Bitcoin network activity decline suggests longer bear market: Glassnode

Although Bitcoin prices made a strong 15% recovery over the past week, metrics suggest more network demand would be needed to sustain further price increases. With several on-chain metrics for Bitcoin (BTC) still in a bearish range, a continuation of the recent price recovery will require increased demand and fees spent over the network, says Glassnode. The assessment of mediocre market growth over the past week came from blockchain analysis firm Glassnode in its latest The Week On Chain report on August 1.In it, analysts pointed to sideways growth in transactional demand, active Bitcoin....

Related News

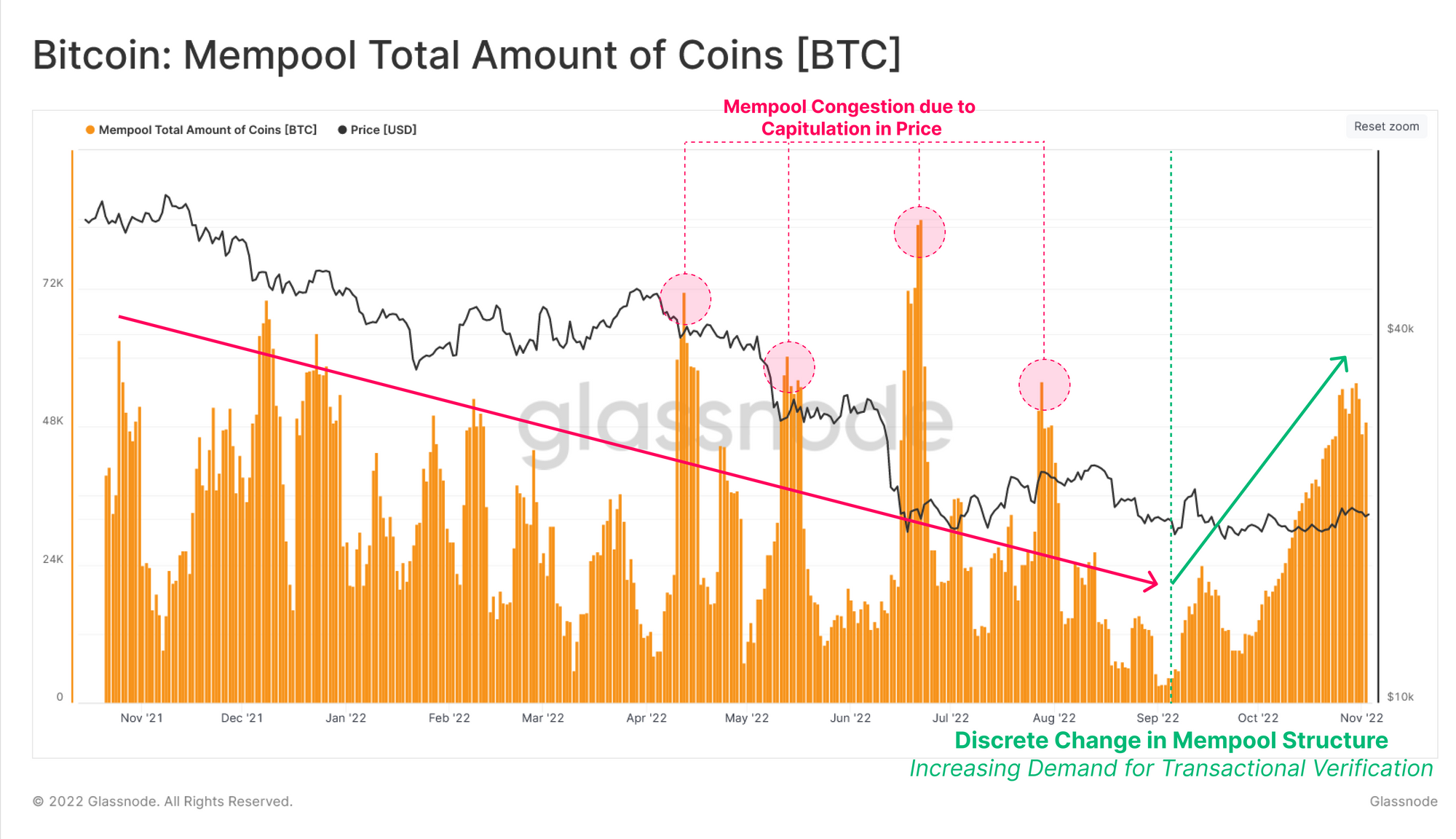

Data from Glassnode shows demand on the Bitcoin network has been gradually recovering recently, after facing months of continuous decline. Total Amount Of Coins In Bitcoin Mempool Has Been On The Rise During Past Month According to the latest weekly report from Glassnode, the BTC network has been observing a small, but sustained surge in […]

Glassnode’s senior researcher has revealed how Unrealized Loss on the Bitcoin network is still smaller than even mild bear markets in the past. Bitcoin Relative Unrealized Loss Hit Just 1.3% Recently In a new post on X, senior researcher at on-chain analytics firm Glassnode, CryptoVizArt, has talked about how Bitcoin currently compares to past bearish […]

The report by Glassnode also revealed that up to 60% of the transaction volume is in what it calls “profit dominance”, and long-term holders are the most likely to be in the green. The price of Bitcoin (BTC) has been on the decline again recently, but new insights from blockchain analytics firm Glassnode show that up to 75% of Bitcoin addresses are in profit.In its Week-On Chain report published on Monday, April 11, Glassnode analyzed the number of Bitcoin wallets that are in profit and found that around 70% to 75% of addresses are seeing an unrealized profit, much higher than the 45% to....

Active addresses, entities, and transactions on the Bitcoin network are all moving sideways while the number of wallets holding at least some of the assets continues to reach new highs. So-called “market tourists” are fleeing from Bitcoin (BTC), leaving only long-term investors holding and transacting in the top cryptocurrency, according to blockchain analytics firm Glassnode.In its July 4 Week Onchain report, Glassnode analysts said June saw Bitcoin have one of its worst-performing months in 11 years, with a loss of 37.9%. It added activity on the Bitcoin network is at levels concurrent....

On-chain data shows signs of an altcoin winter may be emerging as Ethereum, Solana, and other cryptocurrencies have seen a decline in activity. Altcoins Are Observing A Drop In On-Chain Activity In a new thread on X, institutional DeFi solutions provider Sentora (formerly IntoTheBlock) has talked about how interest in altcoins has been cooling off recently. Related Reading: CryptoQuant Head Reveals Reason Behind Bearish Bitcoin Trend The on-chain indicator of relevance here is the “Active Addresses,” which measures, as its name suggests, the total number of addresses that are....