data was released last week, the BTC price plunged to just that price level. Unexpectedly for many, a very quick rebound happened, catching shorters off guard. With November 02 – when the FED meets again – in mind, the Bitcoin price doesn’t have much room to fall below that level at the moment. Moreover, a look at the on-chain suggests another crash is possible in the short term, although there....

Ether's recent price drop has failed to deter investors from accumulating the cryptocurrency, on-chain data indicates.

Analysts and traders discuss both bull and bear cases for Bitcoin after the BTC price plunged to $16,200. The price of Bitcoin (BTC) dropped sharply on Nov. 26 following a mass sell-off from whales. Data from on-chain data firms, namely Santiment, Intotheblock, and CryptoQuant, show heightened levels of whale exchange inflows.Whales selling right under Bitcoin's all-time high, particularly when the market sentiment was overly euphoric, led to a massive drop. Roughly $1.8 billion worth of futures contracts were wiped out, as Cointelegraph reported. Some exchanges, like Binance as an....

Despite the Bitcoin markets slipping below $30,000, on-chain data suggests accumulation may be underway, as $1 billion worth of BTC leaves exchanges each month. Despite Bitcoin crashing below $30,000 for the first time in one month, on-chain metrics suggest whales may be steadily accumulating BTC.According to Glassnode’s July 19 “The Week On-Chain” report, the Bitcoin reserves of centralized exchanges have continued to evaporate despite the recently sustained bearish momentum, with an average of 36,000 Bitcoin (worth roughly $1 billion) being withdrawn from exchanges monthly. Glassnode....

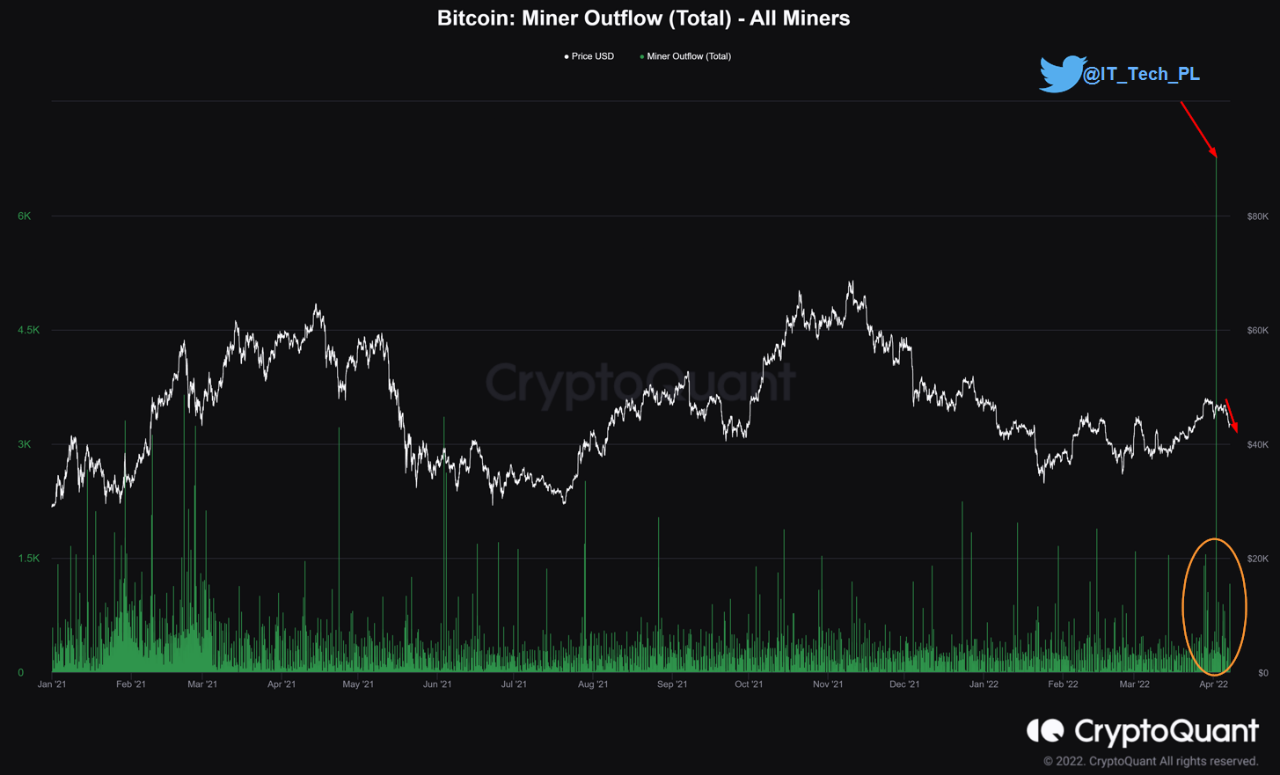

On-chain data suggests Bitcoin miners seem to have dumped big recently as their outflow has spiked to the largest value since more than a year ago. Bitcoin Miner Outflows Have Observed A Large Spike Recently As pointed out by an analyst in a CryptoQuant post, F2Pool miner wallets transferred a huge amount of coins shortly […]